Kalshi CEO Claims ‘State Law Doesn’t Apply’ to Our Operations: A Bold Statement on Regulatory Challenges

Kalshi, a pioneering prediction market startup, has recently made headlines by filing lawsuits against New Jersey and Nevada. These legal actions come in response to state attempts to shut down its newly launched sports trading operations. Kalshi argues that as a federally regulated platform, it is not subject to state gaming commissions’ regulations, positioning itself uniquely in the sports betting landscape.

Kalshi’s Legal Standpoint

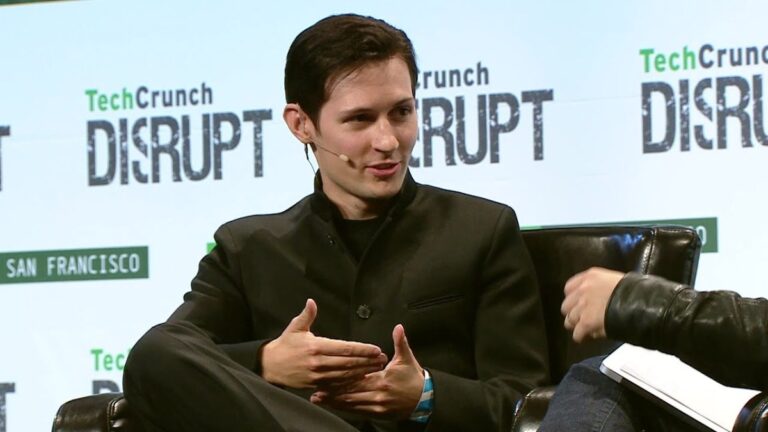

Kalshi’s CEO, Tarek Mansour, expressed confidence in their legal strategy during a recent StrictlyVC event in San Francisco. He stated, “We’re not necessarily very concerned [because] we are regulated at the federal level. The state law doesn’t really apply.” This assertion highlights Kalshi’s belief in its federal authority over state regulations.

Potential Impact on Sports Betting Market

If Kalshi prevails in its lawsuits, it could solidify its position in the lucrative sports betting market. However, these legal challenges might also initiate a broader conflict between state regulators and federal authorities under the current administration.

Historical Context of Kalshi’s Legal Battles

This is not the first occasion where Kalshi has confronted regulatory challenges. In a significant legal victory against the Commodity Futures Trading Commission (CFTC) last year, Kalshi secured the ability to process over $1 billion in trades linked to the outcomes of the 2024 political elections.

Transitioning to Sports Prediction Markets

In January, Kalshi expanded its offerings to include prediction markets for sporting events, allowing users nationwide to place bets on major events like March Madness and the Super Bowl, even in states where traditional gambling is prohibited. However, six states, including Nevada and New Jersey, have issued cease-and-desist orders, claiming Kalshi’s operations resemble unauthorized sports betting.

- States Involved: Nevada, New Jersey, Illinois, Maryland, Ohio, Montana

- Key Argument: State gaming commissions assert Kalshi lacks proper licensing and does not pay state taxes on sports trades.

Kalshi’s Defense and Industry Opposition

Mansour maintains that Kalshi is legally compliant, holding a license from the CFTC. He attributes the pushback from state regulators to a “massive casino lobby that’s unhappy” with Kalshi’s innovative trading contracts.

Recent Legal Developments

On Tuesday, Kalshi achieved a preliminary legal victory in its lawsuit against Nevada, with a federal judge ruling that the company can continue its operations in the state while the case is pending.

The Ambiguity of Prediction Markets

Prediction markets are relatively new financial instruments, leading to uncertainty about applicable laws. Kalshi aims to navigate this ambiguity, offering users the ability to bet on a wide array of events, from Elon Musk’s decisions regarding DOGE to the outcome of the World Series.

As the legal landscape evolves, Kalshi’s ongoing battle could set important precedents for the future of prediction markets.

Connections to the Trump Administration

Kalshi’s prediction market has garnered attention for its forecasts regarding the 2024 U.S. presidential election, notably indicating a higher likelihood for Donald Trump’s victory. In recent months, Kalshi has strengthened its ties with the Trump administration, including the appointment of Donald Trump Jr. as a strategic advisor and a former board member leading the CFTC.

Defining the Line: Gambling vs. Prediction Markets

A central question in Kalshi’s legal struggle is whether its operations constitute gambling. State regulators argue they do, while Mansour contends that prediction markets function more like derivatives exchanges, providing valuable insights into market risks.

- Gambling: Creating artificial risk and betting on outcomes (e.g., dice rolls).

- Prediction Markets: Offering a platform to gauge and price real-world events and risks.

Economic Utility of Prediction Markets

Mansour cites Kalshi’s market for the TikTok ban as an example of its economic utility, stating, “It’s something that’s pretty important that we didn’t have any sort of gauge on what was going to happen.” With a reported valuation of $787 million, Kalshi’s future in the sports betting arena could significantly enhance its market position.

For more insights on the evolving landscape of prediction markets, visit our Prediction Markets Overview.

Watch the full interview with Tarek Mansour here.