How Musk’s $97.4 Billion Bid Could Disrupt OpenAI’s For-Profit Transformation

In a surprising move, Elon Musk, the wealthiest individual globally, has proposed a $97.4 billion acquisition of the nonprofit organization that oversees OpenAI. Musk’s interest comes through his AI venture, xAI, in collaboration with a group of external investors, as detailed in a letter addressed to the attorneys general of California and Delaware.

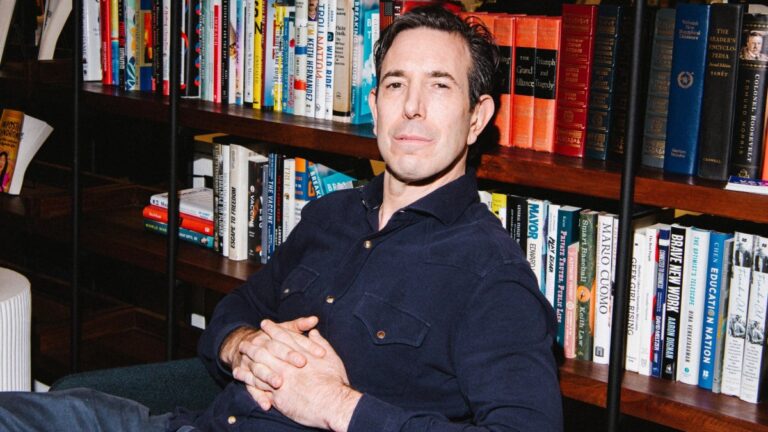

OpenAI’s CEO Responds to Musk’s Offer

OpenAI’s CEO, Sam Altman, swiftly rejected Musk’s offer, using the opportunity to make a light-hearted jab at the billionaire. Altman humorously suggested, “no thank you, but we will buy Twitter for $9.74 billion if you want,” in a post on X shortly after Musk’s bid became public. Musk is the owner of X, formerly known as Twitter, which he acquired for approximately $44 billion in October 2022.

A Complicated History

The relationship between Musk and OpenAI is intricate. As a co-founder of OpenAI, Musk is currently embroiled in a lawsuit against the organization, claiming anticompetitive practices, among other allegations. Experts in corporate governance suggest that Altman’s dismissal of Musk’s $97.4 billion offer involves complexities beyond a simple refusal.

Challenges in OpenAI’s Transition

OpenAI, originally established as a nonprofit, transitioned to a “capped-profit” model in 2019. The nonprofit organization remains the sole controlling shareholder of the capped-profit OpenAI corporation, which is obligated to adhere to the nonprofit’s foundational charter.

Currently, OpenAI is undergoing another transformation, aiming to become a traditional for-profit entity, specifically a public benefit corporation, to secure increased funding. However, Musk’s unsolicited bid may complicate this transition, potentially raising the nonprofit’s valuation.

Regulatory Scrutiny and Legal Hurdles

The attorneys general of Delaware and California have requested further details from OpenAI regarding its plans for restructuring into a for-profit benefit corporation. This request forces OpenAI to take external bids like Musk’s seriously. While OpenAI’s board is likely to reject Musk’s proposal, the situation may lead to future legal and regulatory disputes.

Implications of Musk’s Bid

Experts believe that Musk’s bid serves to challenge OpenAI’s board, which must ensure that it is not undervaluing its nonprofit assets, including intellectual property derived from proprietary research. Stephen Diamond, a corporate lawyer, remarked, “Musk is throwing a spanner into the works,” underscoring the fiduciary responsibilities that the nonprofit board must consider.

OpenAI’s Funding Prospects

Reports indicate that OpenAI is preparing for a funding round that could value its for-profit division at $260 billion. With Musk’s bid, it appears there is a contingent of investors willing to pay a significant premium for OpenAI’s nonprofit sector, creating pressure on the board of directors.

Grounds for Rejection

Despite the hefty offer, OpenAI’s board is not compelled to accept. Corporate law grants significant authority to existing boards to defend against unsolicited takeover attempts. David Yosifon, a professor of corporate governance law, noted that OpenAI could categorize Musk’s bid as hostile, considering the strained relations between Musk and Altman.

Furthermore, OpenAI may contest the credibility of Musk’s offer, as his wealth largely depends on Tesla stock, implying that his investment partners would need to contribute significantly to the total amount.

Considering OpenAI’s Mission

OpenAI’s board may need to evaluate Musk’s offer based on how it aligns with the nonprofit’s mission: to ensure that artificial general intelligence benefits all of humanity. Yosifon pointed out that Altman’s public response on X might not have been the best legal strategy, as it could be perceived unfavorably by regulators.

Potential Impact on OpenAI’s Valuation

As the board deliberates, it is likely to side with Altman, especially since most directors were appointed after Altman’s brief dismissal and subsequent reinstatement in late 2023. However, Musk’s bid may inadvertently inflate the market value of OpenAI’s nonprofit assets, potentially complicating future fundraising efforts and negotiations with existing investors, including major partner Microsoft.

In summary, OpenAI’s ongoing restructuring efforts have become significantly more complicated in light of Musk’s high-stakes offer, which has implications for both the nonprofit’s future and its financial strategies.

Stay updated on the latest developments in AI and corporate governance by subscribing to the TechCrunch AI-focused newsletter.