Similar Posts

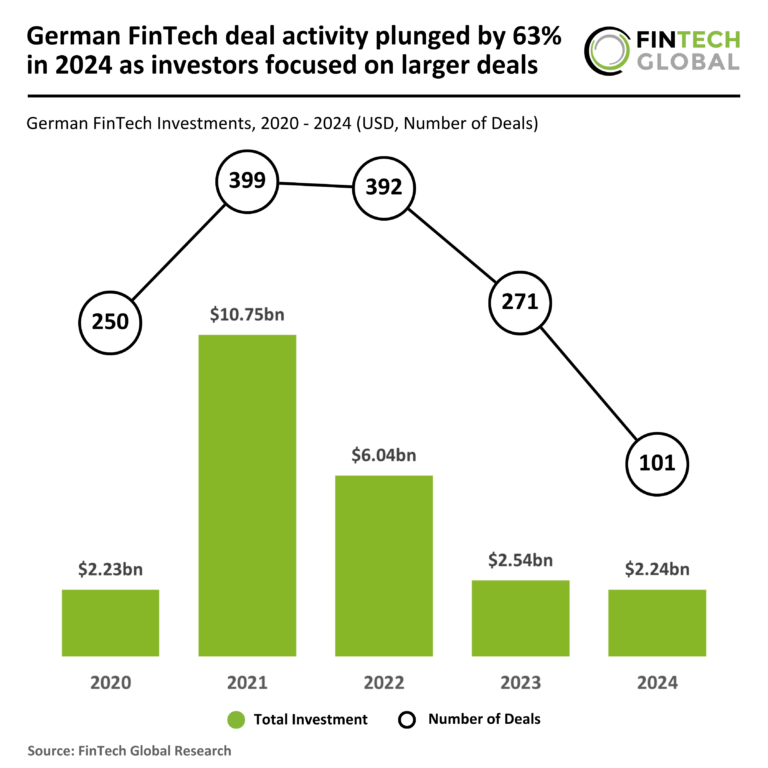

2024 Sees 63% Drop in German FinTech Deal Activity as Investors Shift Focus to Bigger Opportunities

In 2024, German FinTech investments experienced a 63% decline in deal activity, with only 101 deals recorded compared to 271 in 2023, marking the lowest level in five years. Total funding decreased slightly to $2.2 billion from $2.5 billion, reflecting a more selective investment approach amid economic uncertainties. However, the average deal value surged to $22.1 million, more than doubling from $9.4 million in 2023, indicating a shift towards investing in established firms. Notably, osapiens secured a $120 million Series B funding round, the largest FinTech deal in Germany this year, emphasizing the focus on quality investments.

Revolutionizing Project Financing: CapeZero, the Clean Energy FinTech, Secures $2.6M Investment

CapeZero, a software platform aimed at streamlining financial workflows for renewable energy developers, has raised $2.6 million in seed funding, led by Powerhouse Ventures. This investment will enhance the platform’s capabilities, significantly reducing financial modeling time from months to minutes. Key features include real-time scenario analysis and standardized analytics, allowing project finance teams to work 50-75% faster. Founded in 2023, CapeZero’s leadership team boasts extensive experience in renewable energy finance. CEO Manish Hebbar highlighted the platform’s role in overcoming financing complexities as the renewable energy sector anticipates a surge in investment, projected to rise from $60 billion to $150 billion annually by 2030.

Taktile Secures $54M in Funding for Groundbreaking AI Decision-Making Platform from Leading Investors

Taktile, an innovative decision automation platform, has raised $54 million in Series B funding to enhance risk management strategies in financial services. The funding round, led by Balderton Capital, included contributions from notable investors like Index Ventures and Larry Summers. Taktile aims to optimize risk decision-making for fintech companies and traditional banks using AI-driven tools. Currently processing hundreds of millions of risk decisions monthly, Taktile serves major institutions across 24 markets. With accolades from the 2024 Banking Tech Awards USA, the platform is recognized for addressing critical needs in credit underwriting and fraud prevention, promising a more efficient financial landscape.

UAE FinTech Klaim Raises $26 Million to Accelerate Regional Growth and Innovation

UAE-based Klaim, a healthcare payments solutions provider, has secured $10 million in Series A equity funding and an additional $16 million for regional expansion. This investment aims to strengthen Klaim’s presence in the UAE and facilitate entry into Saudi Arabia and Oman. The funding will enhance innovation in healthcare finance by streamlining medical insurance claim payments, allowing providers to receive payments within 24 hours. CEO Karim Dakki highlighted that this funding validates Klaim’s vision and will support rapid scaling. Klaim’s solutions aim to optimize financial processes for healthcare providers and improve patient care in the MENA region.

Endor Labs Secures $93M Funding to Enhance AI-Driven Application Security Platform

Endor Labs has raised $93 million in a Series B funding round led by DFJ Growth, with participation from notable investors like Salesforce Ventures and Dell Technologies Capital. This funding aims to enhance application security, particularly against AI-generated code. Endor Labs protects over 5 million applications and performs over 1 million security scans weekly, serving clients like OpenAI and various financial institutions. The investment will support the expansion of its AppSec platform, incorporating AI for threat detection and vulnerability remediation. The company has seen impressive growth, with a 30x increase in annual recurring revenue since its Series A round.