Similar Posts

One Peak Invests £25M in Iplicit to Propel Cloud Accounting Innovations Forward

Iplicit, a cloud accounting software platform for the UK mid-market, has secured £25 million in its first institutional funding round from One Peak. This investment aims to accelerate product development and growth. Established in 2019, Iplicit has seen impressive triple-digit revenue growth, including a 113% increase in 2024, earning accolades such as inclusion in the Deloitte UK Technology Fast 50 and a top 10 spot in the Sunday Times Best Places to Work awards. CEO Lyndon Stickley emphasized that the funding is crucial for maintaining momentum and reinforcing Iplicit’s position in the cloud accounting market.

FinTech Funding Surge: Over $1 Billion Raised This Week – Discover the Latest Deals!

In 2025, the FinTech sector began strongly, raising $1.2 billion across 30 deals within three weeks, with weekly totals exceeding $1 billion. Notable funding included Deel’s $300 million for its payroll platform and Openly’s $193 million for home insurance. The majority of investments targeted US-based firms, with Germany and the UK also participating. India emerged as Asia’s leading FinTech hub, despite a decline in deals. Key trends included a focus on infrastructure and enterprise software, while AI and generative AI were highlighted as disruptive technologies in asset management. The sector’s growth continues to attract significant investor interest.

Asean Launches Innovative ESG Framework to Empower SMEs in Supply Chain Sustainability

The ASEAN Capital Markets Forum (ACMF) launched the Asean Simplified ESG Disclosure Guide (ASEDG) Version 1 to improve ESG reporting among SMEs in Southeast Asia. Unveiled at the ASEAN Finance Ministers and Central Bank Governors Meeting, the guide consolidates global and regional ESG standards into 38 key disclosures, organized into three tiers: Basic, Intermediate, and Advanced. This initiative aims to support SMEs in effectively communicating their sustainability efforts to stakeholders, addressing the challenges they face in reporting. The guide will be updated regularly to align with international standards and gather regional feedback, promoting sustainable growth across ASEAN.

Klarna and OnePay Join Forces to Revolutionize Walmart Installment Loans in the U.S.

Klarna has partnered with OnePay, a consumer finance app, to offer exclusive installment loans for Walmart purchases in the U.S. This collaboration aims to enhance the shopping experience by providing flexible payment options both in-store and online. The integration of OnePay’s services into Walmart’s checkout is expected later this year, allowing customers to finance various products, including electronics. Klarna’s CEO, Sebastian Siemiatkowski, called the partnership a game changer, while OnePay’s CEO, Omer Ismail, stressed the importance of accessible credit options. Approved customers can choose repayment plans between 3 to 36 months, improving their purchasing flexibility.

