Similar Posts

ID.me Secures $275 Million in Funding from Ares Management to Revolutionize Digital Identity Solutions

ID.me, a leading digital identity wallet provider, has secured a $275 million credit facility from Ares Management to enhance its identity verification capabilities while prioritizing security and privacy. The platform has over 139 million users, with 65 million verified to federal standards, and has seen a 450% revenue increase since 2020 due to high market demand. ID.me offers a secure digital wallet for identity verification through various methods, serving sectors like government and healthcare. CEO Blake Hall emphasized the facility’s role in scaling growth, while Ares Management expressed confidence in ID.me’s market leadership amid rising fraud threats.

Lightkeeper Secures Strategic Growth Investment from PSG to Propel Innovation Forward

Lightkeeper, a data analytics and risk management provider for investment managers, has secured a growth investment from PSG, which will boost its expansion and innovation. Dean Schaffer, a senior advisor at PSG, has been appointed as CEO, while co-founder Danny Dias transitions to Chief Product Officer. This partnership aims to accelerate product development and enhance the Portfolio Intelligence platform. Lightkeeper’s offerings include a centralized platform for actionable insights, custom queries, and data visualization, along with an Idea Analytics Software for tracking investment ideas. Schaffer emphasizes the importance of data-driven decisions in today’s financial markets.

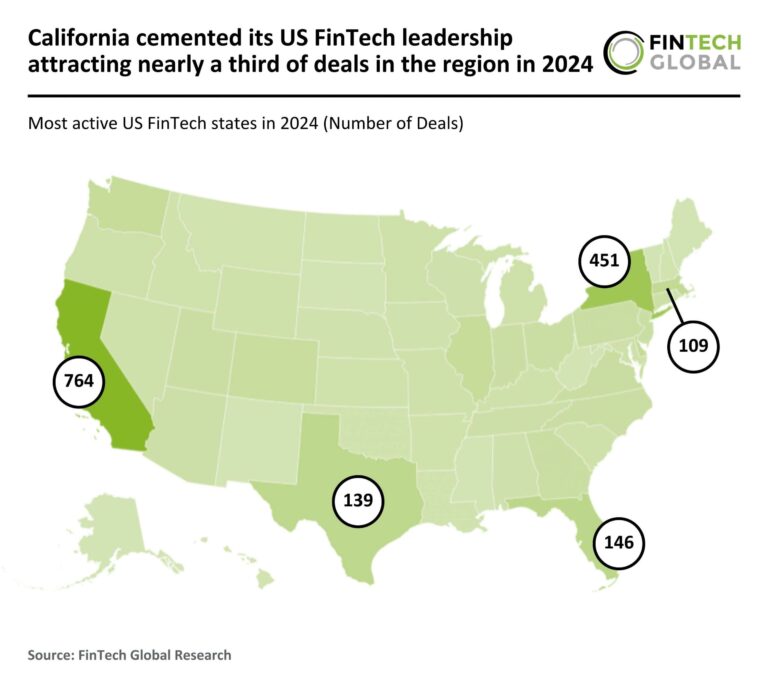

California Dominates US FinTech Landscape: Capturing Nearly One-Third of 2024 Deals

In 2024, California maintained its position as the leading US FinTech hub, accounting for 31% of deals with 764 transactions, despite a 59% decline from 2023. Overall, US FinTech funding plummeted to $18.4 billion, a 47% decrease, with deal volume dropping to 1,506, a 63% reduction. Economic uncertainty and rising interest rates contributed to this downturn. New York followed California with 451 deals (18% share), while Florida surpassed Texas with 146 deals (6% share). Notably, Cyera raised $300 million in a Series C funding round, highlighting the importance of advanced data security solutions.

OpenAI Raises $40 Billion in Groundbreaking SoftBank Funding Round

On March 31, OpenAI raised a historic US$40 billion in a private funding round, valuing the company at US$300 billion. Led by SoftBank and supported by investors like Microsoft and Coatue, this capital will enhance OpenAI’s AI research and computing infrastructure. Approximately US$18 billion is earmarked for the Stargate infrastructure project, aimed at establishing AI data centers across the U.S. OpenAI expressed excitement about the investment, which will help advance AI technology for the 500 million weekly ChatGPT users. This funding highlights the growing interest in AI and its potential to transform various industries.

Bloom Credit Secures $10.5M Funding to Expand Credit Data Infrastructure with Navy Federal Partnership

Bloom Credit, a FinTech innovator, has partnered with Navy Federal Credit Union, the largest credit union in the U.S., following a successful $10.5 million investment round led by Crosslink Capital. This collaboration aims to improve credit reporting by utilizing consumer permissioned data services through Bloom’s flagship product, Bloom+. This tool allows financial institutions to report recurring payments as tradelines to credit bureaus, enabling consumers to enhance their credit profiles. Navy Federal plans to integrate Bloom+ into its checking accounts, offering over 14 million members a pathway to better credit reporting and promoting financial inclusion.

Revolutionizing Wealth Management: Discover the Future of Personalized Financial Advisory

The wealth management industry is undergoing a major transformation driven by technology, changing client expectations, and a growing affluent demographic, projected to reach $2.6 trillion by 2028. IntellectAI is leading this shift with its intelligent advisory model, blending AI-driven insights and human expertise to enhance client engagement. This hybrid approach streamlines client acquisition, personalized financial planning, and execution through AI-powered automation. Tools like WealthForce.ai illustrate the benefits, including improved client ratios and faster onboarding. Ultimately, the intelligent advisory model prioritizes personal connections alongside AI, fostering better investment outcomes and stronger client relationships in wealth management.