Similar Posts

RIIG-HOOTL Secures UAE Funding to Scale AI-Powered Cybersecurity and Health Tech Insurance Solutions

RIIG – HOOTL, a cybersecurity and AI-driven health tech company, has secured significant funding from UAE investors, prompting a rebranding to HOOTL, which stands for “Humans Out of the Loop.” This funding will accelerate product development, establish a UAE office, and strengthen partnerships with local entities. HOOTL aims to enhance insurance processes through advanced AI systems, aligning with the UAE’s digital transformation goals. CEO Denver Riggleman expressed gratitude for the support, highlighting the innovative nature of their solutions in insurance verification and claims adjudication. Engagements with UAE leaders have reinforced HOOTL’s commitment to the region’s healthcare modernization efforts.

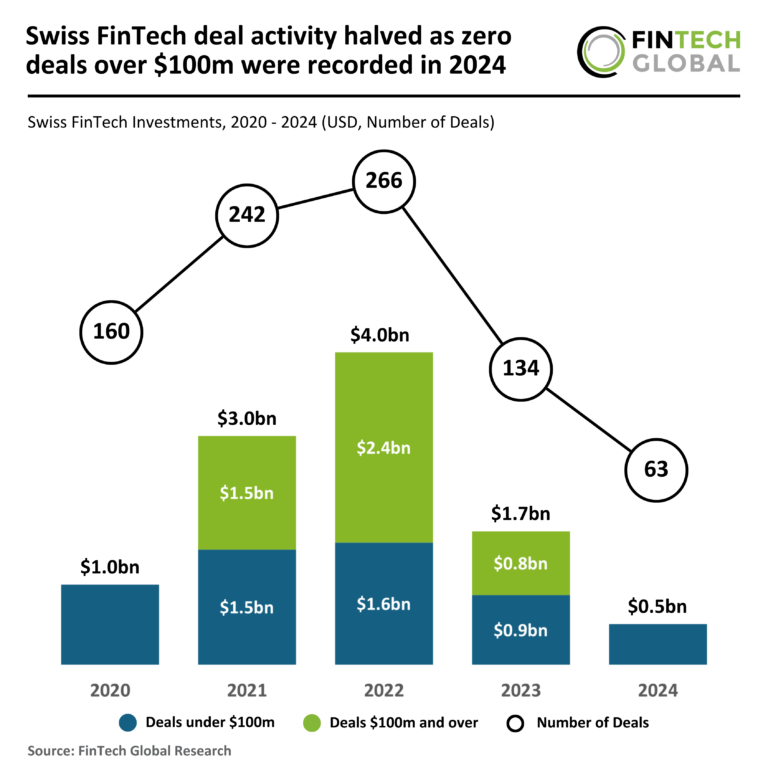

Swiss FinTech Landscape Shifts: 2024 Sees Dramatic 50% Drop in Deal Activity with No Transactions Over $100M

In 2024, the Swiss FinTech sector saw significant declines in deal activity and total funding. The year ended with just 63 deals, a 53% drop from 2023’s 134 deals, and total funding fell to $521 million, down 70% from $1.7 billion the previous year. All investments were under $100 million, reflecting a shift towards smaller, less risky ventures amid economic uncertainties. Despite this downturn, Alpian, a digital banking platform, secured the largest deal at $84 million and doubled its client base within four months, demonstrating resilience and effective financial strategies.

Robeco Launches Innovative Biodiversity Tool to Enhance Corporate Environmental Performance

Robeco, a prominent asset manager known for its sustainability focus, has launched the Biodiversity Traffic Light tool to help investors evaluate companies’ biodiversity performance. This initiative responds to growing investor demand for biodiversity risk assessment beyond traditional sectors. The tool, informed by sector-specific guidelines from the Taskforce for Nature-Related Financial Disclosures, assesses corporate biodiversity impacts, mitigation efforts, and future sustainability commitments. Companies are categorized into four groups based on their environmental performance, aiding investors in screening investments, adjusting portfolio weightings, and enhancing engagement strategies. Robeco aims to support capital allocation towards environmentally responsible companies through this innovative tool.

Bloom Credit Secures $10.5M Funding to Expand Credit Data Infrastructure with Navy Federal Partnership

Bloom Credit, a FinTech innovator, has partnered with Navy Federal Credit Union, the largest credit union in the U.S., following a successful $10.5 million investment round led by Crosslink Capital. This collaboration aims to improve credit reporting by utilizing consumer permissioned data services through Bloom’s flagship product, Bloom+. This tool allows financial institutions to report recurring payments as tradelines to credit bureaus, enabling consumers to enhance their credit profiles. Navy Federal plans to integrate Bloom+ into its checking accounts, offering over 14 million members a pathway to better credit reporting and promoting financial inclusion.

AuditBoard Launches Cutting-Edge AI Governance Solution for Empowering Responsible Innovation

AuditBoard has launched a new AI governance solution to enhance organizations’ risk management and promote responsible AI innovation. With 72% of audit and compliance professionals anticipating significant changes due to AI, effective governance is crucial. The solution aligns with frameworks like the NIST AI Risk Management Framework, addressing cybersecurity, reputational, and financial risks. Key features include streamlined approval workflows, centralized record-keeping, and continuous risk monitoring. AuditBoard’s CTO, Happy Wang, highlighted the urgent need for AI governance, while General Counsel Anthony Plachy noted the rising demand for AI tools necessitating adherence to internal governance standards.

Impact of Recent DEI Initiatives by Leading Firms on ESG Risk Assessments

Major U.S. corporations, including Meta, McDonald’s, and Bank of America, are revising their diversity, equity, and inclusion (DEI) strategies, which investors should watch closely due to potential impacts on ESG risk ratings. A report by ESG News indicates that these changes—ranging from significant policy shifts to the cessation of certain initiatives—are not expected to greatly alter ESG ratings, as DEI accounts for only 40% of the human capital management assessment. While some companies continue to support DEI, concerns remain about broader implications for ESG areas like climate risk management. Investors are advised to monitor these developments carefully.