Similar Posts

Republic Enters Negotiations for All-Stock Acquisition of Indiegogo: A Game-Changing Merger in Crowdfunding

Republic, a New York-based private market investing platform, is in talks to acquire the crowdfunding platform Indiegogo in an all-stock deal. This acquisition aims to enhance Republic’s position in the competitive investment landscape, following its recent acquisition of INX. Founded in 2008, Indiegogo has raised over $55 million from notable investors but has not secured institutional funding since 2014. While Indiegogo operates on a rewards-based model, Republic focuses on equity-based investments. Sources suggest Republic sees growth potential for Indiegogo, particularly in the film sector and the Middle Eastern markets, marking a renewed interest in a merger previously discussed in 2017.

TrueLayer and BR-DGE Team Up to Transform Enterprise Payments with Innovative Pay by Bank Solutions

TrueLayer, a leader in open banking payments in Europe, has partnered with BR-DGE, a payment orchestration platform, to launch Pay by Bank capabilities for global enterprise businesses. This collaboration aims to meet the rising demand for open banking solutions and enhance payment options across various industries, including transport, travel, and online retail. TrueLayer’s technology combines real-time bank payments with financial data, ensuring secure and efficient transactions. Both companies emphasize the importance of this partnership in driving innovation and interoperability in the payments ecosystem, positioning them for future growth in the evolving landscape of open banking.

Japan’s AI Governance Revolution: Navigating Global Regulatory Changes

Japan is shifting its approach to artificial intelligence (AI) regulation by adopting a more flexible framework, as detailed in a February 4, 2025, interim report from the AI Policy Study Group. This new strategy, which incorporates existing sector-specific laws and encourages voluntary risk management, contrasts with stricter regulations in the U.S. and EU. Key features include the integration of AI governance into current legal frameworks, promoting industry-led risk mitigation, and establishing a government body for AI policy coordination. Japan aims to balance innovation with oversight, positioning itself as a facilitator in the global AI landscape while addressing associated risks.

Unlocking Global Success: How Stripe Fuels Luckin Coffee’s Expansion with Seamless One-Click Local Payments

Stripe has partnered with Luckin Coffee to enhance payment solutions as the company expands into Malaysia and Singapore. This collaboration aims to improve cross-border payment experiences in Southeast Asia, where demand for specialty coffee is growing. Luckin Coffee, known for its mobile-first O2O model, has implemented a localized payment system through Stripe, supporting various local options like credit cards, Apple Pay, and GrabPay. Stripe also provides advisory support on market insights and compliance. Luckin Coffee’s General Manager emphasized the partnership’s alignment with their technology-driven strategy, while Stripe’s Regional Head highlighted the importance of innovative operations for global scalability.

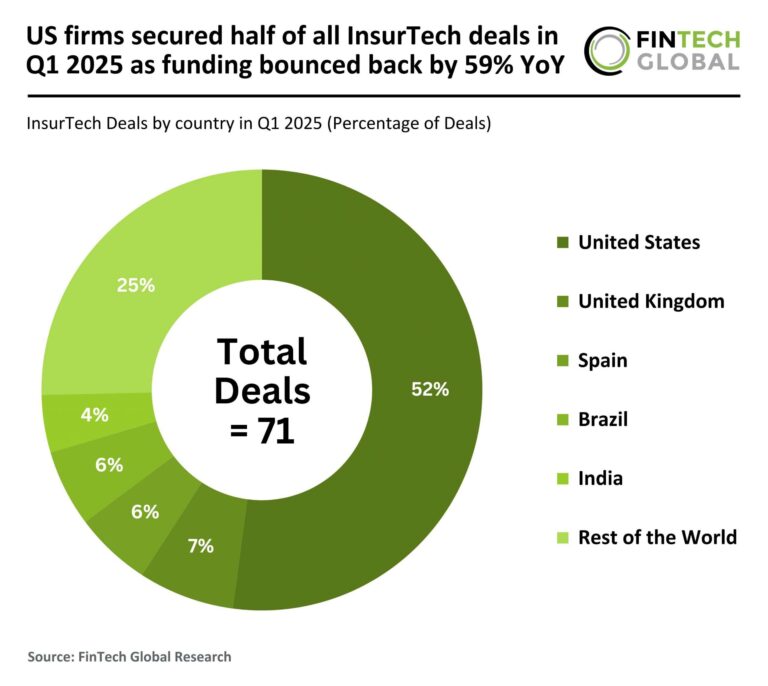

US Firms Dominate InsurTech Landscape: 50% of Q1 2025 Deals as Funding Surges 59% Year-Over-Year!

In Q1 2025, global InsurTech funding surged by 59% year-over-year, reaching $1.1 billion, despite a 22% drop in deal volume to 71 transactions. This shift indicates investors are now favoring fewer, high-value opportunities, signaling renewed confidence in the sector. The US dominated the market, accounting for 52% of deals, while the UK, Spain, and Brazil followed. Notably, High Definition Vehicle Insurance (HDVI) secured $40 million in funding to enhance its telematics-based offerings, achieving a 107% annual growth rate since its 2021 launch and maintaining a low loss ratio, positioning itself to innovate commercial auto insurance.

Understanding Australia’s Updated AML/CTF Regulations: Key Implications for Financial Institutions

Australia’s financial crime compliance landscape is set for significant change as AUSTRAC proposes enhancements to its Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations. Following the AML/CTF Amendment Act 2024, the updates aim to align with international standards and simplify compliance for financial institutions. Key changes include expanded regulatory scope to cover previously exempt sectors like lawyers and real estate agents, a risk-based approach to customer due diligence, stricter compliance officer requirements, and a restructuring of compliance oversight. These reforms will require financial entities to adapt their compliance strategies to effectively combat financial crimes.