Similar Posts

New York Regulator Imposes $40 Million Fine on Block for Anti-Money Laundering Violations

Block, the company behind Cash App, has been fined $40 million by the New York State Department of Financial Services (DFS) for serious failures in anti-money laundering (AML) and virtual currency compliance. An investigation revealed deficiencies in customer due diligence, risk controls, and delays in reviewing suspicious transactions, particularly during its rapid growth from 2019 to 2020. DFS Superintendent Adrienne Harris stated that these issues created vulnerabilities for money laundering. As part of the settlement, Block must pay the fine and engage an independent monitor to ensure compliance with regulatory standards moving forward.

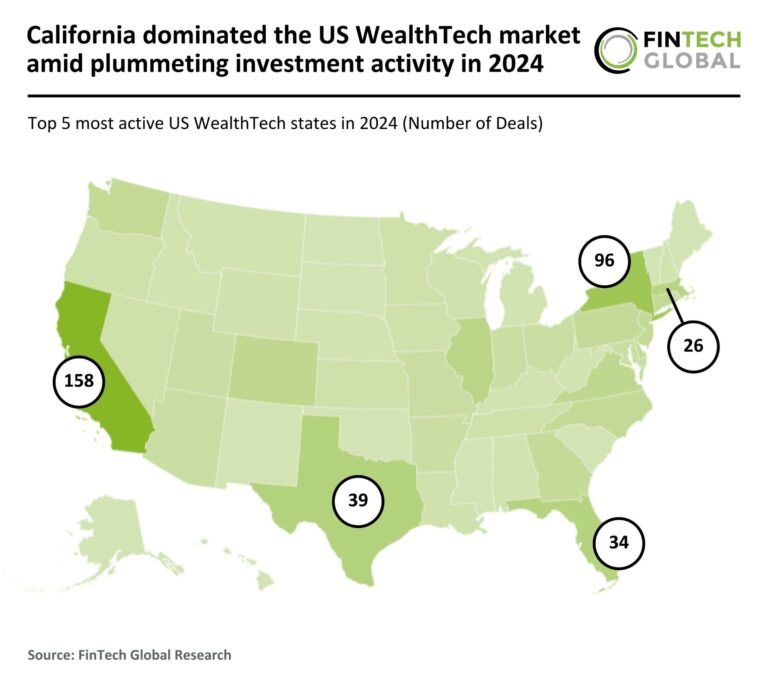

California Leads the Charge in US WealthTech Despite 2024 Investment Decline

In 2024, the US WealthTech industry faced a severe decline, with investment activity plummeting 70% year-over-year. Total funding dropped to $8.2 billion, down 65% from $23.1 billion in 2023, while deal volume fell to 572 transactions, a 70% decrease from 1,937 deals. California led the market with 158 deals (28% share), despite a 71% decline from 2023. Notable activity included Nassau’s $200 million investment from Golub Capital, enhancing its digital financial solutions. This downturn highlights the sector’s struggle to maintain investor confidence amid changing market conditions.

Consilient Launches Innovative Federated Machine Learning Model for Enhanced Correspondent Banking and Financial Crime Prevention

Consilient has launched the Correspondent Banking Model, a groundbreaking solution designed to enhance risk management in correspondent banking, essential for global trade and cross-border payments. Traditional correspondent banking often suffers from a lack of transparency and third-party dependencies, creating vulnerabilities. The new model employs federated learning technology, enabling banks to collaborate in identifying risks while safeguarding sensitive data. Key features include enhanced due diligence and improved audit trails, promoting compliance and transparency. Additionally, the model seamlessly integrates with existing financial technologies, facilitating a smoother transition for institutions. This innovation aims to transform the correspondent banking landscape, improving security and efficiency.

Qantev and InsureMO Join Forces to Transform Global Insurance Services

Qantev, an AI claims platform, has partnered with InsureMO to enhance global insurance services by integrating Qantev’s AI solutions with InsureMO’s platform. This collaboration aims to streamline data transfer and improve efficiency among insurers, agents, and healthcare providers. Key benefits include optimized claims processes, improved customer interactions, and valuable data insights. Qantev CEO Tarik Dadi highlighted the partnership as a transformative step for the industry, while InsureMO CEO Woody MO emphasized the alignment with their goal of simplifying insurance. This strategic alliance is set to revolutionize the insurance landscape, making it more accessible and efficient for clients worldwide.

Virgin Money and Mastercard Join Forces to Revolutionize Credit Card App with Open Banking Innovations

Virgin Money is enhancing its customer experience by allowing users to manage credit card and current account balances from multiple banks via its Credit Card App, thanks to a partnership with Mastercard. This integration of advanced open banking technology aims to simplify financial management for over 6.6 million customers in the UK. Key features include access to various bank balances in one app and improved financial management tools. Katherine Lovell from Virgin Money expressed enthusiasm about making it easier for customers to access financial information. The initiative highlights the transformative potential of open banking in everyday banking tasks.

Droit Teams Up with LSEG to Revolutionize Global Shareholder Disclosure Compliance Automation

Droit has integrated LSEG’s Global Shareholding Disclosure Data into its Position Reporting platform to enhance regulatory compliance for financial institutions. This integration enables firms to automate and streamline their shareholder disclosure processes through a unified workflow, providing access to 15 types of shareholding data and voting rights information. Droit’s platform features consensus-driven rules, eligibility checks, and compliant report generation, helping firms navigate complex regulations. Droit’s Chief Strategy Officer, Somerset Pheasant, highlighted the importance of precise data and rule interpretation in compliance, while LSEG’s Fausto Marseglia praised the partnership for reducing compliance burdens through automation.