Exciting News for New York Startups: Lerer Hippeau Secures Additional $200M Funding!

In a significant development for the venture capital landscape, Lerer Hippeau, a prominent seed fund based in New York, has successfully closed its ninth fund at an impressive $200 million. This new funding round marks a notable increase from its previous fund, which totaled $140 million, bringing Lerer Hippeau’s total assets under management to $1.4 billion.

Notable Investments and Achievements

Since its inception in 2010, Lerer Hippeau has played a pivotal role in nurturing and supporting a number of high-profile startups. Many of these companies have either gone public or been acquired, particularly within the vibrant New York startup ecosystem. Some of the notable investments include:

- Allbirds

- Axios

- Birchbox

- Brit + Co

- Casper

- Namely

- Zipline

- Warby Parker

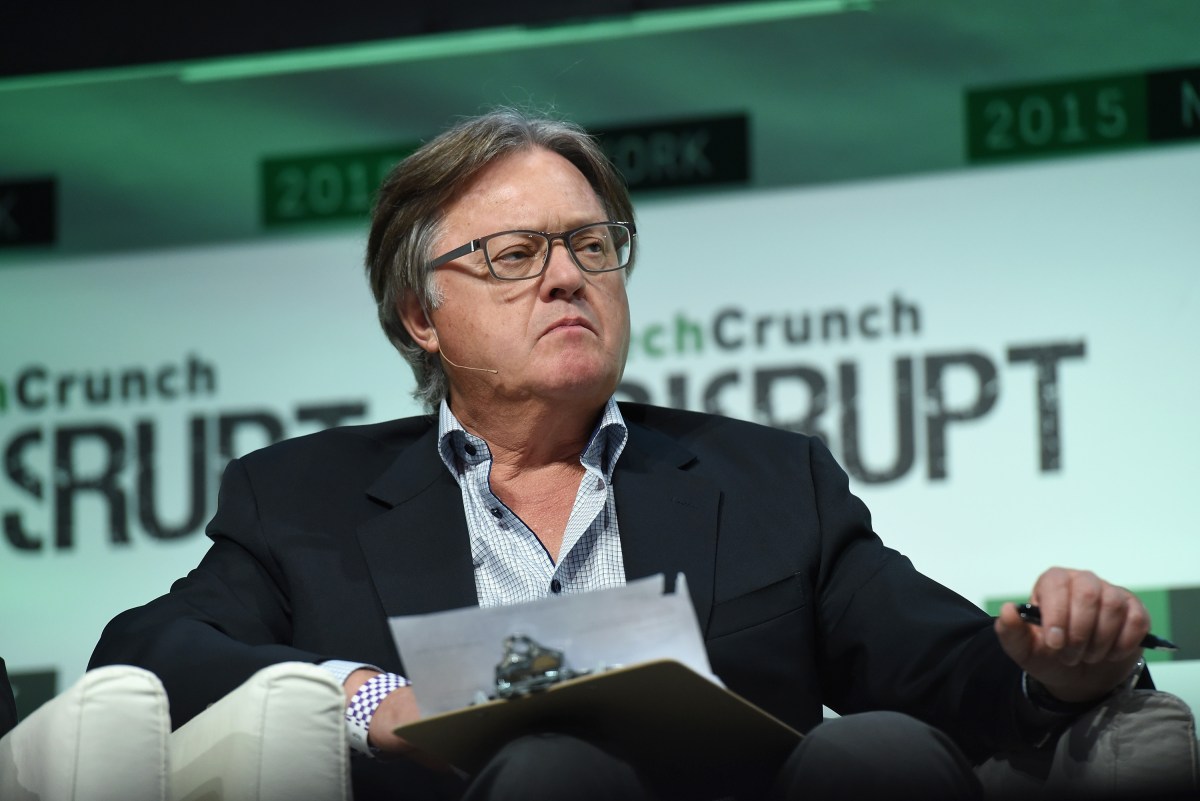

A Family Affair in Venture Capital

Lerer Hippeau has evolved into a family-centric enterprise, with Andrea Hippeau serving as a partner. She is the daughter of co-founder and managing partner Eric Hippeau. Additionally, Ben Lerer, the firm’s managing partner, is the son of co-founder and current managing partner emeritus, Ken Lerer.

Recent Trends in Venture Capital

The venture capital scene in New York is thriving, with other major players making substantial moves as well. Earlier this year, Insight Partners, a powerhouse in the VC sector, raised a remarkable $12.5 billion. Similarly, Thrive Capital secured $5 billion in August 2024. While these firms extend their investments beyond New York to include Silicon Valley and other regions, their substantial financial resources significantly strengthen the local startup ecosystem.

For more insights into the venture capital industry and its impact on startups, visit our Venture Capital Insights page.