Similar Posts

Revolutionizing Gratitude: British FinTech Thankyü Launches Cashless Tipping Platform to Empower Service Staff

British FinTech start-up thankyü has launched an innovative tipping platform aimed at supporting hospitality staff, gig workers, and musicians. The TipTap wearable band allows customers to tip directly via their smartphones, addressing financial pressures in the sector. Upcoming changes, such as increased National Insurance rates and reduced business rates relief, could significantly impact businesses reliant on tips. thankyü’s decentralized platform enables instant tip management without deductions, compliant with the Employment (Allocation of Tips) Act 2023. Successfully trialed at various venues, it offers flexible tipping options and promotes direct payments, relieving employers of National Insurance contributions. The app is available for free on major platforms.

Sokin Secures $15 Million Investment from BlackRock to Accelerate Global Expansion

UK-based payments firm Sokin has secured $15 million in debt funding from BlackRock, following a $31 million investment from Morgan Stanley. This funding will fuel Sokin’s growth, which has already seen a 51% increase in new account openings and a 130% workforce expansion since July. The company plans to open new offices in London, New York, Toronto, and Dubai and has acquired Norwegian FinTech Settle Group AS for a European EMI license. Sokin aims to streamline international payments for businesses, currently handling over $4.5 billion annually. CEO Vroon Modgill emphasized the importance of this backing for Sokin’s mission.

Unlocking the Future: How Saifr is Revolutionizing RegTech with AI Innovation

Saifr, a Boston-based company founded in 2020, utilizes advanced AI to identify compliance risks in content creation and e-communications for financial services. In 2024, Saifr achieved significant growth milestones, including a strategic acquisition, increased revenue, and collaboration with Microsoft. CEO Vall Herard emphasized AI’s role in streamlining compliance processes and ensuring regulatory adherence. Saifr transforms regulations into executable code for AI, enhancing compliance in financial applications. Herard suggests that smaller institutions benefit more from purchasing AI solutions. Looking ahead to 2025, Saifr plans to enhance its model-as-a-service offerings and collaborate further with Microsoft Azure AI Foundry.

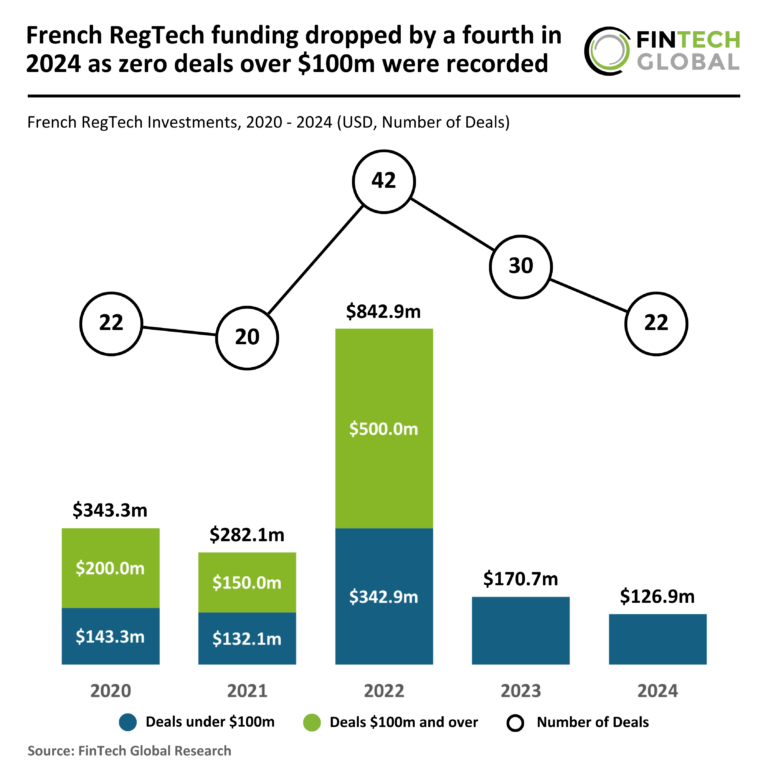

2024 Sees 25% Decline in French RegTech Funding: No Deals Exceeding $100M

In 2024, French RegTech investments have faced a significant downturn, with total funding dropping to $127 million, a 26% decline from 2023 and 63% from 2020. While deal volume remained stable at 22, the average deal size slightly increased to $5.8 million, yet still far below the $15.6 million average seen in 2020. Investors are focusing on lower-risk, smaller deals amid economic uncertainties. A notable exception is Dotfile, an AI-driven compliance automation firm, which raised $6.7 million to enhance its compliance platform and expand internationally, positioning itself as a leader in the RegTech market.

HUMBL Secures $500K Funding to Boost Expansion in North and Latin America

HUMBL has secured a $500,000 investment from Quail Hollow Capital through a Convertible Promissory Note, aimed at enhancing its business operations. This funding will cover crucial public company expenses, including audits, accounting, legal services, and compliance costs. Under CEO Thiago Moura’s leadership, HUMBL is transitioning to prioritize shareholder value while operating in North and Latin American markets. The company offers a digital wallet for users to store and manage digital assets and payments. Moura highlighted that this investment will support essential operating costs and facilitate strategic growth and sales expansion in their markets.