Similar Posts

Mastering ESG Data: A Step-by-Step Guide to Compliance with ESRS Standards Before Reporting

As the European Sustainability Reporting Standards (ESRS) deadlines approach, effective management of ESG data is crucial for compliance and maintaining stakeholder trust. A guide from Position Green outlines a streamlined approach, emphasizing the use of their software for data preparation. Key steps include defining reporting frameworks, establishing clear data ownership, ensuring accuracy through validation and audits, standardizing reporting formats, and linking ESG data to business performance. By centralizing data collection and utilizing automated tools, organizations can enhance their sustainability reporting and align it with strategic objectives, thus laying a strong foundation for ESRS compliance.

VIA Raises $28 Million to Propel Expansion of Cutting-Edge Cybersecurity Platform

VIA, a Boston-based cybersecurity firm, has raised $28 million in Series B funding to enhance its decentralized platform for data and identity protection, meeting high security standards required by the U.S. Department of Defense. The funding round was led by Bosch Ventures, with participation from BMW i Ventures, MassMutual Ventures, and others. VIA’s platform features a zero trust architecture designed to mitigate insider threats and ensure quantum-resistance, addressing evolving cyber threats. The funds will accelerate the deployment of VIA’s Web3 data protection solutions among large enterprises, revolutionizing enterprise security with advanced identity management and encryption capabilities.

Kin Unveils Innovative Home Insurance in California to Bridge the Coverage Gap

Kin, a direct-to-consumer home insurance provider, has expanded its offerings to include comprehensive home insurance for California homeowners, addressing the challenges of securing coverage in wildfire-prone areas. The situation has worsened since the January 2025 wildfires, with nonrenewal rates tripling, leaving many without options. Kin aims to counter the perception that California is uninsurable by utilizing innovative technology and analytics. Their digital model enhances customer interactions and offers tailored solutions for wildfire risks. CEO Sean Harper emphasizes the importance of adapting to environmental changes, ensuring homeowners can feel secure in their properties.

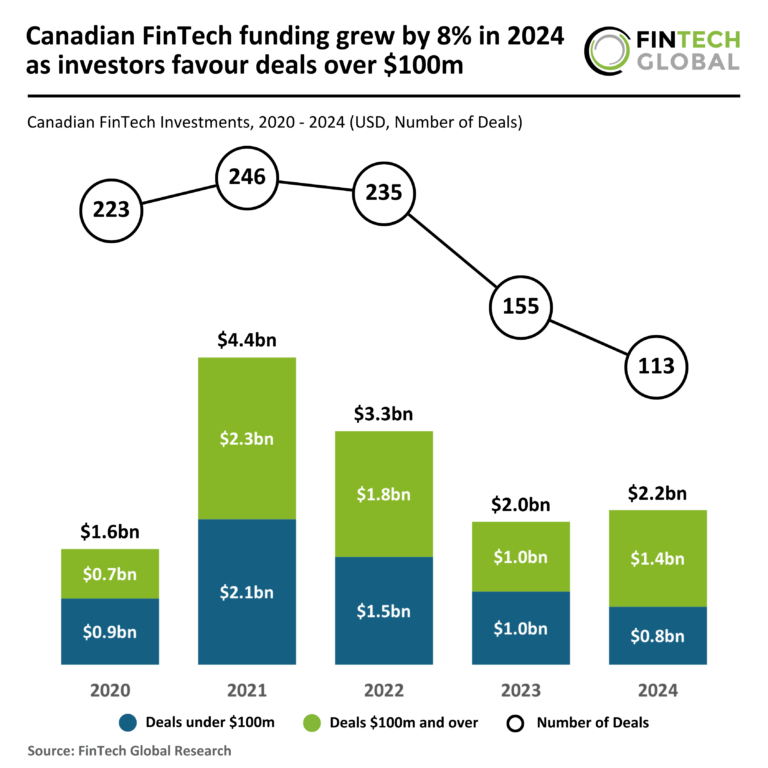

Canadian FinTech Funding Surges 8% in 2024: Investors Prefer $100M+ Deals!

In 2024, the Canadian FinTech sector experienced an 8% increase in funding, reaching $2.2 billion, up from $2 billion in 2023 and showing a 34% rise since 2020. However, the number of deals declined by 27% to 113, while the average deal size surged by 47% to $19.5 million. A notable trend is the shift towards larger deals, with investments over $100 million totaling $1.4 billion, a 38% increase from 2023. Cohere, a Toronto-based AI startup, secured the largest deal at $500 million, enhancing its total funding to $970 million and planning workforce expansion.

Transforming Insurance: Kennedys IQ and Solomonic Unite to Revolutionize Litigation Data Integration

Kennedys IQ has formed a strategic partnership with Solomonic, a litigation analytics firm, to transform litigation risk management in the insurance industry. This collaboration aims to enhance risk visibility by integrating Solomonic’s data with Kennedys IQ’s advanced analytics, focusing on key phases of the insurance lifecycle, including policy issuance and renewal. The partnership will enhance the SmartRisk Machine Intelligence platform, improving analytical capabilities and providing deeper insights for insurers. Both companies’ leaders expressed optimism about the collaboration’s potential to empower clients with actionable insights, ultimately aiming to improve underwriting accuracy and reduce claims uncertainty.