Similar Posts

Berlin’s Hallo Theo Raises €10M Seed Funding to Transform Property Management Landscape

Berlin-based digital property management firm hallo theo has raised €10 million in seed funding led by Insight Partners to enhance its technology and market presence. The funding addresses inefficiencies in Germany’s property management sector, which frustrates property owners and tenants. hallo theo aims to modernize the industry through automation and AI, improving data accuracy and service response times. CEO Jona Schaeffer emphasized the need for transformation in a market valued at over €29 trillion. The investment will facilitate the expansion of hallo theo’s digital platform, promising a more efficient and transparent management experience for users.

NetRise Secures $10M Series A Funding to Strengthen Software Supply Chain Security

NetRise, a cybersecurity firm specializing in software supply chain risk management, has raised $10 million in Series A funding, increasing its total funding to $24.8 million. Led by DNX Ventures and supported by other investors, this funding aims to enhance NetRise’s threat detection and visibility capabilities. The company offers tools like a Software Bill of Materials (SBOM) for identifying vulnerabilities and managing software assets. As cybersecurity threats linked to supply chain vulnerabilities rise, NetRise seeks to improve its platform for proactive monitoring and firmware security, establishing itself as a key player in addressing these growing challenges.

Ensuring Financial Stability: The FSA’s Role in Japan’s Markets

The Japan Financial Services Agency (FSA), established in July 2000, regulates the nation’s financial sector under the Prime Minister’s Office, ensuring economic stability and integrity. It supervises various entities, including banks, securities companies, and insurance providers, focusing on compliance, fraud prevention, and anti-money laundering. The FSA’s operational functions include policy planning, inspections, crisis management, and international cooperation. Organized under a Commissioner, it encompasses specialized offices to enhance regulatory effectiveness. Its framework covers banking, securities, insurance, and cryptocurrencies, emphasizing consumer protection and market transparency. The FSA plays a crucial role in maintaining Japan’s reputation as a global financial hub.

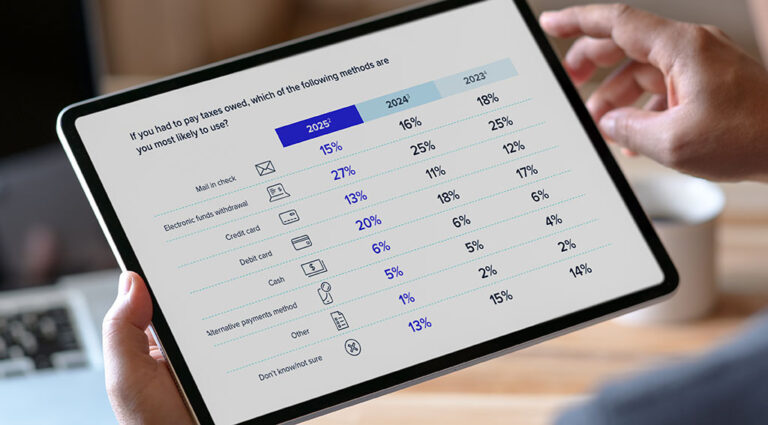

Americans Focus on Debt and Savings: 44% Plan to Use Tax Refunds for Financial Relief

As tax season nears, a survey by ACI Worldwide and YouGov reveals that nearly 40% of U.S. taxpayers plan to use their refunds to pay off debts, reflecting financial insecurity amid inflation. About 44% intend to save their refunds, while 65% prefer digital payment methods for taxes, with a decline in paper checks. Concerns about tax-related scams persist, particularly among Generation Z, with many unaware of common fraud schemes. The survey indicates that 39% will file electronically, and highlights the importance of consumer education to combat fraud during this critical time.

Visa Introduces Tap-to-Add Card in Egypt: A Game Changer for Effortless Digital Wallet Payments

Visa has launched its Tap-to-Add Card in Egypt, aimed at simplifying the integration of contactless cards into digital wallets and enhancing wallet adoption. This innovative feature allows users to add their Visa card by tapping it on a mobile device, eliminating manual data entry and minimizing errors. Key benefits include faster integration, improved security through Visa’s Chip Authenticate service, cost efficiency for issuers, and an enhanced user experience. The initiative reflects Visa’s commitment to advancing digital payments in Egypt, supporting the country’s goal of a cashless society while ensuring data protection against fraud.

New 1,000-Employee Threshold: Key Exemption for Firms Under CSRD Reporting Requirements

The European Commission’s Omnibus Proposal, introduced in February 2025, aims to transform sustainability reporting under the Corporate Sustainability Reporting Directive (CSRD) by easing compliance for businesses. It consists of two main directives: the “Stop-the-Clock” Directive, which grants a two-year extension for companies to meet CSRD obligations, and the “Simplification” Proposed Directive, which adjusts reporting thresholds to apply only to firms with over 1,000 employees or significant financial metrics. These changes aim to reduce the administrative burden, particularly on SMEs, and promote voluntary standards, while the legislative process continues toward final approval.