Similar Posts

Japan’s Financial Crime Crackdown: Tackling the Surge in Illicit Account Trading

The Japanese government is planning a significant crackdown on fraud linked to illicit bank accounts and anonymous communication tools, addressing a surge in social media-driven investment scams and telecom fraud. In 2024, authorities reported 4,513 fraud cases, a 30% increase from 2023. Current penalties for fraudulent activities include up to one year in prison or fines of 1 million yen, with harsher consequences under organized crime laws. Proposed reforms include mandatory retention of communication histories by telecom operators and enhanced identity verification for SIM cards. The government is also considering new investigative methods and improved data-sharing frameworks among financial institutions to combat these crimes.

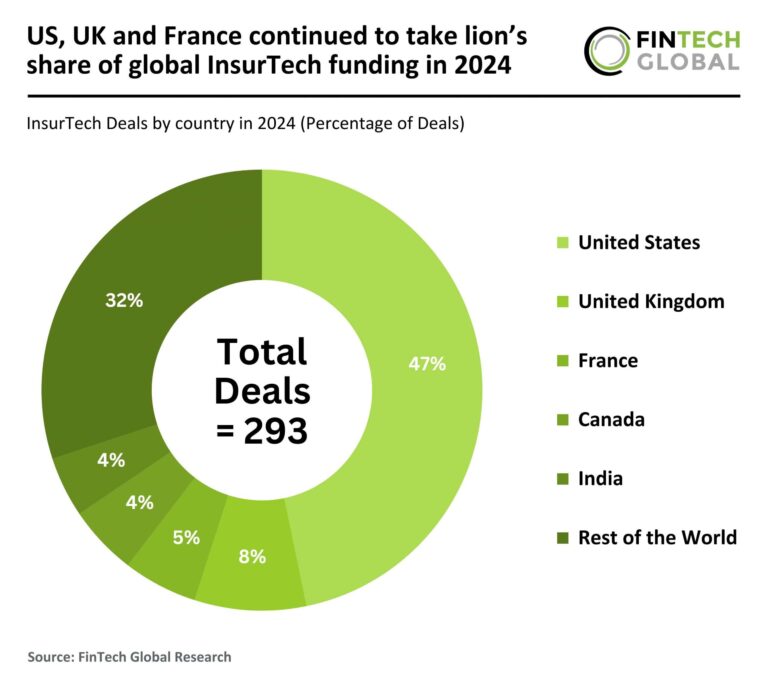

US, UK, and France Dominate Global InsurTech Funding Landscape in 2024

In 2024, the global InsurTech market faced a significant downturn, with total funding dropping to $5 billion, a 35% decrease from 2023 and a 64% decline since 2020. The number of deals also fell sharply to 293, down 47% from the previous year. Contributing factors include macroeconomic uncertainties, regulatory changes, and investor caution. Despite the downturn, the US, UK, and France led funding, accounting for 60% of deals. Notably, Akur8 secured a $120 million Series C round, focusing on insurance pricing innovation. Investors remain selective, prioritizing mature opportunities in this evolving landscape.

Revolutionizing Compliance: KYC Portal Introduces KYCP Managed Service to Slash Costs

KYC Portal has launched KYCP as a Managed Service to help organizations streamline compliance processes and reduce operational costs. This solution is particularly beneficial for businesses looking to avoid the financial burden of extensive IT infrastructure. The service provides access to compliance programs via a fully-managed shared instance, allowing clients to focus on compliance, risk assessments, and workflow management. It features a transparent pricing model that includes hosting fees and ongoing maintenance. While offering various advantages, limitations include the lack of access to certain tools and direct integration capabilities. Ideal for non-regulated firms facing reputational risks, KYCP simplifies compliance management for diverse organizations.

Transforming Insurance: Risk Digitization Emerges as a Top Technology Priority

Risk digitisation is now the top technology priority for insurers in North America and the UK, according to a Cytora survey of 200 senior leaders. An overwhelming 79% plan to invest in this area over the next two years, surpassing other technologies like CAT models and CRM systems. Key benefits include revenue growth (22%), increased transaction capacity (19%), and improved service (17%). However, challenges persist, with 62% struggling with manual data extraction and 55% facing workflow issues. Investment in AI and automation is also rising, with 26% investing over £500,000 last year. The shift is expected to enhance productivity and employee morale in the insurance workforce.

AI Revolution: Transforming UK Financial Advice to Seize a £50bn Market Opportunity

The UK’s financial advice sector is poised for change, driven by a study from AI fintech firm Aveni and YouGov, revealing a potential £50 billion market for advisers who adopt AI. The research shows a generational trust gap, with only 24% of 35-44-year-olds consulting advisers compared to 49% of those over 55. Younger respondents are more open to AI-driven financial advice, with 83% of 25-34-year-olds willing to use it for lower costs. Experts emphasize the need for advisers to integrate AI to improve accessibility and affordability, especially as £7 trillion in generational wealth is set to transfer in the coming decade.