Similar Posts

Wombo Games Unveils Its Debut Game: Raiders of Blackveil – A New Adventure Awaits!

Wombo Games, founded by an ex-IO Interactive co-founder, has announced its debut title, Raiders of Blackveil, a MOBA-inspired roguelite. This game aims to combine fast-paced multiplayer action with roguelite mechanics, offering dynamic gameplay, diverse characters, and an engaging storyline. Players can expect unique challenges and rewards in each session, enhancing replayability. Although the release date is yet to be confirmed, Wombo Games promises continuous updates and new content. Raiders of Blackveil is set to stand out in the gaming market, appealing to fans of both genres. Stay tuned for more updates from Wombo Games.

Snail Games Unveils Exciting New Titles and Partnerships at GDC 2023!

Snail Games is gearing up for a major presence at the Game Developers Conference (GDC), showcasing exciting updates, first-look reveals, and strategic partnerships. Attendees can anticipate announcements highlighting new game titles, collaborations to enhance gameplay, and insights into the company’s growth strategy in the competitive gaming market. GDC serves as a networking platform for Snail Games to connect with industry leaders, showcase innovations, and gather player feedback. Visitors to Snail Games’ booth will have the opportunity to experience the latest developments and learn about future projects, underscoring the company’s commitment to innovation and growth.

Unlocking Agentic AI: How Intuit’s Semantic Data Architecture Delivers Measurable ROI Beyond Vectors

Intuit’s innovative AI architecture is transforming the business landscape by enabling a shift from automation to autonomy, enhancing efficiency and driving significant outcomes. Its ‘done for you’ agentic AI automates complex tasks, allowing employees to focus on higher-value work, and provides AI-driven insights for improved decision-making. Key features include intelligent automation, adaptive learning, and seamless integration with existing systems. Benefits of transitioning to autonomous AI include cost reduction, enhanced customer experiences, and scalability. Various industries, such as financial services, e-commerce, and healthcare, have successfully adopted Intuit’s AI solutions, resulting in measurable improvements in performance and efficiency.

Unleashing the Open-Source Revolution: DeepSeek-R1 Outperforms OpenAI’s o1 in Processing Power and Cost Efficiency

Choosing the right model in today’s fast-paced world can be challenging. Our comprehensive analysis and hands-on testing provide actionable insights to help you make informed decisions. We evaluate various models based on features, usability, and performance through real-world scenarios, analyzing their practical implications. Our structured approach offers in-depth analysis, user-centric insights, and expert recommendations tailored to meet your needs. To assist you further, visit our reviews page for detailed comparisons and consider Consumer Reports for unbiased insights. With our guidance, you can confidently select a model that enhances your daily experience.

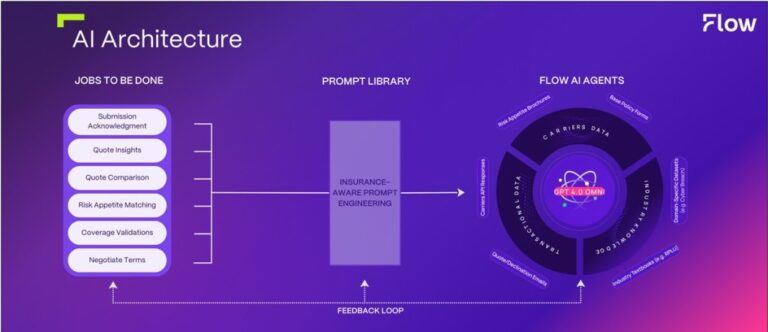

Flow Specialty Unveils Revolutionary AI-Powered Insurance Broker: The First of Its Kind!

Flow Specialty has launched the first-ever AI insurance broker, revolutionizing the commercial brokerage sector by streamlining the insurance process amid increasing coverage challenges due to recent disasters. Their innovative platformless AI model has successfully passed RPLU certification exams in key areas like Cyber Liability and Executive Liability. This technology enhances risk assessment and offers tailored solutions, improving client experiences. The AI broker provides rapid application processing, accurate data analytics, and 24/7 accessibility. By adopting AI, Flow Specialty positions itself as a leader in the specialty brokerage market, addressing the growing demand for efficient insurance solutions. For more information, visit their official site.

Q1 2025 Sees Global VC Investment Deals Decline: Insights and Trends from NVCA

In Q1 2025, global venture capital deals have notably declined, as reported by the National Venture Capital Association (NVCA) and Pitchbook. North America saw a drop from 4,282 deals in Q1 2024 to 3,155 in Q1 2025, while Europe decreased from 2,917 to 1,852 deals in the same timeframe. This trend suggests a shift in investor confidence and market conditions, prompting a reassessment of funding strategies. The report emphasizes the overall decline in deal volume, shifts in investor sentiment, and potential long-term implications for startups and innovation. Staying informed is crucial for investors and entrepreneurs.