Similar Posts

GLEIF and Companies House Join Forces to Boost Global Business Transparency

The Global Legal Entity Identifier Foundation (GLEIF) has partnered with the UK’s Companies House to enhance business transparency and operational efficiency. This collaboration aims to simplify access to UK companies’ registration data by integrating direct links to Companies House documents within Legal Entity Identifier (LEI) records. Benefits include streamlined access to company data, improved due diligence for compliance, and increased operational efficiency. GLEIF’s CEO, Alexandre Kech, emphasized the initiative’s role in fostering corporate transparency, while Companies House CEO Louise Smyth noted it enables secure access to extensive business information. This partnership may lead to future collaborations with global business registries.

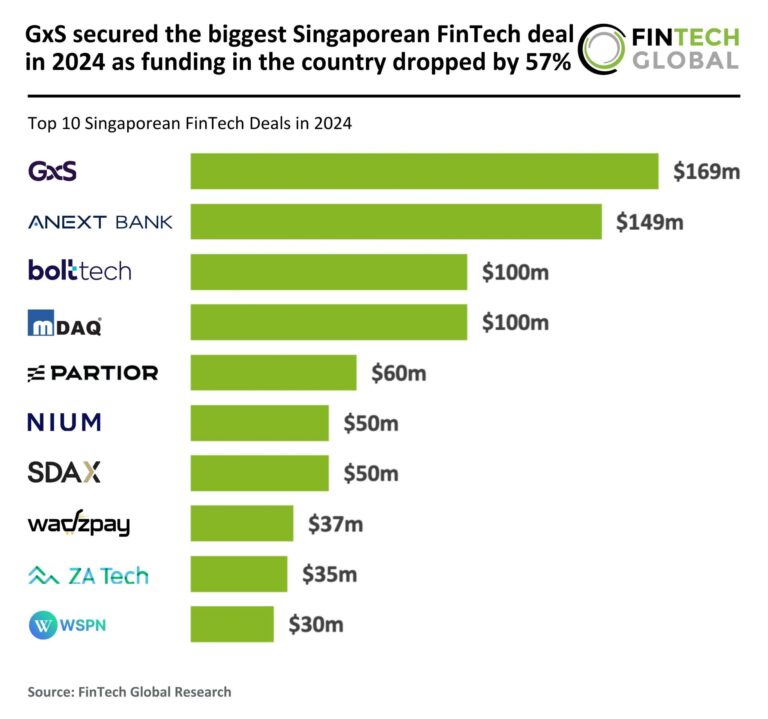

GxS Clinches Major Singapore FinTech Deal in 2024 Amidst 57% Drop in National Funding

In 2024, Singapore’s FinTech sector faced a significant downturn, experiencing a 57% drop in funding, with total investments falling to $1.7 billion from $4 billion in 2023. Deal activity also decreased sharply, with 116 deals recorded, down from 221. This shift reflects a cautious investment climate driven by economic uncertainties and regulatory challenges. Investors are now prioritizing sustainable growth over aggressive expansion. Despite the overall decline, GXS Bank secured the largest deal of the year at $169.1 million, aimed at enhancing its FlexiLoan product for underserved customers. Stakeholders must adapt strategies to navigate this evolving landscape.

Profile Teams Up with Valletta Credit Finance Corporation to Revolutionize Digital Banking Solutions

Profile, a leading European financial solutions provider, has partnered with Valletta Credit Finance Corporation Ltd (VCFC) in Malta to implement the Finuevo Core banking platform. This collaboration aims to modernize VCFC’s back-office operations and automate payment processes for its growing client base, particularly affluent and corporate clients. The Finuevo Core offers comprehensive banking operations, real-time credit transfers, and enhanced monitoring for regulatory compliance. VCFC specializes in high-end payment cards and targets ultra-high-net-worth individuals. Both CEOs emphasized their commitment to delivering innovative, luxury payment solutions tailored to evolving client needs through this partnership.

NavSav Insurance Welcomes Bryan Montoya as Central Texas Market Agency Leader

NavSav Insurance has appointed Bryan Montoya as the new market agency leader for its Central Texas cluster, a move aimed at enhancing growth and service offerings. Montoya brings extensive experience in leadership and sales, having built a strong reputation in both captive and independent insurance sectors. His innovative sales strategies and client relationship skills are expected to bolster NavSav’s competitive edge. CEO Brent Walters emphasized the importance of recruiting top talent like Montoya to stay ahead in the industry. NavSav’s commitment to growth and personalized service, partnering with over 150 carriers, positions it to reshape the insurance landscape.

MIB Group Boosts Underwriting with Clareto Acquisition from Munich Re for Enhanced Electronic Health Record Integration

MIB Group has acquired Clareto, a medical record retrieval company, from Munich Re Life US to enhance its electronic health records (EHR) capabilities for life insurance underwriting. This acquisition aims to improve data access and analytics, facilitating more automated risk assessments. Although financial details were not disclosed, integrating Clareto’s expertise into MIB’s EHR platform will provide broader access to medical data and improve the underwriting process. Leaders from both MIB and Munich Re emphasized the partnership’s potential to streamline underwriting data acquisition, accelerate decision-making, and enhance customer satisfaction within the life insurance sector.