Similar Posts

KPMG Ties Executive Compensation to Sustainability Goals Across Global Corporations

A KPMG International study reveals a significant trend in corporate governance, with 78% of major firms linking executive compensation to sustainability metrics. The report evaluated 375 publicly listed companies across 15 countries, showing that 88% align sustainability goals with remuneration strategies, focusing on climate change and workforce issues. European Union companies lead in adopting these practices, followed by the UK and Australia. Investors are increasingly seeking a balance between short-term and long-term sustainability objectives. KPMG’s Nadine-Lan Hönighaus emphasizes the importance of transparent, measurable sustainability targets in executive pay schemes to enhance corporate sustainability efforts.

CrediLinq Raises $8.5M to Enhance Embedded Finance Solutions for Digital SMEs

CrediLinq recently secured $8.5 million in a Series A funding round led by OM/VC and MS&AD Ventures, with participation from Citi North America and other investors. The funds will support the company’s global expansion, starting in the U.S., U.K., and Australia, and enhance its Credit-as-a-Service platform aimed at improving capital access for underserved digital-first SMEs. CrediLinq plans to invest in its technology and leadership team while strengthening partnerships with e-commerce platforms like Amazon and TikTok Shop. The investment underscores confidence in CrediLinq’s innovative approach to lending and its potential for significant global impact.

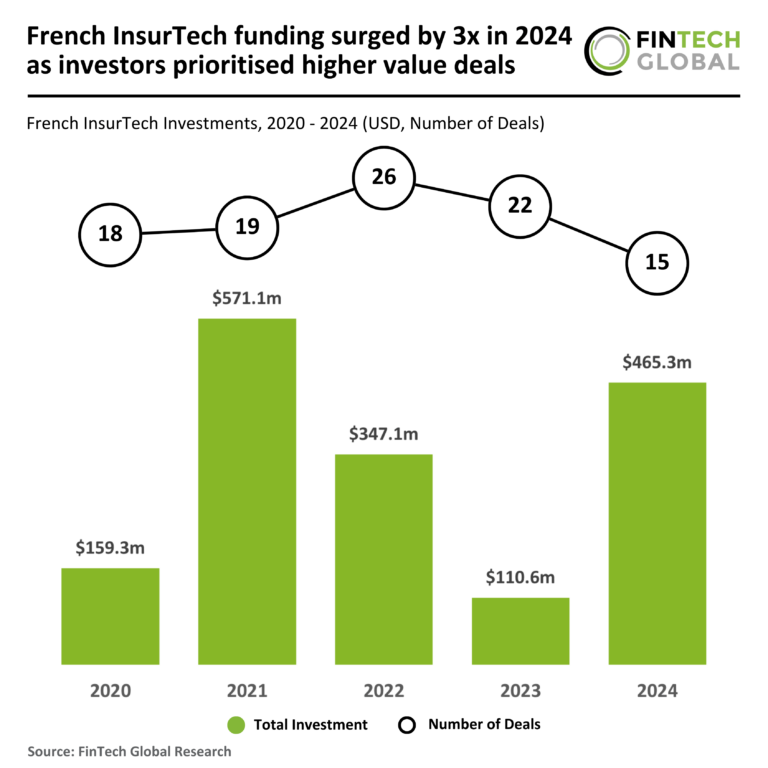

French InsurTech Funding Soars 300% in 2024: Investors Focus on High-Value Opportunities

In 2024, the French InsurTech sector is witnessing a remarkable transformation, with funding skyrocketing to $465 million, a tripling from $111 million in 2023. Although the number of deals has decreased by 32% to 15, the average deal size has surged to $31 million, indicating a strategic shift towards larger investments in established firms. This trend reflects growing investor confidence, particularly in companies like Alan, which raised $193 million in its Series F funding round, the largest for the sector this year. Alan aims to enhance healthcare through automated claims and various digital health services, poised for significant growth.

Clair Secures $23.2M to Revolutionize Real-Time Wage Access in Embedded FinTech

Clair, a prominent FinTech company specializing in Earned Wage Access (EWA) solutions, has raised $23.2 million in its Series B funding round, led by Upfront Ventures with continued support from Thrive Capital. This funding will enhance Clair’s services that allow employees instant access to earned wages, benefiting both employees and businesses. The platform has reached over 29,000 locations and recently partnered with Gusto, significantly increasing adoption rates. CEO Nico Simko highlighted the potential to integrate EWA into payroll systems, tapping into a market of over 50 million U.S. employees. The funding aims to drive product development and expansion efforts.

SandboxAQ Secures $450M in Series E Funding, Attracting Leading Investors

SandboxAQ, a leader in enterprise quantitative AI, has raised over $450 million in its Series E funding round, reflecting strong investor confidence in its advanced Large Quantitative Models (LQMs). Notable backers include Ray Dalio, Google, NVIDIA, and BNP Paribas, boosting SandboxAQ’s potential in AI and quantum technology. The company aims to leverage AI to address challenges in industries like biopharma, cybersecurity, and financial services. Since its spinoff from Alphabet in 2022, it has raised over $950 million. The new funds will enhance its technological capabilities and expand its market influence, reinforcing its position in AI innovation.

BlackCloak Secures Funding from The LegalTech Fund: A Game-Changer in Digital Executive Protection

BlackCloak, a cybersecurity firm focused on protecting high-profile individuals, has secured a significant investment from The LegalTech Fund, enhancing its capabilities in digital executive protection. The company offers a comprehensive Digital Executive Protection platform designed for corporate leaders and high-net-worth individuals, featuring concierge-style cybersecurity, personal device security, and ongoing support against cyber threats. CEO Dr. Chris Pierson expressed enthusiasm for the partnership, which aims to advance their mission of safeguarding executives and their families. The investment will strengthen BlackCloak’s connections in the legal industry and enhance its service offerings amidst evolving cyber threats.