Similar Posts

Revolutionizing UK Payments: GoCardless and Financial Cloud Join Forces to Boost Open Banking Solutions

Financial Cloud has partnered with GoCardless to enhance payment processes for UK financial service providers. This collaboration will integrate GoCardless’ Direct Debit and Instant Bank Pay features into Financial Cloud’s CRM platform, creating a seamless payment experience. Benefits include improved payment management, scalability for increased transaction volumes, and quick transactions, especially for ad-hoc payments. GoCardless serves nearly 100,000 businesses globally, processing over $130 billion annually, focusing on both recurring and one-off payments. Leaders from both companies expressed excitement about the partnership, emphasizing its potential to simplify processes and improve customer experiences in the evolving financial landscape.

Brite Payments and OXID eSales Join Forces to Revolutionize Instant E-Commerce Payment Solutions

Brite Payments, a Swedish FinTech firm, has partnered with Germany’s OXID eSales to enhance e-commerce payment processes by integrating Brite Instant Payments and Instant Payouts into OXID’s platform. This collaboration aims to provide merchants with fast, secure transactions and simplify the refund process through an easy plugin. Key features include a frictionless checkout, bank payment capabilities, and reduced fraud risks, meeting the needs of the growing number of consumers in Germany familiar with digital payment methods. Both companies emphasize improving the overall payment experience, benefiting merchants with predictable cash flow and lower operational costs.

US Justice Department Disbands Crypto Crime Task Force: Impacts on the Digital Currency Landscape

The US Department of Justice (DOJ) has disbanded its specialized cryptocurrency enforcement team, signaling a shift away from rigorous prosecution in the digital asset space. Deputy Attorney General Todd Blanche stated that the DOJ does not aim to be a digital assets regulator, focusing instead on targeting fraud and criminal activities involving cryptocurrencies. This decision aligns with the Trump administration’s efforts to support the crypto industry, reversing some Biden-era initiatives. The National Cryptocurrency Enforcement Team will be dissolved, and the Market Integrity and Major Frauds Unit will also decrease its focus on cryptocurrency, prioritizing other issues like immigration fraud.

Navigating Compliance Challenges in Southeast Asia: Strategies for Tackling Tariff Increases

As global economic uncertainty rises, so does the risk of financial crime, particularly in Southeast Asia, where companies are relocating to exploit new markets and avoid trade barriers. Greg Watson from Napier AI emphasizes the region’s growth potential but warns of increased illicit activities amidst these changes. Criminal networks may exploit new businesses for money laundering through complex schemes. To combat this, financial institutions must enhance compliance strategies using AI for real-time monitoring and dynamic risk assessments. Regulatory bodies like Singapore’s MAS are tightening AML/CFT requirements to address evolving financial crime risks. Implementing AI in compliance could save institutions billions annually.

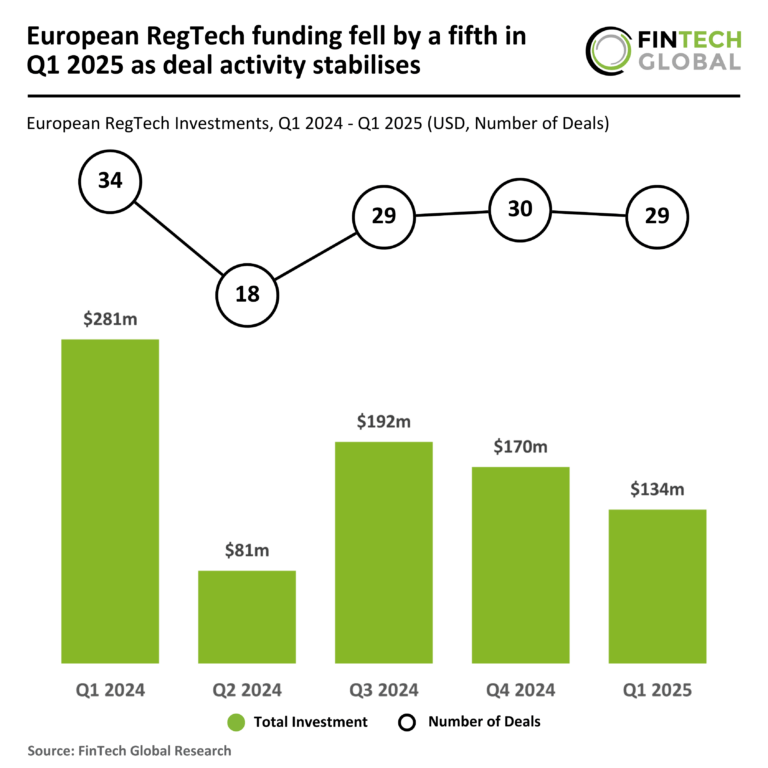

Q1 2025 Sees European RegTech Funding Dip 20% Amidst Stabilizing Deal Activity

In Q1 2025, the European RegTech sector experienced a significant decline in investment, with funding dropping 20% quarter-over-quarter to $134 million, reflecting a broader cautious investment climate. Only 29 deals were completed, a 15% decrease from the previous year, with average deal sizes falling to $4.6 million. Notably, ThreatMark secured $23 million in funding, making it one of the largest deals this quarter, driven by investors like Octopus Ventures. The company focuses on fraud prevention, crucial given the $486 billion in global fraud losses in 2023. The evolving landscape requires stakeholders to adapt to these changes.