Similar Posts

Climate FinTech Bees & Bears Secures €500M to Accelerate Household Energy Transition

Bees & Bears, a climate FinTech company, has secured €500 million in financing to promote sustainable energy solutions in Germany, enabling the installation of nearly 25,000 energy-efficient systems like photovoltaic systems, heat pumps, and energy storage systems. Funded by a reputable bank and overseen by the European Central Bank, the initiative aims to reduce carbon footprints and enhance renewable energy adoption. The company offers flexible installment payment options for homeowners and collaborates with local tradesmen to ensure expert service. Their streamlined financing process includes quick credit checks and a user-friendly experience, supporting the transition to energy independence and combating climate change.

Tirana Bank Teams Up with Backbase to Revolutionize Digital Banking in Albania

Tirana Bank is initiating a major digital transformation by partnering with Backbase, marking its largest technology investment to date. Supported by the BALFIN Group, the initiative aims to triple the bank’s digital customer base in five years and enhance retail and business banking services. Key goals include launching new web and mobile applications and introducing digital lending options. Backbase’s cloud-native platform will facilitate rapid innovation, improved security, and personalized customer experiences. Tirana Bank CEO Dritan Mustafa expresses ambition to become Albania’s leading digital bank, positioning this collaboration as a transformative step in the region’s banking sector.

Revolutionizing AML Compliance: How AI is Minimizing False Positives and Enhancing Efficiency

A recent webinar on anti-money laundering (AML) compliance highlighted the persistent challenge of managing false positives. Despite conventional strategies like tuning screening systems and expanding analyst teams, financial institutions still struggle with inaccurate alerts. WorkFusion’s AI Agents for FinCrime compliance are revolutionizing this process by automating decisions on up to 90% of alerts, significantly reducing human involvement. These AI Agents, like “Evan,” improve efficiency by prioritizing relevant information and allowing analysts to focus on critical cases. This technological advancement marks a shift towards a more effective compliance framework, enhancing operational risk management in the financial sector.

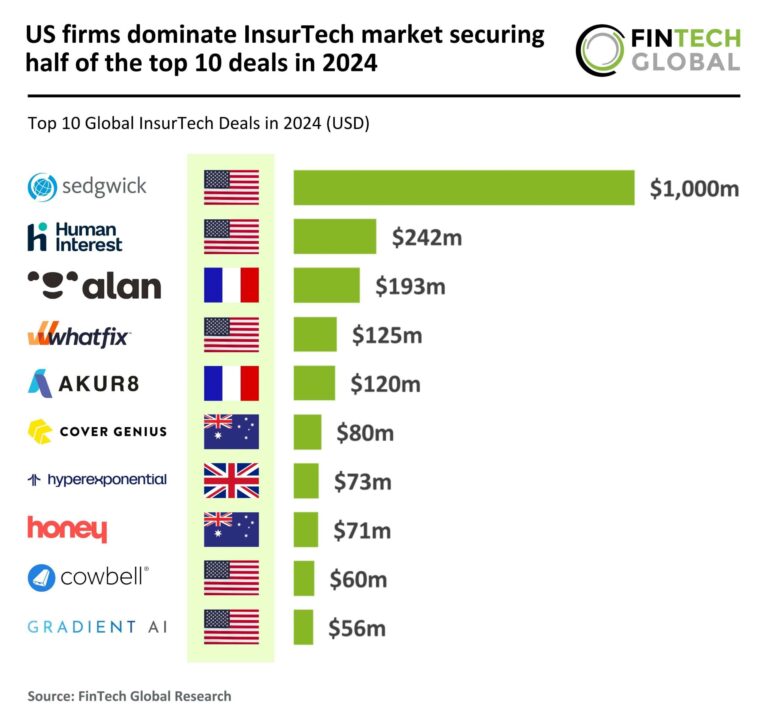

US InsurTech Powerhouses Lead the Market: Securing 50% of Top 10 Deals in 2024

In 2024, the InsurTech market faced a significant funding decline, with global investments dropping 35% year-over-year to $5 billion, and deal count plummeting to 206 from 609 in 2020. U.S. firms led the sector with five of the top ten funding deals, while Australia and France secured two each. The UK saw a decrease, and emerging markets like Singapore and India were absent from the top rankings. Notably, French InsurTech Alan raised $193 million in Series F funding, expanding its health insurance offerings and enhancing its position in the market, particularly through partnerships with Belfius Bank.