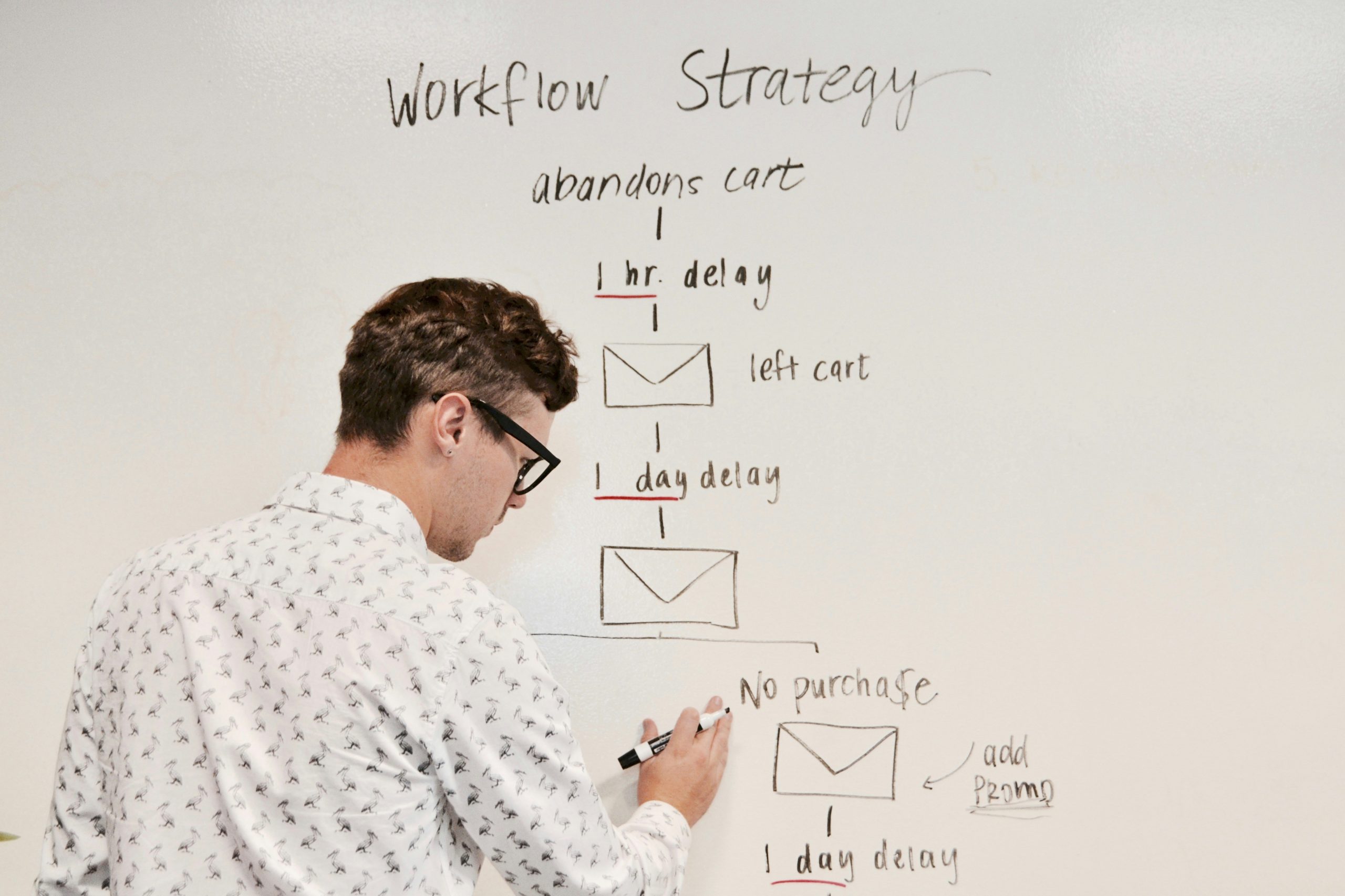

Revolutionizing Financial Crime Compliance: The Impact of WorkFusion AI Agents

Financial institutions face challenges in creating in-house AI solutions for financial crime compliance (FCC), including prolonged timelines, resource demands, and diminishing returns. In contrast, integrating WorkFusion AI Agents provides quick, substantial returns on investment and long-term value while seamlessly fitting into existing processes. A new white paper from WorkFusion details these benefits, discussing mechanisms for superior ROI, implementation strategies, and data management protocols. This publication is particularly valuable for IT leaders looking to modernize FCC operations with AI technology, offering insights into enhancing compliance strategies effectively. For more information, visit WorkFusion’s financial compliance resource page.

Smart Data Foundry Raises £3M to Transform UK Financial Research Landscape

Smart Data Foundry (SDF) has secured £3 million in funding from Smart Data Research UK, part of UK Research and Innovation, to enhance financial health studies for UK households. This investment will support the development of a Financial Data Service, integrating with five existing data services to provide researchers access to anonymized financial behavior data from digital interactions. The initiative aims to deliver insights into the UK’s economic health and foster partnerships among academia, public institutions, and the private sector. SDF, established in 2022, aims to leverage financial data for public benefit, with notable collaborations enhancing its reputation.