Similar Posts

Waterdrop Partners with DeepSeek to Transform AI-Powered Insurance Solutions

Waterdrop Inc. has partnered with DeepSeek to enhance its AI-driven insurance ecosystem, aiming to transform traditional insurance agents into skilled consultants for improved service accuracy and efficiency. This collaboration focuses on implementing large-scale AI applications in sales support, quality assurance, risk management, and product innovation. Waterdrop’s new AI Model Insurance Quality Inspection Solution significantly reduces operational costs and improves communication analysis. Additionally, the company uses AI and big data to create personalized insurance products for demographics such as the elderly and expectant mothers. Founder Shen Peng emphasizes Waterdrop’s commitment to making quality insurance accessible and promoting sustainable industry development.

eBay Partners with Checkout.com for Lightning-Fast Global Payment Solutions

eBay is enhancing its payment infrastructure through a partnership with Checkout.com, aimed at improving transaction experiences globally. This collaboration will streamline payment processes, leading to faster transactions and higher acceptance rates, while ensuring enhanced security for users. With over 2.3 billion live listings, eBay seeks to provide seamless shopping experiences across various international markets. Avritti Khandurie Mittal from eBay emphasized the importance of speed and safety in their services, while Checkout.com CEO Guillaume Pousaz highlighted their technology’s role in maximizing payment efficiency. This initiative is crucial for modernizing eBay’s payment solutions and supporting business growth.

SumUp and FreedomPay Join Forces to Revolutionize Secure and Seamless Payment Solutions

SumUp, a global FinTech firm, has partnered with FreedomPay to enhance payment solutions for retail and hospitality businesses worldwide. This collaboration aims to create a robust payment infrastructure with offline capabilities, ensuring seamless transactions even in remote areas. The partnership offers hardware flexibility and enterprise-level functionality to cater to various business sizes and needs. SumUp provides intuitive payment solutions, including card readers and invoicing services, while FreedomPay delivers a secure global commerce platform integrating payments and data insights. Together, they aim to offer scalable, transparent, and secure payment experiences, empowering merchants in the digital economy.

Chetwood Bank Unveils Irresistible Fixed Rate Savings Accounts for UK Savers

Chetwood Bank, a leading digital challenger bank in the UK, has launched a new range of fixed-rate savings accounts with competitive interest rates and a minimum deposit of £1,000. These accounts are fully protected by the Financial Services Compensation Scheme (FSCS), ensuring customer security. This initiative follows the recent introduction of an Easy Access savings account, marking a significant evolution for the bank. Leadership, including Savings Director Ben Mitchell and CEO Paul Noble, emphasized the bank’s commitment to empowering savers and providing straightforward financial products. Chetwood aims to enhance financial accessibility and transparency for modern savers.

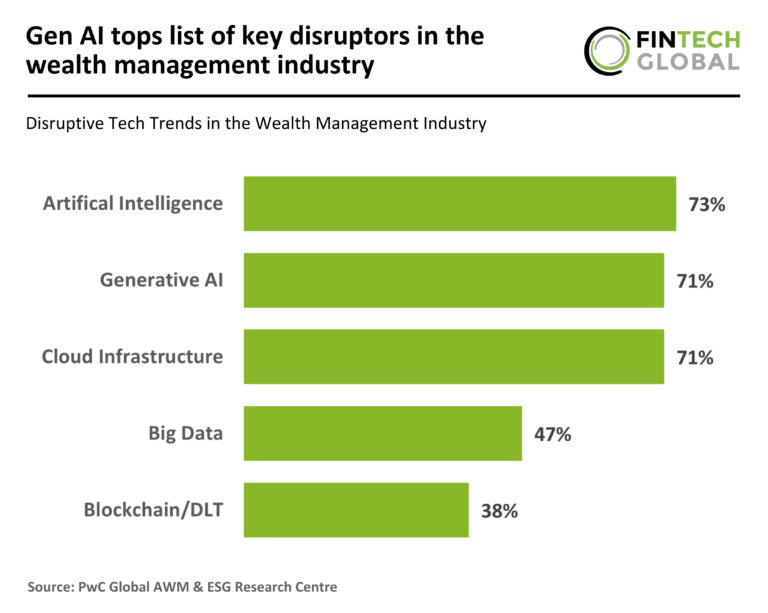

Generative AI: The Game-Changer Disrupting the Wealth Management Industry

A recent PwC survey of 521 industry leaders in asset and wealth management reveals how disruptive technologies like artificial intelligence (AI) and cloud computing are transforming the sector. Key findings show that 73% of respondents view AI and 71% generative AI as pivotal innovations, while 71% highlight cloud technology’s role in modernization. The integration of these technologies is reshaping business models, creating new revenue streams, and addressing challenges such as data security and governance. As firms adapt to technological advancements, they must rethink investment strategies and client expectations to remain competitive in this evolving financial landscape.

Fortress Invests $100 Million in Dataminr to Propel AI-Powered Real-Time Alerts

Dataminr, a leader in real-time AI solutions, has secured a $100 million convertible financing agreement with Fortress Investment Group to support its growth and innovation in AI technology. The company utilizes its advanced platform to analyze data from millions of public sources, helping businesses and governments respond to emerging risks. The funding aims to drive innovation in Generative and Agentic AI, expand Dataminr’s customer base, and support international growth. CEO Ted Bailey expressed enthusiasm for the partnership, emphasizing the opportunities ahead in enhancing real-time information capabilities for clients. The investment positions Dataminr for further expansion within the Global 2000 companies.