Similar Posts

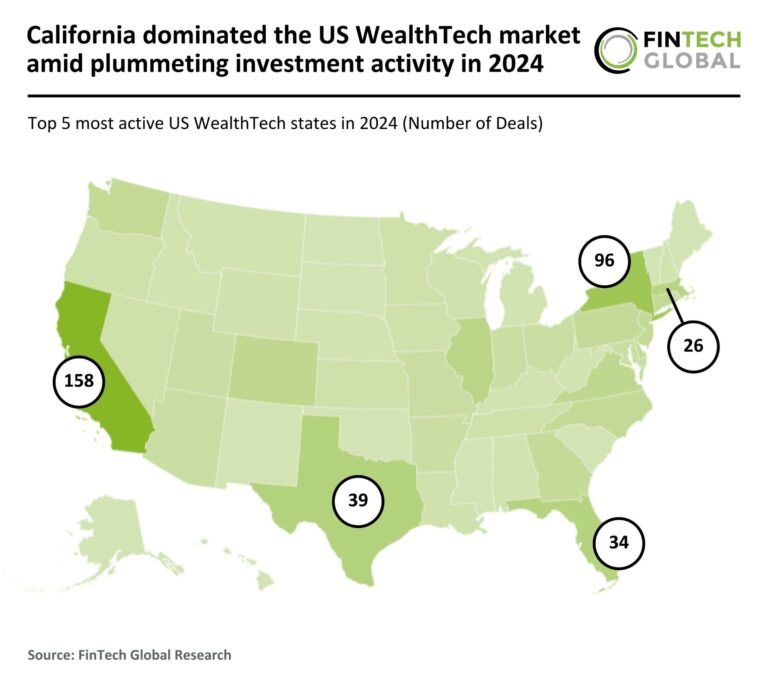

California Leads the Charge in US WealthTech Despite 2024 Investment Decline

In 2024, the US WealthTech industry faced a severe decline, with investment activity plummeting 70% year-over-year. Total funding dropped to $8.2 billion, down 65% from $23.1 billion in 2023, while deal volume fell to 572 transactions, a 70% decrease from 1,937 deals. California led the market with 158 deals (28% share), despite a 71% decline from 2023. Notable activity included Nassau’s $200 million investment from Golub Capital, enhancing its digital financial solutions. This downturn highlights the sector’s struggle to maintain investor confidence amid changing market conditions.

Revolutionary Stablecoin Platform Brale Becomes First US Issuer to Join M0 Network

M0, a Swiss stablecoin platform, has announced that Brale, a regulated US stablecoin issuance platform, is becoming a permissioned Minter on its network. This partnership will make Brale the first issuer of M0-powered stablecoins in the US, enhancing access to liquidity for application-specific stablecoins. M0 offers a robust infrastructure, featuring approved issuers, interoperability, and collateral management. Luca Prosperi, M0’s CEO, highlighted the importance of this collaboration amid evolving US stablecoin regulations. Brale’s CEO, Ben Milne, expressed that this partnership will support innovative stablecoin use cases in the US market, with Brale’s application currently under review.

Bloom Credit Secures $10.5M Funding to Expand Credit Data Infrastructure with Navy Federal Partnership

Bloom Credit, a FinTech innovator, has partnered with Navy Federal Credit Union, the largest credit union in the U.S., following a successful $10.5 million investment round led by Crosslink Capital. This collaboration aims to improve credit reporting by utilizing consumer permissioned data services through Bloom’s flagship product, Bloom+. This tool allows financial institutions to report recurring payments as tradelines to credit bureaus, enabling consumers to enhance their credit profiles. Navy Federal plans to integrate Bloom+ into its checking accounts, offering over 14 million members a pathway to better credit reporting and promoting financial inclusion.

FinTech Funding Soars: Over $16 Billion Raised in Record-Breaking Week!

In a remarkable week for the fintech sector, over $16 billion was raised, signaling strong investment interest, particularly in artificial intelligence and sustainable solutions. Databricks led with a $15 billion Series J funding round to enhance its AI offerings and expand globally. Other notable raises included Bees & Bears with €500 million for sustainable energy and Phantom’s $150 million for blockchain innovations. The fintech sector executed 12 deals, while the USA dominated with 15 transactions. Overall, the week showcased a vibrant landscape driven by strategic investments, setting a promising tone for the year ahead.

FinTech Surge: Over $1 Billion Raised in 16 Major Deals This Week!

The FinTech sector attracted over $1 billion in investments this week, with 16 transactions totaling $1.13 billion despite a slow deal flow. Notable deals included UK-based Abound securing £250 million ($324 million) from Deutsche Bank, Mercury Financial raising $300 million to reach a $3.5 billion valuation, and Island obtaining $250 million in Series E funding, boosting its valuation to nearly $5 billion. Additionally, MoonPay received a $200 million credit line, and Aura raised $140 million to enhance its AI-driven safety solutions. The U.S. dominated the investment landscape, accounting for 11 of the deals, with CyberTech leading sector activity.