Similar Posts

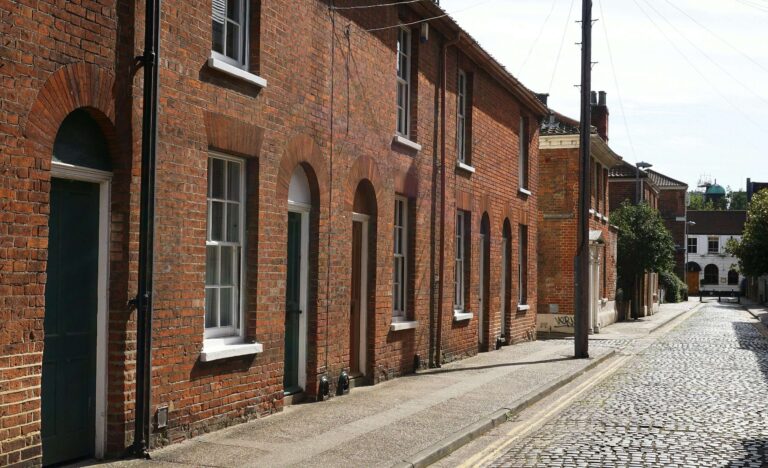

Unlocking AML in Real Estate: The Ultimate Guide for Estate Agents and Homebuyers

Buying a home in the UK involves navigating complex legal requirements, particularly anti-money laundering (AML) checks, which typically take five days to two weeks. The timeline depends on timely document submission and the need for Enhanced Due Diligence. Buyers should prepare identification, address verification, and proof of funds in advance. Estate agents play a crucial role in AML compliance by verifying identities and conducting funds checks. Delays may arise from foreign funds or anonymous buyers, necessitating deeper investigations. Compliance with AML regulations is vital for economic stability, with significant penalties for non-compliance, as seen with fines imposed on 144 estate agents recently.

Cybereason Raises $120M to Revolutionize Cybersecurity Solutions with Innovative Technology

Cybereason has raised $120 million in a funding round led by SoftBank Corp., SoftBank Vision Fund 2, and Liberty Strategic Capital, highlighting investor confidence in the company’s cybersecurity capabilities. The funds will enhance its endpoint detection and response solutions, support global expansion, improve technology against cybersecurity threats, and strengthen partnerships, particularly with Trustwave. Additionally, Cybereason has appointed Manish Narula as the new CEO, marking a strategic leadership change. Narula expressed enthusiasm for the investment, emphasizing its potential to drive innovation in cybersecurity technology and services.

Essential Compliance Tips for Navigating the 2025 Form ADV Update: Your Ultimate Preparation Guide

Investment advisers are preparing to update their Form ADV before the March 31, 2025, deadline, crucial for regulatory compliance. Key steps include funding the Investment Adviser Registration Depository (IARD) account in advance, understanding fee structures ranging from $40 to $225 based on regulatory assets under management, and reviewing client relationships for state-level filing requirements. Consistency across Form ADV sections is vital, ensuring accurate disclosures and removing outdated references. Advisers must also validate data for compliance checks and report any material changes. The SEC’s focus areas for 2025 include marketing compliance, AI risks, and outsourcing risks, emphasizing the need for thorough preparation.

CFPB Faces Backlash for Cancelling Open Banking Rule Crucial to FinTech Competition

The Consumer Financial Protection Bureau (CFPB) faces criticism from the Financial Technology Association (FTA) for planning to revoke the 1033 open banking rule, which allowed consumers to share their financial data with third-party providers. This move is seen as a concession to traditional banks, undermining consumer rights and competition. The FTA’s CEO, Penny Lee, condemned the decision, claiming it benefits Wall Street banks at the expense of consumer control over finances. This rollback is part of a broader trend of the CFPB retreating from consumer protection, raising concerns about the future of open banking and innovation in financial services.

Egyptian FinTech ElGameya Secures 7-Figure Investment to Accelerate Growth of Digital ROSCA Platform

ElGameya, a leading FinTech platform in Egypt, has secured a significant seven-figure USD funding round to enhance its digital savings and lending services. The investment, led by AYADY for Investment and Development and supported by firms like Jedar Capital and Cubit Ventures, aims to accelerate technology development and expand operations. Founded in 2020, ElGameya modernizes the traditional Rotating Savings and Credit Association model through a user-friendly app that allows users to join savings circles. CEO Ahmed Abdeen highlighted the growth, noting a 50% month-on-month increase and nearly one million registered users, emphasizing the platform’s commitment to financial inclusion.