Similar Posts

FS-ISAC Champions Quantum-Resistant Cryptography: Essential Guidance Series for Cybersecurity

The Financial Services Information Sharing and Analysis Center (FS-ISAC) has released essential papers from its Post Quantum Cryptography Working Group to guide the payment card industry (PCI) toward adopting quantum-resilient standards. As quantum computing advances, it poses significant threats to cryptographic security essential for card transactions. One key paper outlines necessary steps for implementing quantum-resistant cryptography, emphasizing strong access controls, data encryption, and thorough risk assessments to mitigate threats. FS-ISAC highlights the dual nature of quantum technology, which can both solve complex problems and challenge existing security. Early strategic planning for quantum migration is crucial for maintaining cybersecurity in the evolving landscape.

Ecommpay Unveils Innovative Italian Payments Suite to Fuel E-Commerce Growth

Ecommpay, a global payments platform, is enhancing support for international e-commerce merchants entering the Italian market by offering localized payment options. This initiative addresses the issue of basket abandonment due to unfamiliar payment methods, crucial for thriving in Italy’s $51 billion e-commerce sector. Ecommpay’s solutions include acquiring, card processing, and alternative payment methods like Satispay and MyBank, improving acceptance rates by 2-3%. With 69% of online transactions using digital payments, Ecommpay aims to optimize user experience through multilingual support, helping merchants create a seamless checkout process and boost customer loyalty in Italy’s dynamic market.

UK Businesses Prepare for ECCTA: Navigating New Economic Crime Laws

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) marks a significant step in the UK’s efforts to improve corporate transparency and tackle financial crime, with provisions effective from March 25, 2025. It aims to combat fraud and money laundering by enhancing Companies House powers, requiring identity verification for directors and significant controllers and rejecting false filings. The Act mandates companies to disclose detailed ownership information and imposes stricter anti-money laundering measures, including rigorous due diligence and monitoring of transactions. These changes reflect a strong commitment to corporate integrity and financial transparency in the UK.

GuidePoint Security Achieves Major Growth with ISO 27001 Certification: Insights from Cybersecurity Consultants

GuidePoint Security has successfully completed a funding round led by Audax Private Equity to enhance its cybersecurity services. This investment is essential for the company to address the growing challenges of cyber threats and establish itself as a trusted advisor in the field. GuidePoint focuses on personalized client engagement, tailored cybersecurity solutions, and unmatched expertise. The funds will support the expansion of operations across the U.S. and international initiatives, responding to rising demand for cybersecurity. CEO Michael Volk emphasized the company’s commitment to client satisfaction and innovative services, while Audax noted GuidePoint’s strong reputation and impressive growth. Previous investor ABS Capital also participated in this round.

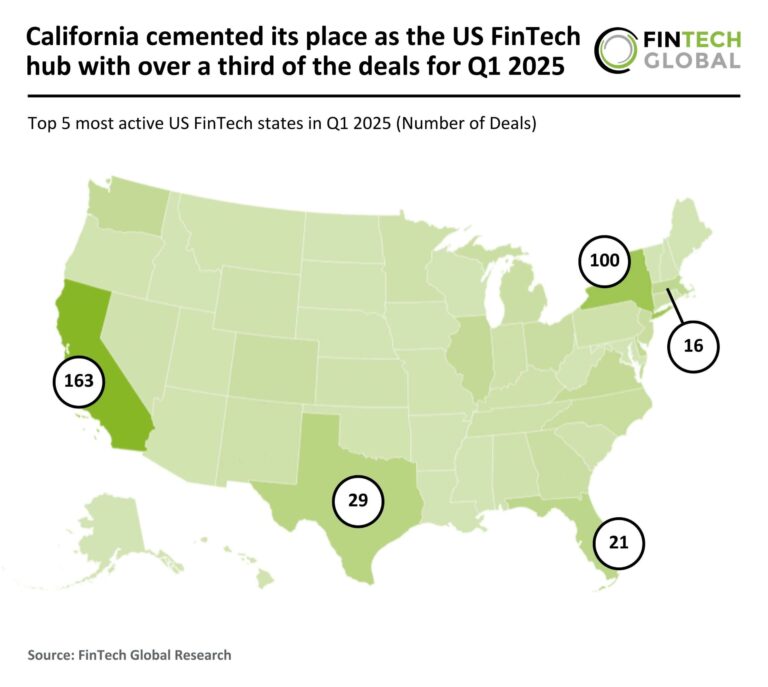

California Reigns Supreme as the US FinTech Hub, Capturing Over 33% of Q1 2025 Investment Deals

In Q1 2025, the US FinTech sector experienced a significant downturn, with deal activity dropping 58% and total funding decreasing to $9.6 billion, a 54% decline from Q1 2024. California remained the leading FinTech hub, accounting for 36% of deals despite a 52% reduction, while New York and Texas also saw declines. Notably, Mercury Financial secured a $300 million funding round led by Sequoia Capital, highlighting ongoing investment interest in innovative banking solutions for startups. This trend reflects a cautious investor approach amid macroeconomic challenges, suggesting a shift in resource allocation within the FinTech industry.