Similar Posts

Discover the Future of Wealth Management: FinTech Global Unveils the Top Innovators in the WealthTech100

FinTech Global has released the 2025 WealthTech100 list, showcasing top firms revolutionizing investment and financial advisory amid market changes. The WealthTech sector is forecasted to grow by $6.08 billion from 2024 to 2028, driven by evolving client expectations and technology advancements. A panel evaluated over 1,200 firms, selecting 100 that demonstrate innovative solutions for wealth management challenges. Notable companies include Abbove, additiv, CAIS, and Croesus, each enhancing client engagement and operational efficiency. Richard Sachar emphasized the need for firms to adapt to hyper-personalized digital experiences, making the WealthTech100 an essential guide for industry leaders navigating this dynamic environment.

Maximizing ROI and Efficiency in CLM: Unleashing the Power of Corporate Digital Identity

In corporate banking, maximizing ROI from Contract Lifecycle Management (CLM) systems is challenging due to data complexities and manual processes. However, integrating Corporate Digital Identity (CDI) into CLM frameworks can drive significant improvements. Encompass is hosting a webinar for banking executives to explore how CDI can enhance CLM efficiency, offering potential savings of up to 32% in operational time, improved compliance, streamlined processes, and robust API strategies. Participants can learn how to achieve tangible ROI within the first year of CDI implementation, enhancing both compliance and client experience. Registration for the webinar is encouraged to transform CLM capabilities.

Aevi and IXOPAY Join Forces to Transform Global Payment Solutions for Merchants

Aevi has partnered with IXOPAY to enhance global merchant payment systems, aiming to unify in-person and online transactions. This collaboration integrates Aevi’s card-present solutions with IXOPAY’s card-not-present capabilities, allowing merchants to manage both types of transactions seamlessly. Benefits include reduced costs, increased transaction success rates, and diverse payment options without extra integrations. The partnership addresses the complexities of multi-channel payment management, offering merchants greater control, flexibility, and scalability. Industry leaders from both companies emphasize the importance of this collaboration in providing frictionless payment experiences and adapting to the evolving payments landscape.

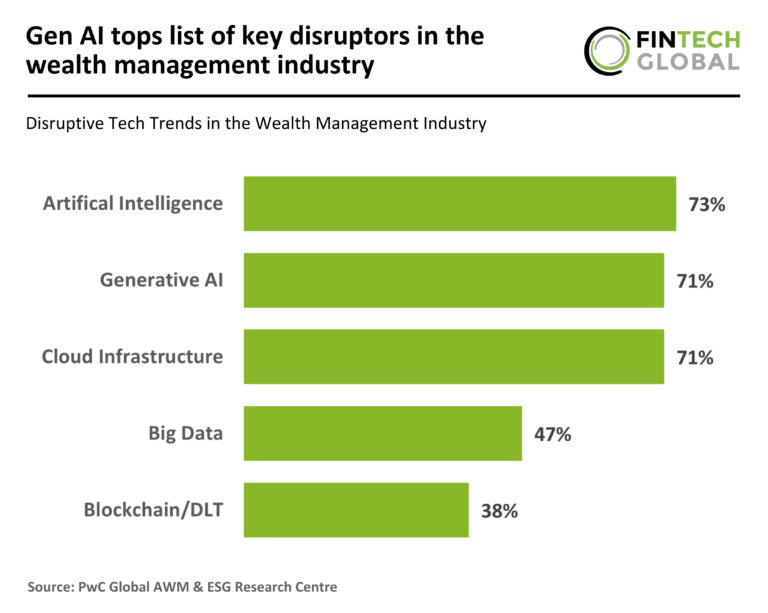

Generative AI: The Game-Changer Disrupting the Wealth Management Industry

A recent PwC survey of 521 industry leaders in asset and wealth management reveals how disruptive technologies like artificial intelligence (AI) and cloud computing are transforming the sector. Key findings show that 73% of respondents view AI and 71% generative AI as pivotal innovations, while 71% highlight cloud technology’s role in modernization. The integration of these technologies is reshaping business models, creating new revenue streams, and addressing challenges such as data security and governance. As firms adapt to technological advancements, they must rethink investment strategies and client expectations to remain competitive in this evolving financial landscape.

Unlocking Open Banking: Enable Banking and Qred Join Forces to Empower Entrepreneurs

Enable Banking has partnered with Qred Bank to enhance financial services using innovative open banking technologies. Founded in 2015, Qred Bank offers flexible business loans to over 50,000 businesses across Europe and Brazil, allowing for early repayment. Enable Banking provides a PSD2-compliant API connecting to over 2,500 European banks, facilitating secure financial data access and account-to-account payments. This collaboration integrates Enable Banking’s infrastructure with Qred’s risk assessment tools, improving credit approval processes and customer experiences. Both companies emphasize the partnership’s potential to support entrepreneurs and foster growth in small businesses across Europe.