Similar Posts

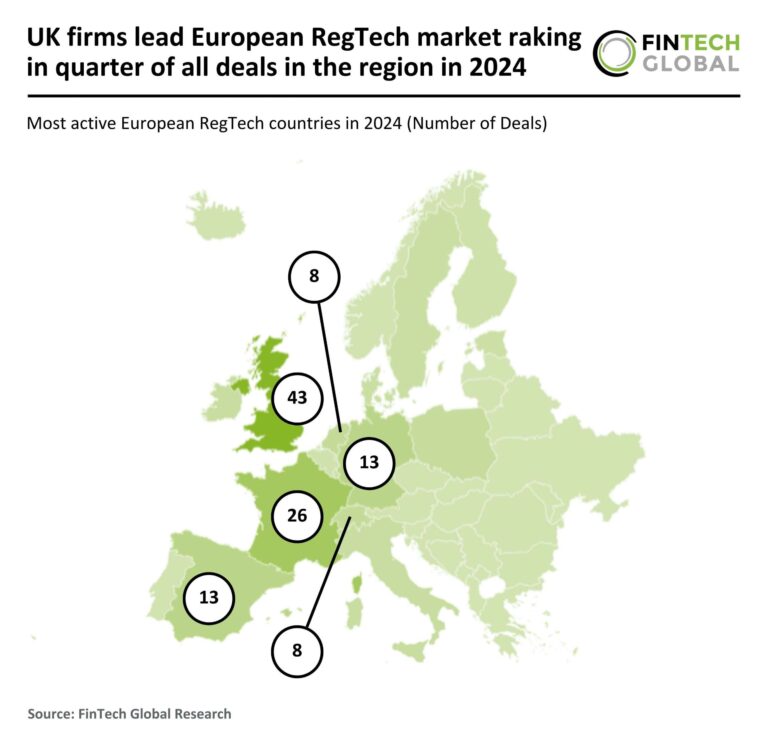

UK Firms Dominate European RegTech Market, Capturing 25% of 2024 Regional Deals

In 2024, the European RegTech market faced a significant decline, with total funding dropping 53% to $724 million and completed deals falling by 50% to 111. This downturn reflects investor caution amid market uncertainty. The UK remained the leader, accounting for 26% of deals, despite a 54% decrease to 43 deals. France and Germany also saw declines, while Spain emerged as a new player. Notably, London-based Napier AI secured $56.9 million in funding, one of the largest deals of the year, highlighting innovation as a potential driver for future recovery in the sector.

Aufinity Secures $26M Series C Funding Led by BlackFin for Innovative Automotive Payments Platform

Aufinity Group, a FinTech specializing in digital payment solutions for the automotive industry, has raised $26 million in Series C funding, led by BlackFin Capital Partners, with participation from existing investors like PayPal Ventures and Seaya Ventures. The funds will enhance Aufinity’s payment management capabilities and support its expansion across Europe. The company, known for its white-label solutions for car dealers and OEMs, aims to improve transaction speeds and customer experience. CEO Lasse Diener expressed excitement about accelerating growth and forming strategic partnerships, citing increased international demand as a key factor for this funding round.

Zolve Neobank Raises $51M in Equity and $200M in Debt for US and Canada Expansion

Zolve, a neobank focused on financial services for global citizens relocating to the US, has raised $51 million in equity and $200 million in debt funding to expand its operations. The Series B round, led by Creaegis, included investments from HSBC, SBI, and others. Founded in 2021, Zolve offers credit cards, bank accounts, and uses international credit data to aid expats. With plans to enter Canada by August and expand to the UK and Australia by 2026, Zolve aims to address challenges faced by cross-border financial institutions, enhancing financial inclusion for skilled professionals.

CodeAnt AI Secures $2M Funding to Accelerate Software Development with Innovative AI Code Review Platform

CodeAnt AI, a U.S.-based software development startup, has raised $2 million in seed funding to improve its AI-driven code review processes, enhancing code quality and efficiency. Led by investors including Y Combinator and VitalStage Ventures, this funding round values the company at $20 million. Founded by Amartya Jha and Chinmay Bharti, CodeAnt AI automates code reviews, integrates with GitHub and GitLab, and offers AI insights and one-click fixes for over 30 programming languages. The investment will support team expansion and scaling of its platform, addressing the growing need for quality control in AI-generated code.

81% of Financial Firms Worry About ‘Automation Armageddon’ Amidst Rising Process Complexity

The 2025 State of Process Orchestration and Automation Report by Camunda highlights alarming trends in the financial services sector, with 81% of organizations concerned about “digital chaos” from complex automated processes. Organizations manage an average of 50 task execution endpoints, increasing compliance risks (81%) and core process failure risks (71%). Kurt Petersen of Camunda emphasizes the need for effective process orchestration to avoid automation pitfalls. Additionally, 79% of firms struggle with AI integration, citing compliance and operational challenges. Overall, 90% believe hyperautomation is unattainable without proper orchestration, indicating a significant need for improved automation management tools.

Trump Unveils Executive Order to Revolutionize Federal Payment Systems

President Donald Trump’s recent Executive Order signifies a major shift in Federal Government payment management, aiming to replace paper checks with electronic payment systems by September 30, 2025. This change affects all transactions, including benefits, vendor payments, and tax refunds. Agencies must adopt modern electronic funds transfer methods such as direct deposit and digital wallets. The government will also process payments to itself electronically and phase out physical lockbox services. A public awareness campaign will help educate recipients about the transition, while exceptions will be made for those lacking access to electronic systems. The initiative aims to combat financial fraud and reduce costs.