Similar Posts

Elevate Your SME’s Success: Banca AideXa – Your Trusted Partner in KYB and Fraud Prevention

Banca AideXa, an Italian FinTech supporting SMEs, has partnered with Trustfull, a fraud prevention provider, to enhance Know Your Business (KYB) controls during customer onboarding. This collaboration aims to improve security measures while maintaining a smooth user experience. Founded in 2020, Banca AideXa leverages open banking and AI to streamline financing for SMEs, which contribute 50% of Italy’s GDP. Trustfull’s technology analyzes digital signals to detect fraud, reinforcing Banca AideXa’s commitment to secure and efficient financial services. Both companies emphasize that this partnership will advance their mission to redefine financial services for SMEs in Italy.

Curve Secures £37M Investment to Propel Growth and Unveil Innovative Curve Pay Digital Wallet

Curve, a prominent digital wallet provider, has raised £37 million in a funding round led by Hanaco Ventures, signaling increased confidence in its mission to transform the digital wallet landscape. The investment will help Curve achieve profitability by 2025, expand product offerings like Curve Pay, and enhance customer experience. Key features of the Curve wallet include cashback rewards, real-time spending insights, fee-free foreign transactions, and the unique ‘Go Back in Time®’ feature for managing transactions. CEO Shachar Bialick emphasized Curve’s innovative approach, aiming to redefine the digital wallet experience and simplify financial management for users.

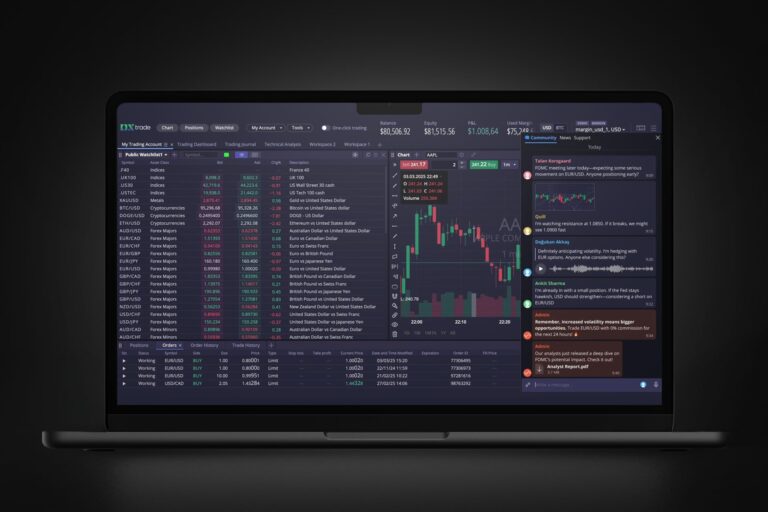

Unlocking Success: Devexperts’ Innovative Approach to Futures Trading System Development

As interest in futures trading grows, demand for advanced trading technology rises. Devexperts, a key FinTech software provider, emphasizes the choice between in-house and outsourced trading systems. In-house development offers control but high costs, while outsourcing facilitates quicker deployment and less maintenance. The trading firm’s hardware and software needs vary; market makers require low-latency setups, whereas retail brokers can use flexible SaaS solutions. User interfaces are vital for client engagement and operational oversight, integrated through a robust backend. Devexperts provides comprehensive solutions, including trading platforms, matching engines, and risk management tools, enhancing the trading infrastructure landscape.

Asuene Expands U.S. Presence: Climate Tech Leader Acquires NZero for Sustainable Growth

Japanese climate technology provider Asuene has acquired US startup NZero, which specializes in real-time energy data and emissions tracking. This acquisition positions NZero as a subsidiary of Asuene America Holdings, enhancing both companies’ capabilities in corporate sustainability and decarbonization. Founded in 2019, Asuene supports over 25,000 businesses in managing CO2 emissions and implementing ESG strategies. NZero, based in Nevada, offers a platform for real-time energy data analysis, benefiting industries like transportation and real estate. The partnership comes at a pivotal moment as US states pursue ambitious emissions reduction targets, aiming to shape a sustainable future aligned with global decarbonization goals.

Why NextGen AML Technology is the Future: Overcoming the Failures of Legacy Systems

Banks continue to rely on outdated anti-money laundering (AML) systems, opting to layer new technology rather than fully replacing them. This approach, once seen as safer, now poses inefficiencies and compliance risks. Legacy systems struggle to adapt to evolving regulations and often duplicate functionalities, increasing costs. They also lack integrated testing environments, delaying compliance. NextGen AML platforms, like those from Napier AI, offer rapid implementation, cloud efficiency, and built-in testing capabilities, making them more suitable for modern compliance needs. A complete replacement of legacy systems is necessary to achieve the adaptability and risk reduction required in today’s financial landscape.

AscentAI: Transforming Regulatory Compliance Through Innovative Technology

Chicago’s Ascent Technologies has rebranded as AscentAI, launching a new Regulatory Lifecycle Management (RLM) Platform designed for financial institutions. This AI-driven platform aims to enhance compliance processes, reduce costs, and improve risk management. Key components include AscentHorizon, which tracks global regulations, and AscentFocus, which evaluates regulatory obligations. CEO Christopher Junker noted the overwhelming information challenges faced by compliance organizations, while VP Ellen Krueger highlighted the platform’s ability to streamline change management. AscentAI aims to provide actionable insights and automate compliance tasks, reflecting a commitment to innovation in the legal and risk management sectors.