Similar Posts

AI Security Firm Pillar Secures $9M Funding to Revolutionize Enterprise Software Safety

Pillar Security, a US startup specializing in AI-native cybersecurity solutions, has raised $9 million in seed funding, led by Shield Capital and supported by Golden Ventures and Ground Up Ventures. This funding will enhance its end-to-end security platform for enterprises using AI, addressing challenges like evasion attacks and data poisoning. As AI adoption increases, concerns about AI-related security breaches are rising, with 77% of cybersecurity leaders expressing significant worry. CEO Dor Sarig highlighted AI’s transformative impact on software development, emphasizing Pillar Security’s commitment to redefining application security for the Intelligence Age. The funding will accelerate research and market strategies.

SouthTrust Bank Partners with Jack Henry to Revolutionize Technology Infrastructure

Jack Henry has partnered with SouthTrust Bank to modernize its technology infrastructure and enhance operational efficiency, supporting the bank’s growth objectives. Founded in 1934 in George West, Texas, SouthTrust Bank manages approximately $550 million in assets and operates eight locations. The collaboration will automate processes, streamline workflows, and improve fintech integration through Jack Henry’s core processing system and Digital Platform, offering services like Zelle® and Apple Pay. CEO Steve Jackson highlighted the partnership’s importance for meeting evolving customer needs. The bank aims to reach $2 billion in assets in the next decade, focusing on expansion and innovation in community banking.

Agritech Innovator Arya.ag Secures $30M Debt Facility from HSBC, Backed by GuarantCo

Arya.ag, an agritech and lending platform, has secured a $30 million debt facility in partnership with HSBC and GuarantCo, marking GuarantCo’s first transaction in India’s agritech sector. The funding will help Arya.ag address agricultural challenges like inadequate storage and delayed financing by providing storage solutions close to farms, thus reducing post-harvest losses. Farmers can access loans within 30 minutes of depositing their produce. Co-founder Prasanna Rao emphasized that this partnership will enhance services, helping farmers avoid distress sales and achieve better returns. This collaboration is expected to significantly impact India’s agricultural landscape.

Unlocking Ethical AI Compliance: The Transformative Role of RegTech

As global adoption of artificial intelligence (AI) rises, ethical AI practices are increasingly vital. Regulatory Technology (RegTech) plays a crucial role in ensuring compliance through structured frameworks and monitoring systems. RegTech can streamline ethical compliance by integrating regulatory requirements into the AI development lifecycle, conducting automated audits to identify biases, and ensuring responsible data governance. It promotes algorithmic transparency and adapts to evolving regulations. Challenges remain, particularly regarding the potential misuse of AI, but RegTech’s advantages, including efficiency and proactive risk management, are essential for fostering trust and accountability in AI applications, paving the way for responsible adoption.

Orion Security Secures $6M in Funding to Combat Data Leaks with AI-Driven Solutions

Orion Security has successfully completed a $6 million Seed funding round to enhance its advanced data protection solutions against rising data breach threats, particularly from insiders. The funding, led by Pico Partners and FXP, with support from Underscore VC and cybersecurity experts, aims to bolster Orion’s AI-driven technology. This innovative approach differentiates normal workflows from potential threats by analyzing data movement anomalies. Orion’s upgraded Indicators of Leakage (IOL) engine leverages AI reasoning to minimize false positives and improve security monitoring. Co-founder Nitay Milner emphasizes the need for context in data protection tools to effectively combat data theft.

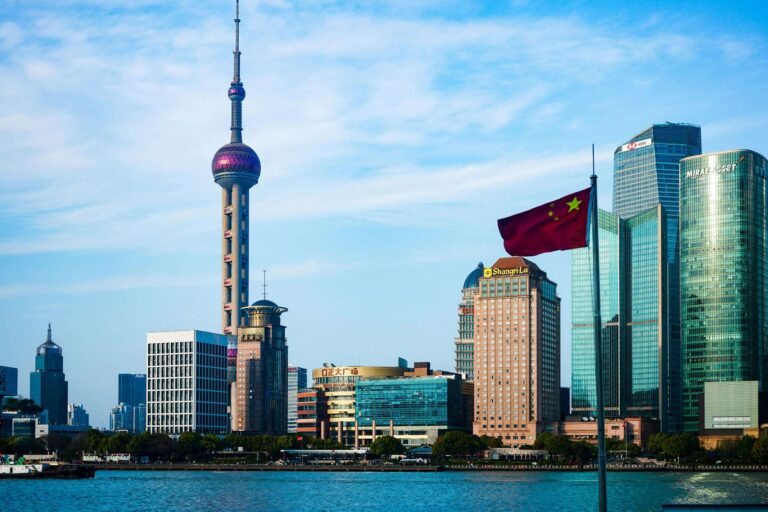

China Launches First Sovereign Green Bond on the London Stock Exchange: A Milestone in Sustainable Finance

China has launched its first sovereign green bond, raising RMB 6 billion through three- and five-year bonds, marking a significant commitment to environmental sustainability. This initiative, reported by ESG Today, is historic as it represents the first Chinese sovereign bonds listed on an international market, specifically the London Stock Exchange (LSE). Following discussions to strengthen UK-China economic ties, the Ministry of Finance introduced a Sovereign Green Bond Framework in February, funding projects in clean transportation, water management, and pollution control. The bond issuance attracted bids of approximately RMB 47 billion, highlighting strong investor interest and promoting the internationalization of the renminbi.