Similar Posts

eBay and Klarna Team Up: Unlock Flexible Payment Solutions for U.S. Shoppers!

eBay has partnered with Klarna to enhance the shopping experience for U.S. customers by introducing flexible payment options. This collaboration aims to increase affordability and choices, especially in categories like electronics and fashion. Klarna’s features include the ability to split purchases into four interest-free payments and flexible financing plans for larger items. Additionally, a new resell feature allows users to list previous Klarna purchases on eBay, promoting sustainability through circular commerce. Both companies express excitement about the partnership, emphasizing its potential to improve customer satisfaction and adapt to changing consumer demands.

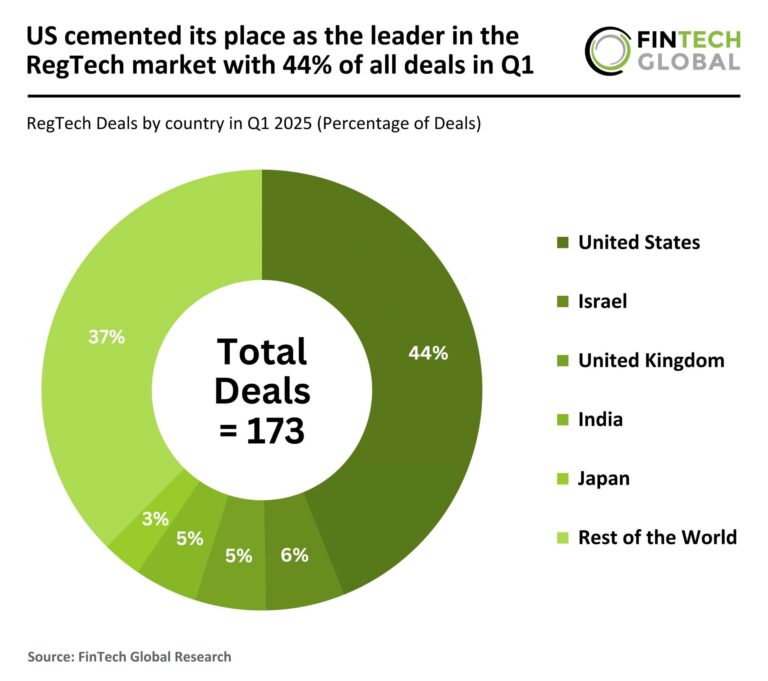

US Dominates RegTech Market with 44% of Global Deals in Q1: A Leader in Regulatory Technology Innovation

In Q1 2025, the global Regulatory Technology (RegTech) sector saw an 18% decline in deal activity, totaling 173 deals compared to 214 in Q1 2024. Despite this drop, funding increased to $2.3 billion, up 18% from the previous year, indicating a shift towards larger investment rounds in high-potential companies. The US led the market with 44% of deals (76), though down 28% from last year. Israel and the UK followed with 10 and 9 deals, respectively. A highlight of the quarter was Cybereason’s $120 million funding round, showcasing strong investor confidence in its cybersecurity solutions.

Safetrust Secures Strategic Investment from dormakaba: A Major Step for Secure Identity Solutions

Safetrust, a leader in secure identity solutions, has received a strategic investment from dormakaba, a global access solutions provider. This partnership aims to enhance Safetrust’s market presence and advance its post-quantum-ready security technology. While specific investment details remain undisclosed, the collaboration will improve Safetrust’s innovative technologies that leverage neuroscience and data analytics for enhanced security intelligence. Safetrust’s offerings include cloud-connected sensors and solutions for physical access and digital identity verification. Both CEOs expressed enthusiasm for the partnership, highlighting its potential to address security challenges in a digital landscape.

Unlocking Corporate Sustainability: The Essential Role of Auditors in Impactful Reporting

Corporate sustainability reporting has evolved from a voluntary practice to a critical business necessity due to stakeholder demands for transparency. Auditors now play a vital role in validating environmental, social, and governance (ESG) disclosures, expanding their focus beyond financial accuracy. The 2023 Corporate Sustainability Reporting Directive (CSRD) enhances ESG reporting by standardizing data and empowering auditors to provide assurance, combating greenwashing. It offers two assurance levels: limited and reasonable, which bolster the credibility of sustainability reports. However, auditors face challenges in mastering ESG techniques and adapting to new technologies. Their evolving role is essential for fostering stakeholder trust in ESG efforts.

Transforming Financial Markets: How Machine Learning is Redefining Fair Value Measurement

Accurate asset valuation, especially for illiquid financial instruments, is increasingly crucial in the evolving financial landscape. Kidbrooke, an analytics platform, explores how machine learning techniques like hierarchical clustering and artificial neural networks (ANNs) can improve the consistency of asset valuations. Fair value measurement, essential under International Financial Reporting Standards (IFRS), reflects an asset’s current worth rather than historical cost. Kidbrooke’s AI models, including Variational Autoencoders and Gaussian Mixture Models, enhance clustering for financial valuation. ANNs further refine yield estimates for Level 2 instruments, reducing pricing errors and integrating alternative datasets, thus increasing accuracy and reliability in asset valuation.