Similar Posts

Databricks Secures $15 Billion Funding to Accelerate Global AI Innovation

Databricks has successfully closed its Series J funding round, raising $10 billion and achieving a valuation of $62 billion. Key investors include QIA, Temasek, and Meta. The company also secured a $5.25 billion credit facility led by JPMorgan Chase. Databricks aims to democratize access to data and AI, focusing on applications like disease detection and climate change mitigation. The new funds will support the development of AI products, strategic acquisitions, and international expansion. CEO Ali Ghodsi emphasized the importance of data intelligence in maximizing generative AI’s potential, while QIA’s CEO expressed confidence in Databricks’ leadership in the AI sector.

California Wildfires Impact Fixed Income Markets: Bond Spreads Widen Amidst Crisis

Recent wildfires in California are significantly impacting the bond market, particularly municipal and corporate bonds. The Los Angeles Department of Water and Power (LADWP) has seen spreads widen by up to 50 basis points due to concerns over liabilities and resource management, leading to a downgrade by Standard & Poor’s. Legal actions against LADWP are ongoing, with potential rate increases or new debt issuance expected. Other municipal bonds are also facing similar pressures, while corporate bonds, like those of Southern California Edison, are under scrutiny for alleged fire-related liabilities. Financial uncertainty is likely to persist as investors monitor tax revenue impacts and market dynamics.

2024 Sees Unprecedented Surge in Global Regulatory Fines, Reaching $19.3 Billion

In 2024, global regulatory enforcement reached a record $19.3 billion in fines, driven by increased scrutiny of financial crime and compliance failures. Major penalties included FTX’s historic $12.7 billion for fraud and TD Bank’s $3 billion for anti-money laundering violations. The SEC fined Genesis Global Capital $21 million for registration failures, while the FCA imposed nearly £30 million on Starling Bank for financial crime issues. PwC faced fines for not reporting fraud, and the ASIC penalized Mercer Superannuation £11.3 million for greenwashing. The year highlighted the need for robust compliance programs and internal controls in corporations.

VIA Raises $28 Million to Propel Expansion of Cutting-Edge Cybersecurity Platform

VIA, a Boston-based cybersecurity firm, has raised $28 million in Series B funding to enhance its decentralized platform for data and identity protection, meeting high security standards required by the U.S. Department of Defense. The funding round was led by Bosch Ventures, with participation from BMW i Ventures, MassMutual Ventures, and others. VIA’s platform features a zero trust architecture designed to mitigate insider threats and ensure quantum-resistance, addressing evolving cyber threats. The funds will accelerate the deployment of VIA’s Web3 data protection solutions among large enterprises, revolutionizing enterprise security with advanced identity management and encryption capabilities.

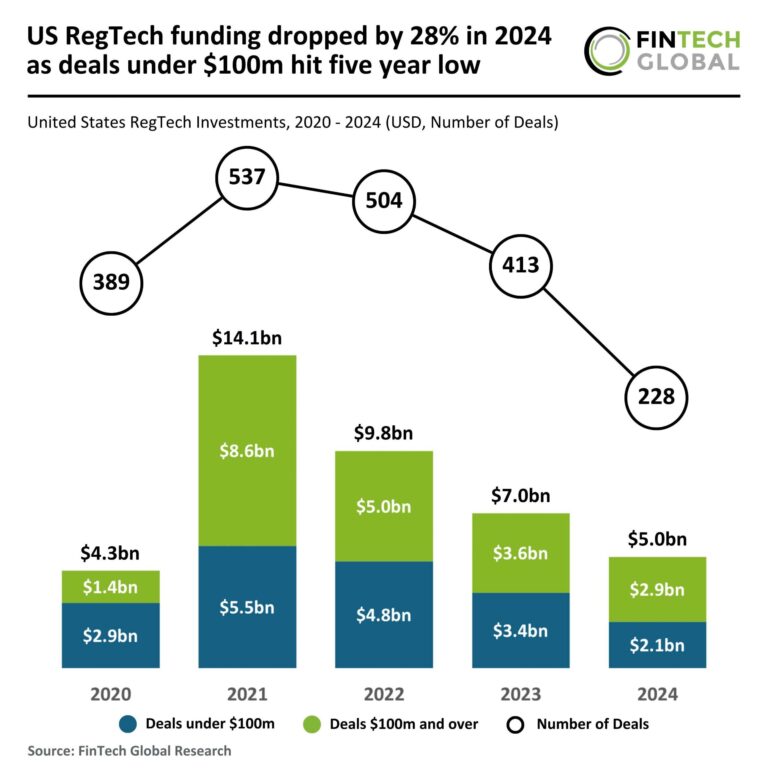

US RegTech Funding Plummets 28% in 2024: Deals Under $100M Reach Five-Year Low

In 2024, the US RegTech investment landscape saw a significant decline, with total funding dropping 28% to $5 billion and deal volume decreasing 45% to 228. Smaller deals under $100 million fell to $2.1 billion, the lowest in five years, while larger deals remained more stable, totaling $2.9 billion. Amid this downturn, Norm AI stood out, securing a $27 million Series A funding round led by Coatue, with additional investments from firms like Bain Capital Ventures. Norm AI specializes in AI-driven regulatory compliance, dramatically improving efficiency for major corporations.

Unmissable Week: 23 Small FinTech Fundraises You Need to Know About!

This week, the FinTech sector secured $793.7 million in funding, marking a decrease from the previous month’s trend of over $1 billion weekly. Notably, NinjaOne led with a $500 million Series C round, boosting its valuation to $5 billion. A total of 23 companies received funding, with most deals under $15 million. Taktile raised $50 million in Series B for AI-driven decision automation. The US and UK each saw ten companies close funding rounds, although European FinTech activity has sharply declined by 63% year-on-year in 2024. Various sectors, including PayTech and CyberTech, experienced diverse funding activities.