Similar Posts

eBay and Klarna Team Up: Unlock Flexible Payment Solutions for U.S. Shoppers!

eBay has partnered with Klarna to enhance the shopping experience for U.S. customers by introducing flexible payment options. This collaboration aims to increase affordability and choices, especially in categories like electronics and fashion. Klarna’s features include the ability to split purchases into four interest-free payments and flexible financing plans for larger items. Additionally, a new resell feature allows users to list previous Klarna purchases on eBay, promoting sustainability through circular commerce. Both companies express excitement about the partnership, emphasizing its potential to improve customer satisfaction and adapt to changing consumer demands.

Waterdrop Partners with DeepSeek to Transform AI-Powered Insurance Solutions

Waterdrop Inc. has partnered with DeepSeek to enhance its AI-driven insurance ecosystem, aiming to transform traditional insurance agents into skilled consultants for improved service accuracy and efficiency. This collaboration focuses on implementing large-scale AI applications in sales support, quality assurance, risk management, and product innovation. Waterdrop’s new AI Model Insurance Quality Inspection Solution significantly reduces operational costs and improves communication analysis. Additionally, the company uses AI and big data to create personalized insurance products for demographics such as the elderly and expectant mothers. Founder Shen Peng emphasizes Waterdrop’s commitment to making quality insurance accessible and promoting sustainable industry development.

Visa Boosts Digital Payments for African SMEs with Strategic Investment in Moniepoint

Moniepoint, a Nigerian business payments and banking platform, has secured a significant investment from Visa to enhance financial services for SMEs across Africa. Founded in 2015, Moniepoint processes over one billion transactions monthly, contributing to over $22 billion in payment volumes. The funding will support Moniepoint’s expansion and financial inclusion initiatives, enabling SMEs to access vital resources in a digital economy. CEO Tosin Eniolorunda views Visa’s investment as a strong endorsement of their mission. This partnership aims to improve digital payment infrastructure and foster economic growth across Africa, particularly benefiting the informal economy.

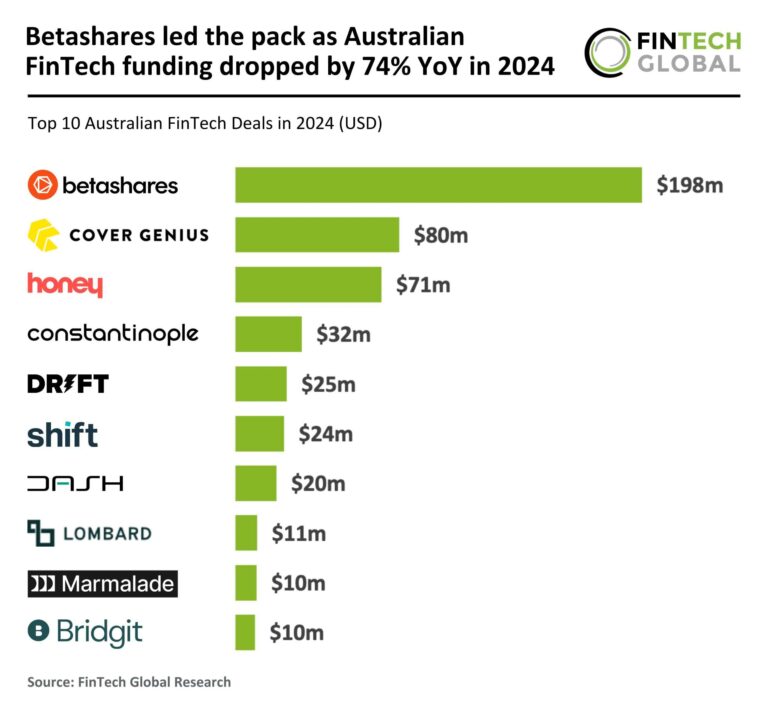

Betashares Tops Australian FinTech Scene Despite 74% Year-Over-Year Funding Decline in 2024

In 2024, the Australian FinTech landscape experienced a significant investment decline, with funding plummeting 74% to $891 million from $3.5 billion in 2023. Deal activity also fell sharply, with only 57 deals recorded, a 66% drop from the previous year. Investors are becoming more selective, focusing on sustainable growth, as reflected in the decreased average deal size of $15.6 million. Notably, Betashares secured the largest deal of the year with a $198 million investment from Temasek. As the market adjusts, FinTech firms must prioritize transparency and cost-effectiveness to attract investment and create long-term value.

Broadridge Unveils Innovative Digital Asset Solutions for Enhanced Institutional Crypto Strategies

Broadridge Financial Solutions has launched Broadridge Digital Asset Solutions, a suite designed to help financial institutions enhance their digital asset operations while ensuring compliance with global cryptocurrency regulations. Leveraging its expertise in data management and investor communications, Broadridge aims to improve investor access and understanding of digital assets. A key feature is Broadridge® ClearFi, which consolidates on-chain and off-chain data to present standardized information about digital holdings. This platform benefits broker-dealers, exchanges, and wallet providers, addressing challenges investors face due to fragmented data. Broadridge’s initiative aims to promote transparency and democratize investing in the digital asset space.

Unlocking Savings: How ESG Teams Can Position Compliance as a Cost-Effective Strategy

The demand for Environmental, Social, and Governance (ESG) regulations is rising, prompting businesses to rethink compliance strategies. While often viewed as a financial burden, experts suggest ESG should be seen as a cost-saving initiative. Richard Singleton from Menzies argues that integrating ESG into business strategies enhances resilience and mitigates risks. Despite challenges from shifting political landscapes and resistance from some corporations, there is a growing recognition of ESG’s value. ESG teams are encouraged to frame compliance as an investment, emphasizing benefits like attracting talent and operational efficiencies. Effective communication and collaboration within organizations are key to improving ESG perceptions.