Similar Posts

MyPass Secures A$7.5 Million to Accelerate Expansion of Digital Credentials Platform Across North and South America

MyPass Global, a technology firm specializing in workforce onboarding and credential management, has raised A$7.5 million (about $4.7 million) in a Series A funding round led by OneVentures. This funding will support MyPass’s expansion into North and South America and enhance product development. Founded in 2013, MyPass offers a digital Skills Passport that allows workers to manage training and credentials efficiently. With over 1,300 companies using its platform, which has onboarded 350 organizations and validated over 246,000 documents in 2024, MyPass aims to address global workforce management challenges amid tightening regulations.

Mastering RFPs: A Proven Guide to Boosting Tax Compliance Success and Eliminating Delays

Comply Exchange’s recent webinar, “Know Your Pain: Write RFPs That Solve, Not Stall,” emphasized the critical role of a well-structured Request for Proposal (RFP) in ensuring effective tax compliance. Key points included the necessity of gathering input from diverse teams—tax, legal, product, and more—to avoid overlooking important issues. The webinar cautioned against vague language in RFPs, urging specificity in areas like customization and multilingual support. Additionally, it highlighted that software alone does not eliminate compliance liability. To enhance tax compliance, stakeholders should align early, define requirements clearly, and consider advanced compliance tools. For further insights, visit Comply Exchange.

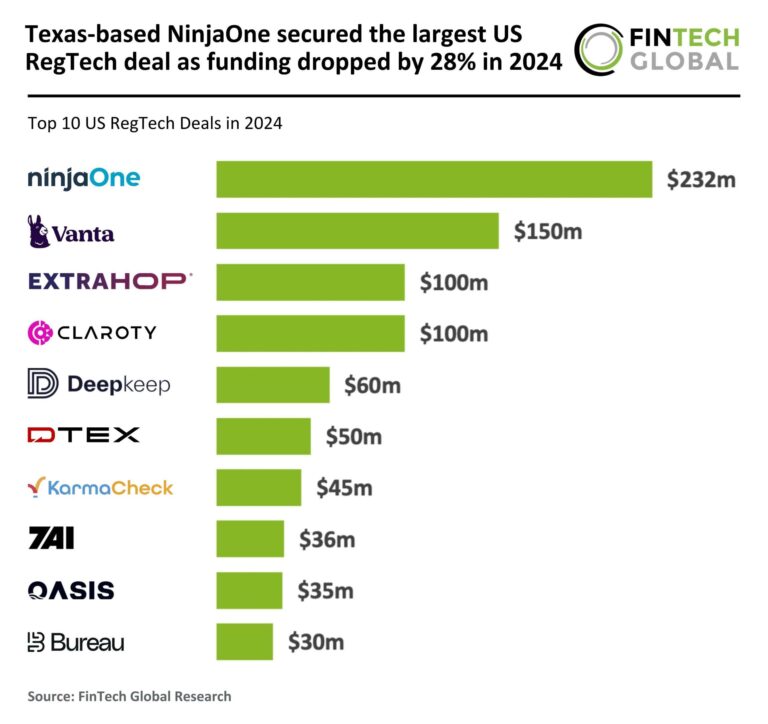

Texas-Based NinjaOne Clinches Major US RegTech Deal Amidst 28% Funding Decline in 2024

In 2024, US RegTech funding saw a 28% decline, totaling around $5 billion across 228 deals, down from $7 billion in 2023. Despite this drop, average deal sizes increased to $22 million, indicating investor preference for established companies amid rising regulatory complexities. California led in funding, securing four of the top ten deals, while states like Washington and New York also performed well. Notably, NinjaOne, a Texas-based firm, raised $231.5 million in the largest deal, valuing the company at $1.9 billion. With this funding, NinjaOne plans to enhance its platform and reinforce its market position in regulatory technology.

US SEC Declares Meme Coins Are Not Securities: What This Means for Investors

The US Securities and Exchange Commission (SEC) recently announced that meme coins are not classified as securities under federal laws, significantly impacting their regulation and trading. According to the SEC’s Division of Corporation Finance, transactions involving meme coins are exempt from registration under the Securities Act of 1933. Meme coins, driven by market demand and speculation, are likened to collectibles and primarily serve entertainment purposes. The SEC’s evaluation, using the Howey test, concluded that meme coin purchases do not involve investment in an enterprise. However, fraudulent activities related to them remain subject to enforcement under various laws, ensuring market protection.

Boosting Profits: How Decarbonisation Drives Cost Savings and Revenue Growth

Decarbonization offers significant financial advantages for businesses beyond regulatory compliance. By integrating decarbonization into strategic planning, companies can reduce operating costs through energy-efficient technologies and renewable energy sources. This strategy not only drives revenue growth by catering to the rising demand for sustainable products but also improves resource quality and operational resilience. Linking decarbonization efforts to financial metrics demonstrates its value, as companies prioritizing ESG initiatives can achieve higher market valuations. To maximize returns, businesses should align decarbonization with their financial strategies, implement low-cost efficiency measures, and leverage tax incentives, making it a crucial lever for financial success.

Sotira Secures $2M Funding to Revolutionize the $500 Billion Overstock Procurement Market

Sotira, an AI-powered surplus inventory management platform, has raised $2 million to transform the $500 billion overstock procurement industry. Supported by investors like Unusual Ventures and Night Capital, Sotira aims to replace outdated methods, such as spreadsheets, which contribute to significant losses from unsold stock. The platform utilizes AI to streamline inventory offloading, reducing review times by half and enabling users to recover up to 50% of costs, saving five figures monthly. With strategic partnerships in various sectors and grants from California, Sotira is positioned to enhance efficiency and financial returns in surplus inventory management.