Similar Posts

Pemberton Capital Boosts Operational Efficiency with Broadridge’s Innovative Sentry Solution

Broadridge Financial Solutions has partnered with Pemberton Capital Advisors to enhance private credit management within the FinTech landscape. Utilizing Broadridge’s Sentry Private Credit Portfolio Management solution, this collaboration aims to optimize Pemberton’s operations amid rising demand for private credit and collateralized loan obligations (CLO). The Sentry platform improves workflow efficiency, transparency, and decision-making for asset managers. Pemberton, a European leader in private credit management, seeks to scale its operations with Broadridge’s advanced technology. Executives from both firms expressed optimism about the partnership’s potential to drive operational efficiency and meet growing market demands.

Plumery Unveils Lightning-Fast Digital Lending: Get Your Loan Approved and Disbursed in Under 3 Minutes!

On January 21, 2025, Plumery launched its Digital Lending platform in Amsterdam, aimed at transforming the loan origination process for financial institutions. This fully digital solution allows customers to complete loan applications and receive funds in just 180 seconds, significantly enhancing efficiency. Banks can introduce new lending products within 18 weeks, expanding their portfolios without increasing staff. Plumery’s platform features user-friendly interfaces, secure data handling, automated processing, and AI-driven credit decisioning. By streamlining customer experiences and workflows, Plumery enables financial institutions to meet rising expectations and adapt to regulatory changes in the competitive lending landscape.

Boost MySQL Database Performance: Proven Strategies to Tackle Slow-Running Queries

Slow MySQL queries can severely impact database performance. This guide outlines strategies to optimize MySQL, focusing on indexing, query restructuring, and server configuration. Key techniques include creating indexes on frequently used columns, using the EXPLAIN statement to analyze queries, and optimizing configurations like innodb_buffer_pool_size. Limit wildcard usage in queries and avoid functions in WHERE clauses to enhance performance. Additionally, consider application-level caching and monitor slow queries with tools like mysqldumpslow. With consistent monitoring and optimization, MySQL databases can achieve better efficiency and response times, even under complex workloads. For further details, refer to the MySQL Optimization Guide.

Validis Secures Major Investment from Citi and Barclays to Revolutionize Business Lending Solutions

Validis, a leader in financial data collection and standardization, has received strategic investments from Citi and Barclays to enhance its innovative platform for automating data processes essential for business lending. The technology streamlines financial monitoring, enabling quicker credit application reviews and improving risk management. With this funding, Validis aims to accelerate growth through product innovation and expanded marketing while transforming the audit sector by partnering with over 100 firms to provide audit-grade data. CEO Michael Turner emphasized the platform’s ability to reduce costs and time for complex clients, while Barclays’ James Binns highlighted enhanced customer service through automated solutions.

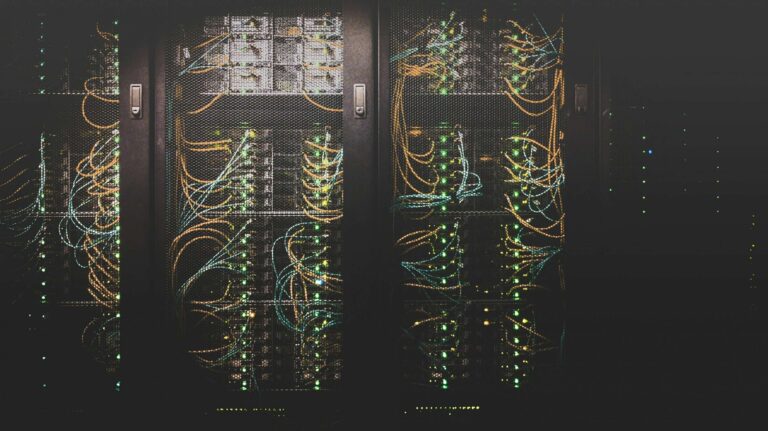

Flexential Secures Strategic Investment to Accelerate Growth and Expand Data Center Solutions

Flexential has formed a significant partnership with Morgan Stanley Infrastructure Partners (MSIP) and GI Partners to enhance its digital infrastructure capacity in the U.S. This collaboration will provide substantial capital to support Flexential’s expansion, which includes over 40 interconnected data centers and a capacity exceeding 325MW. CEO Chris Downie views this partnership as a pivotal moment for the company’s growth, paving the way for new strategic opportunities. MSIP’s Christopher Ortega expressed confidence in Flexential’s innovative infrastructure, emphasizing its potential to capitalize on market opportunities. The partnership aims to strengthen Flexential’s position in the data center industry.

Infact Secures £4M Seed Investment to Revolutionize Real-Time Credit Referencing

Infact, a new Credit Reference Agency, has secured £4 million in seed funding, led by AlbionVC, and gained authorization from the Financial Conduct Authority (FCA). This funding, supported by prominent investors and angel backers, enables Infact to address shortcomings of traditional credit bureaus. Their innovative platform features real-time credit risk reporting and an intuitive API for lenders, aiming to meet modern consumer and lender needs. The funds will be used to expand their database, enhance products for challenger banks, and grow their team. CEO Will Mason emphasizes the focus on recognizing individual consumer financial profiles.