Similar Posts

Transforming Industries: The Revolutionary Impact of Blockchain Technology

The financial industry is undergoing a transformation driven by technological advancements, particularly blockchain technology, which serves as a decentralized digital ledger. Blockchain enhances security, transparency, and decentralization, enabling peer-to-peer exchanges without intermediaries. This innovation has given rise to Decentralized Finance (DeFi), allowing users to access services like lending and trading, fostering inclusivity for those excluded from traditional banking. Meanwhile, traditional financial institutions are integrating blockchain to streamline operations, improve fraud prevention, and facilitate asset tokenization. As blockchain’s role in finance expands, it promises to enhance financial inclusion and support developments like Central Bank Digital Currencies (CBDCs), reshaping the future of money.

Toulouse Embraces the Future: Pay Your Commute with Cryptocurrency!

Tisséo, the public transportation operator in Toulouse, France, has launched a system enabling passengers to buy tickets for Metro, bus, tram, and cable car using cryptocurrencies via an app on Android devices. A third-party provider facilitates the conversion of digital currencies into euros for seamless transactions. While the innovation excites many, some commuters, like 60-year-old Patrice, remain skeptical about cryptocurrency’s suitability for small payments. This initiative not only enhances convenience and speed but also aligns public transit with modern technology. Its success could influence broader acceptance of cryptocurrencies in various sectors.

Coinbase Strikes $2.9 Billion Deal to Acquire Crypto Options Exchange Deribit

Coinbase has announced its acquisition of Deribit for $700 million in cash and shares, aimed at enhancing its crypto options trading offerings. The deal includes 11 million shares of Coinbase’s Class A common stock and highlights Deribit’s significant $30 billion open interest in the options market. This acquisition will bolster Coinbase’s institutional derivatives, integrating crypto options into US futures and expanding its international perpetual futures. The move is expected to boost profitability and diversify trading revenues. Deribit CEO Luuk Strijers expressed optimism about the merger, which promises to offer traders a wider range of opportunities under a single brand.

Visa Introduces Innovative Agentic Commerce and Stablecoin Solutions for the Future of Finance

Visa has launched Visa Intelligent Commerce, an AI-driven solution aimed at enhancing shopping experiences. Partnering with industry leaders like Anthropic, IBM, and OpenAI, Visa envisions a future where AI agents handle shopping tasks for consumers, requiring trust from all parties involved. Key features include AI-ready cards with tokenized credentials, personalized shopping experiences, and AI payment systems with customizable spending limits. Additionally, Visa has partnered with Bridge to introduce stablecoin-linked cards, enabling users to make purchases with stablecoins at any Visa-accepting merchant. These innovations position Visa at the forefront of the evolving digital payments landscape.

Nomura-Backed Komainu Secures $75 Million Investment in Bitcoin Revolution

Komainu has made significant strides in the cryptocurrency sector by securing funding through bitcoin and establishing a Bitcoin Treasury to manage its assets effectively. The raised funds will focus on scaling operations and integrating Blockstream technologies. Komainu aims to enhance its Komainu Connect system by utilizing Blockstream’s Liquid Network, reducing settlement times from hours to minutes. Additionally, Blockstream’s AMP technology will automate tokenization and trading solutions, improving efficiency. Komainu’s Co-CEO, Paul Frost-Smith, emphasized that this partnership with Blockstream will enhance customer experience and position Komainu as a leading provider of institutional digital asset services.

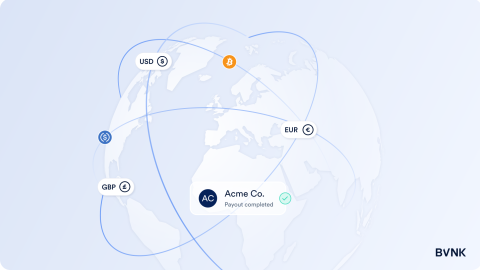

BVNK Unveils Innovative Embedded Wallet for Seamless Fiat and Stablecoin Transactions

A new embedded wallet revolutionizes digital finance by integrating fiat, crypto, and stablecoin payments, offering businesses enhanced payment options. Key features include multi-currency support (e.g., Swift, ACH, Bitcoin, Ethereum), API integration for seamless embedding into various platforms, and storage flexibility for stablecoins and fiat. The wallet also includes auto-conversion capabilities, allowing businesses to convert stablecoins to fiat easily. Simon Griffin, BVNK’s Chief Product Officer, emphasizes that stablecoins are transforming global transactions by enabling continuous payments, though challenges remain in currency conversion. This innovative wallet is essential for companies aiming to adapt to the evolving financial landscape.