Similar Posts

Semeris Secures $4.3 Million to Revolutionize AI-Driven Legal Document Analysis in Finance

Semeris, an AI-driven legal document analysis company focused on financial institutions, has secured $4.3 million in funding, primarily from Puma Growth Partners. This investment will enhance its platform and expand its sales team to meet increasing demand for efficient AI solutions in structured finance. Founded in 2020 by Peter Jasko and Sam Daroczy, Semeris aims to revolutionize legal document analysis by streamlining workflows and ensuring regulatory compliance. The funding will allow the company to diversify its product offerings and improve its AI capabilities. Semeris is positioned to lead a technological shift in legal documentation, promising greater efficiency for finance professionals.

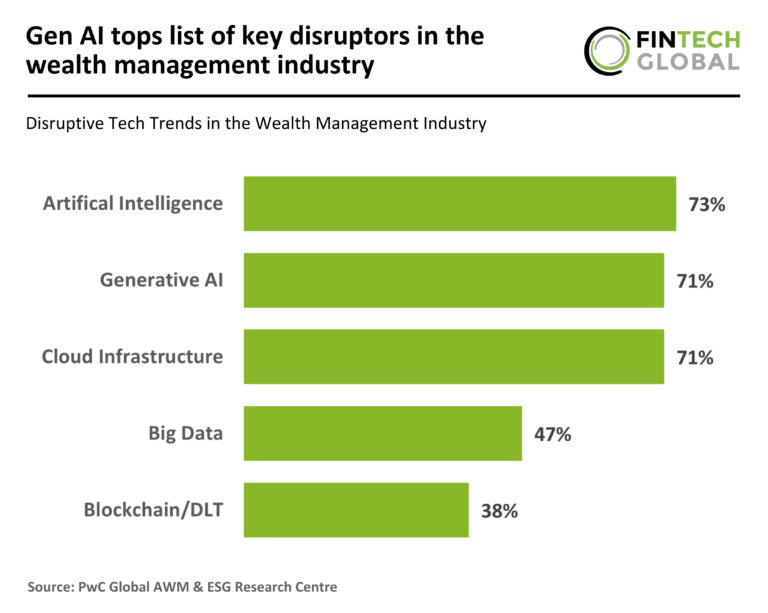

Generative AI: The Game-Changer Disrupting the Wealth Management Industry

A recent PwC survey of 521 industry leaders in asset and wealth management reveals how disruptive technologies like artificial intelligence (AI) and cloud computing are transforming the sector. Key findings show that 73% of respondents view AI and 71% generative AI as pivotal innovations, while 71% highlight cloud technology’s role in modernization. The integration of these technologies is reshaping business models, creating new revenue streams, and addressing challenges such as data security and governance. As firms adapt to technological advancements, they must rethink investment strategies and client expectations to remain competitive in this evolving financial landscape.

Insurity Collaborates with OIP Insurtech to Revolutionize P&C Insurance Implementations

Insurity has partnered with OIP Insurtech, designating them as a System Integrator (SI) partner to enhance implementation and support for property and casualty insurers using Insurity’s software solutions. This collaboration aims to streamline technology integrations, expedite solution deployments, and improve operational efficiency. OIP Insurtech will leverage its expertise in system integration to help insurers adopt digital solutions smoothly and optimize workflows. Insurity offers cloud-based software tailored for insurance carriers, brokers, and MGAs, including platforms for policy management and claims processing. This partnership promises reduced complexity in technology implementation and a dedicated support team for long-term success.

Deel Secures $300M in Secondary Investment, Achieves Impressive $800M Run-Rate: A Milestone for Global Payroll Solutions

Deel, a leading workforce management solutions provider, has raised $300 million in a funding round led by General Catalyst and a sovereign investor. This investment marks a significant milestone in Deel’s rapid growth, achieving an $800 million run-rate and 70% year-over-year growth by December 2024, while maintaining profitability for over two years. Founded in 2019, Deel has transformed into a comprehensive workforce management platform, offering HRIS, payroll management, compliance solutions, and more in 150 countries. CEO Alex Bouaziz anticipates continued growth and innovation in 2025, supported by new investor backing. Visit Deel.com for more information.

Hokodo Secures €10M to Accelerate B2B Credit Solutions Expansion Across Europe

Hokodo, a European leader in digital trade credit solutions for B2B transactions, has raised €10 million in equity funding to accelerate growth and enhance product development. Co-led by Korelya Capital and Opera Tech Ventures, the investment will support product innovation, operational scaling, and omnichannel solutions, including a partnership with French merchant RÉTIF. Founded in 2018, Hokodo is the first regulated electronic money institution in its sector. Co-founder Richard Thornton highlighted the importance of adapting to traditional sales processes. Investor Franco Danesi praised Hokodo’s rapid expansion across Europe, positioning it as a key player in the B2B BNPL landscape.