Similar Posts

Waterdrop Partners with DeepSeek to Transform AI-Powered Insurance Solutions

Waterdrop Inc. has partnered with DeepSeek to enhance its AI-driven insurance ecosystem, aiming to transform traditional insurance agents into skilled consultants for improved service accuracy and efficiency. This collaboration focuses on implementing large-scale AI applications in sales support, quality assurance, risk management, and product innovation. Waterdrop’s new AI Model Insurance Quality Inspection Solution significantly reduces operational costs and improves communication analysis. Additionally, the company uses AI and big data to create personalized insurance products for demographics such as the elderly and expectant mothers. Founder Shen Peng emphasizes Waterdrop’s commitment to making quality insurance accessible and promoting sustainable industry development.

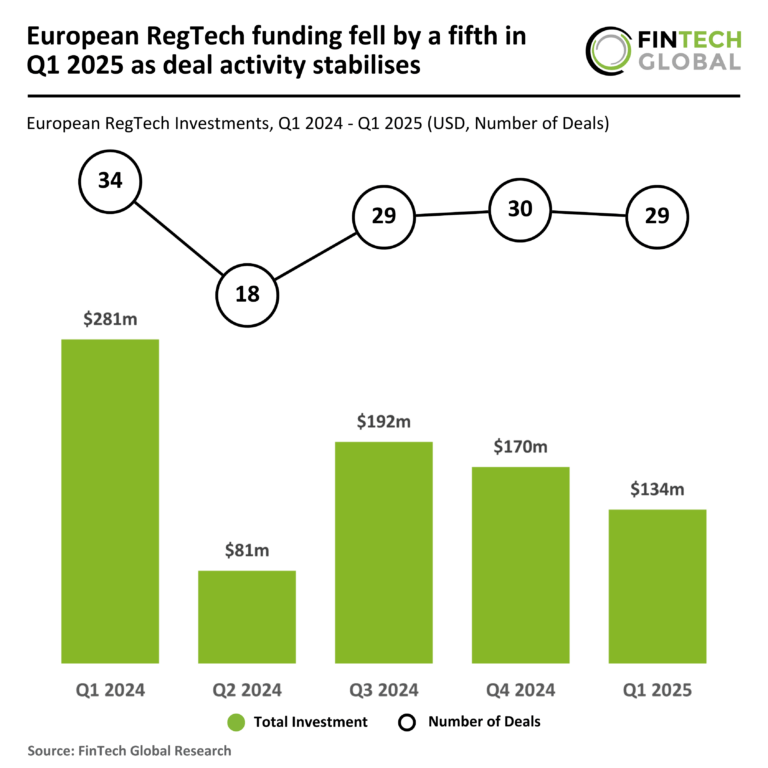

Q1 2025 Sees European RegTech Funding Dip 20% Amidst Stabilizing Deal Activity

In Q1 2025, the European RegTech sector experienced a significant decline in investment, with funding dropping 20% quarter-over-quarter to $134 million, reflecting a broader cautious investment climate. Only 29 deals were completed, a 15% decrease from the previous year, with average deal sizes falling to $4.6 million. Notably, ThreatMark secured $23 million in funding, making it one of the largest deals this quarter, driven by investors like Octopus Ventures. The company focuses on fraud prevention, crucial given the $486 billion in global fraud losses in 2023. The evolving landscape requires stakeholders to adapt to these changes.

Discover the Future of Wealth Management: FinTech Global Unveils the Top Innovators in the WealthTech100

FinTech Global has released the 2025 WealthTech100 list, showcasing top firms revolutionizing investment and financial advisory amid market changes. The WealthTech sector is forecasted to grow by $6.08 billion from 2024 to 2028, driven by evolving client expectations and technology advancements. A panel evaluated over 1,200 firms, selecting 100 that demonstrate innovative solutions for wealth management challenges. Notable companies include Abbove, additiv, CAIS, and Croesus, each enhancing client engagement and operational efficiency. Richard Sachar emphasized the need for firms to adapt to hyper-personalized digital experiences, making the WealthTech100 an essential guide for industry leaders navigating this dynamic environment.

OpenWay Launches Innovative Payment Software Solution Across North and Latin America

OpenWay has launched the Way4 platform, a cutting-edge payment software solution tailored for banks, credit unions, processors, and fintech companies in North and Latin America. Recognized by Aite and Juniper Research, the platform enhances payment system efficiency by enabling institutions to transition from legacy processing systems. It supports personalized services and various payment technologies, including real-time payments and CBDC cards. The platform features APIs for integration, high transaction capacity, and PCI compliance, with flexible deployment options like cloud-based solutions. OpenWay’s expansion is supported by partnerships with firms like Accenture, Deloitte, and Visa, aiming to drive digital transformation in the Americas.

Elon Musk’s X Attracts $1 Billion in New Funding, Maintaining Impressive $44 Billion Valuation

Elon Musk’s social media platform, X, has secured nearly US$1 billion in new equity funding, maintaining its valuation since Musk’s 2022 acquisition. This funding round values X at approximately US$32 billion, keeping its enterprise value around US$44 billion. Notable investors include Darsana Capital Partners and 1789 Capital. Musk aims to use some funds to reduce X’s debt, although Tesla’s stock has declined over 40% this year due to increased competition and Musk’s political profile. X faces challenges with advertising, as brands are hesitant to spend amid concerns over content and legal actions. The platform’s future remains uncertain.