Similar Posts

Riot Secures $30M to Tackle AI-Powered Cyber Threats with Innovative Employee Security Solutions

Riot, a cybersecurity firm focused on employee security solutions, has raised $30 million in a Series B funding round led by Left Lane Capital, with participation from Y Combinator, Base10, and FundersClub. This investment will accelerate Riot’s growth, following its achievement of over $10 million in annual revenue in 2024. Founded five years ago, Riot offers a real-time monitoring platform to identify security vulnerabilities and provides coaching through its cyber coach, Albert. The funding will facilitate international expansion, workforce doubling, and the introduction of new features, including an aggregated security dashboard and enhanced training programs.

California Wildfires Impact Fixed Income Markets: Bond Spreads Widen Amidst Crisis

Recent wildfires in California are significantly impacting the bond market, particularly municipal and corporate bonds. The Los Angeles Department of Water and Power (LADWP) has seen spreads widen by up to 50 basis points due to concerns over liabilities and resource management, leading to a downgrade by Standard & Poor’s. Legal actions against LADWP are ongoing, with potential rate increases or new debt issuance expected. Other municipal bonds are also facing similar pressures, while corporate bonds, like those of Southern California Edison, are under scrutiny for alleged fire-related liabilities. Financial uncertainty is likely to persist as investors monitor tax revenue impacts and market dynamics.

Monzo Co-Founder Sounds Alarm: AI Poised to Disrupt Software Engineering Jobs

Tom Blomfield, co-founder of Monzo, has sparked debate by predicting that artificial intelligence (AI) will soon surpass human software engineers, potentially making their roles obsolete. He argues that AI could enhance coding productivity significantly, likening its impact to a “combine harvester” for software development. Reactions have been mixed, with some embracing his vision while others challenge the notion of easy replacement. Blomfield envisions future coding teams that may operate autonomously, requiring minimal human oversight. He warns that the implications of AI could extend beyond software engineering, potentially disrupting various industries like medicine, law, and architecture.

Centiglobe and Mastercard Join Forces to Revolutionize Cross-Border Payments

Centiglobe has partnered with Mastercard Move to enhance its blockchain-based payment platform, improving access to international payment services for its members, which include regulated banks and payment service providers. This integration allows near real-time transactions through a single connection, simplifying cross-border payment processes. Key benefits include enhanced accessibility to various payment services, a fixed cost structure based on transaction volume, and effective liquidity management. Mastercard Move supports over 180 countries and 150 currencies, connecting with over 95% of the global banked population. This collaboration aims to redefine the payment landscape and drive efficiency in international transactions.

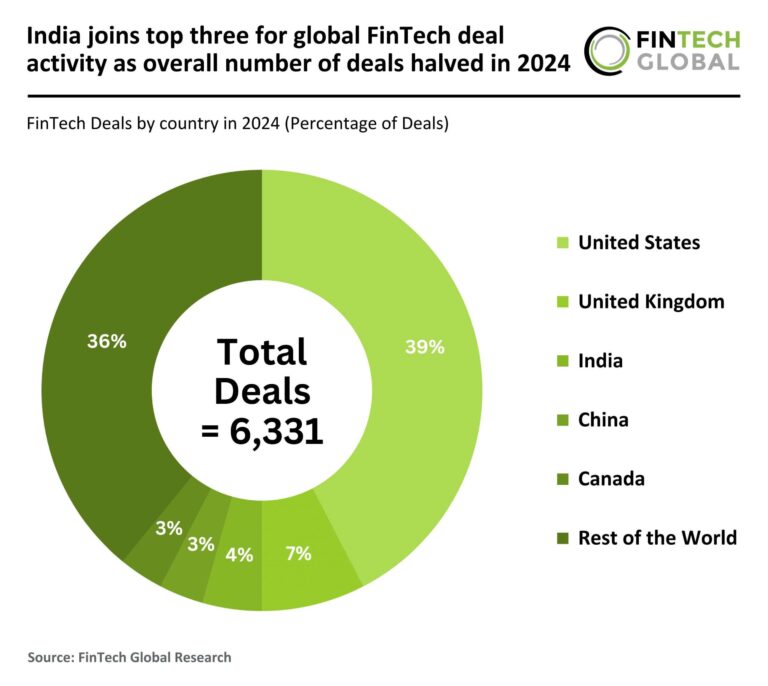

India Ranks Among Top Three in Global FinTech Deals Despite 50% Decline in 2024 Transactions

In 2024, global FinTech investment faced a significant downturn, with total funding dropping to $89.66 billion—a 45% decline from 2023. Deal volume plummeted by 57%, with completed deals falling from 14,604 to 6,331, influenced by rising interest rates and cautious investor sentiment. Despite this, India emerged as a key player, securing third place in global deal activity with 274 deals, surpassing China. A highlight was Svatantra Microfinance’s $230 million funding round, focusing on affordable solutions for women entrepreneurs. While challenges remain, opportunities for recovery exist in emerging markets like India as the sector adapts to economic pressures.

2025 Reporting Updates: Key IRS Deadlines and FATCA Changes You Need to Know!

The IRS has announced important updates for financial institutions to comply with by January 2025 to avoid penalties. Key deadlines include distributing Form 1099 copies by January 31, 2025, with paper filings due by February 28 and electronic submissions by March 31. Late penalties have increased, reaching up to $660 for intentional non-compliance. Additionally, the Cayman Islands has launched a CRS compliance review, while Finland and France urge timely FATCA and CRS report submissions. Global updates include new reporting jurisdictions in South Korea and changes in Switzerland’s CRS submission deadlines. Financial institutions must enhance compliance processes accordingly.