Similar Posts

CIMB Bank Teams Up with ACI Worldwide to Revolutionize Real-Time and Cross-Border Payment Solutions

CIMB Bank is enhancing its financial technology through a partnership with ACI Worldwide, aiming to unify all account-to-account payment types on a modern platform. This initiative, part of CIMB’s strategy to modernize payment systems in Malaysia, includes real-time payments, ACH transactions, RTGS, and cross-border payments, supporting the ISO 20022 global messaging standard. The new platform promises improved security, regulatory compliance, and interoperability. CIMB’s Group CTO, Ros Aziah, highlighted the transformation as essential for future-proofing banking operations. Leslie Choo of ACI Worldwide praised the collaboration as a step towards leading in a digital-first economy across the ASEAN region.

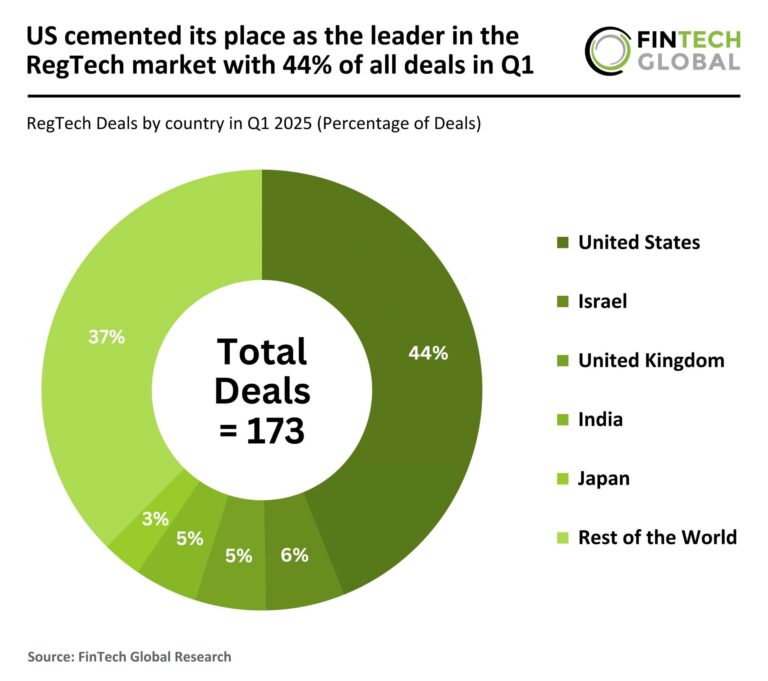

US Dominates RegTech Market with 44% of Global Deals in Q1: A Leader in Regulatory Technology Innovation

In Q1 2025, the global Regulatory Technology (RegTech) sector saw an 18% decline in deal activity, totaling 173 deals compared to 214 in Q1 2024. Despite this drop, funding increased to $2.3 billion, up 18% from the previous year, indicating a shift towards larger investment rounds in high-potential companies. The US led the market with 44% of deals (76), though down 28% from last year. Israel and the UK followed with 10 and 9 deals, respectively. A highlight of the quarter was Cybereason’s $120 million funding round, showcasing strong investor confidence in its cybersecurity solutions.

Miggo Secures $17M Series A Funding to Revolutionize Runtime Application Resilience

Miggo, a leader in real-time automated detection and response (ADR) technology, has successfully raised $17 million in a Series A funding round led by SYN Ventures, with support from YL Ventures. This funding will enhance Miggo’s ADR platform, designed to counteract AI-driven threats by providing in-application defense without the need for code changes. Key features include real-time threat blocking and behavioral monitoring. The investment will help expand Miggo’s reach in sectors like finance, SaaS, and e-commerce, while accelerating product development, particularly its DeepTracing™ technology. CEO Daniel Shechter emphasized the importance of real-time protection for security teams.

LSEG Unveils Innovative App to Centralize Financial Research and Insights for Investors

The London Stock Exchange Group (LSEG) has launched LSEG Research & Insights, a new platform designed to enhance access to financial insights for finance professionals. This user-friendly app consolidates a wide range of research materials, covering topics such as commodities, sustainable finance, and investment strategies. Key features include expert insights from FTSE Russell and integrated financial analysis tools. Available through LSEG Workspace, the platform simplifies user experience by centralizing diverse research outputs, enabling better-informed investment decisions. Dean Berry, LSEG’s Group Head of Workflows, highlighted the app’s strategic importance in providing actionable intelligence for trading and investment.

MoneyGram and Mastercard Join Forces to Revolutionize Global Digital Payments

MoneyGram has partnered with Mastercard to transform digital money transfers, enhancing customer experiences through faster, secure, and near real-time transactions. By integrating Mastercard Move, MoneyGram expands its services to 38 receiving markets and nearly 10 billion endpoints globally. The collaboration promises cost-effective solutions, improved financial accessibility, and a digital-first approach. MoneyGram CEO Anthony Soohoo emphasized the partnership’s potential to empower communities, while Mastercard’s Chiro Aikat highlighted the importance of secure and efficient transactions. This alliance is set to significantly impact the digital payments landscape, aiming for seamless, affordable, and secure cross-border payments.

Achieve SOC 2 Type II Compliance with ChainThat: Elevating Your Data Protection Strategy

ChainThat has announced that its Beyond Policy Administration (BPA) platform has achieved SOC 2 Type II compliance, highlighting its commitment to secure and reliable services. This compliance, established by the AICPA, evaluates an organization’s ability to manage customer data based on five trust principles: security, availability, processing integrity, confidentiality, and privacy. Achieving Type II compliance indicates that ChainThat has maintained adherence to these principles over an extended period. This milestone reassures clients of the company’s robust data protection measures and commitment to continuous improvement, enhancing customer confidence and positioning ChainThat as an industry leader in data security.