Similar Posts

UK FinTech Capital on Tap Secures £650M to Boost £1.2B Master Trust Facility Expansion

Capital on Tap, a UK FinTech specializing in business credit cards for small enterprises, has raised £650 million, boosting its Master Trust facility to £1.2 billion. This funding, supported by partnerships with major financial institutions like SMBC Group, Société Générale, and HSBC, aims to enhance funding flexibility and support growth. The company focuses on providing flexible credit lines and financing solutions to small businesses in the UK and US, offering benefits such as cashback and travel rewards. CEO Damian Brychcy emphasized the funding’s importance in empowering small business owners to thrive in a competitive landscape.

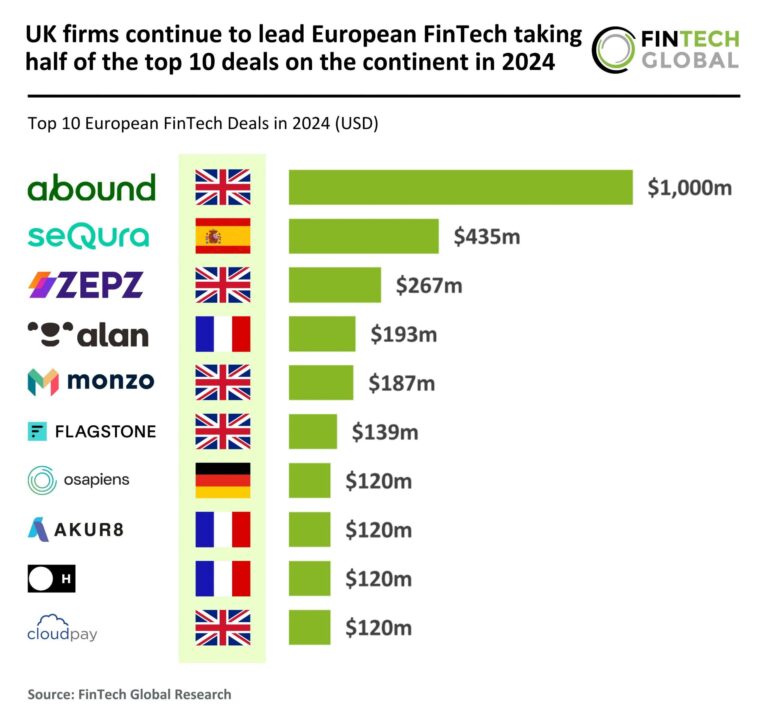

UK Firms Dominate European FinTech: Capturing 50% of Top 10 Deals in 2024

In 2024, European FinTech funding plummeted to $18.4 billion across 1,050 deals, a 47% decrease from $34.6 billion in 2023, reflecting a 46% drop in deal volume. This downturn is significant compared to 2020’s $34.3 billion and 3,295 deals. However, average deal sizes rose to $17.5 million, indicating a shift towards larger funding rounds concentrated among established players. The UK maintained its leading position, securing 50% of the top deals, while France, Germany, and Spain also improved their standings. Notable investments include Flagstone’s $139 million funding to enhance its savings platform and market expansion efforts.

AAA Life Partners with One Inc for Innovative Digital Payment Transformation Using PremiumPay

One Inc has partnered with AAA Life Insurance Company to implement its PremiumPay® solution as AAA Life’s main platform for digital payments, aiming to enhance operational efficiency and customer experience. This integration will streamline payment processes for policyholders, offering flexibility through various payment methods, including digital wallets. AAA Life’s COO, Michael Vellat, emphasized the importance of modernizing payment processes, while One Inc’s CEO, Ian Drysdale, highlighted the role of efficient payment solutions in driving growth. This collaboration represents a significant advancement in the insurance sector, transforming customer experiences through improved digital capabilities.

Axoflow Secures $7M Seed Funding for Cybersecurity Innovation, Led by EBRD

Axoflow, a cybersecurity startup, has secured $7 million in seed funding, led by EBRD Venture Capital, to improve the quality and accessibility of security data for enterprises. Existing investors, including Credo Ventures and e2vc, have also increased their stakes. Axoflow focuses on automating security data management, enhancing threat detection, integrating AI, and supporting compliance. The new funding will advance its security data pipeline, reducing data volume by over 50% and lowering operational costs. As cyber threats grow increasingly complex, Axoflow aims to empower cybersecurity professionals with better control and visibility, strengthening overall security posture.