Similar Posts

Revolutionizing Accounting Efficiency: AI Tax Co-Pilot TaxGPT Secures $4.6M Funding

TaxGPT, a San Francisco-based FinTech company, has secured $4.6 million in funding to enhance its AI tax co-pilot platform for accounting firms. Key investors include Rebel Fund, Mangusta Capital, Y Combinator, and notable individuals like Jason Calacanis. Founded in 2023 by Kashif Ali and Isabella Maceda-Ali, TaxGPT evolved from a personal tax challenge into a professional solution, now serving over 10,000 tax professionals. The funding will accelerate product development and expand the team. With increasing tax complexity and a looming CPA shortage, TaxGPT aims to leverage AI to streamline tax research and compliance for firms.

Luma Financial Technologies Secures $63M Funding to Accelerate Global Expansion

Luma Financial Technologies has raised $63 million in a Series C funding round led by Sixth Street Growth, with participation from major financial institutions like Bank of America and Morgan Stanley. Founded in 2018, Luma provides a technology platform that streamlines the research and management of alternative investments and annuities. The funding will support expansion into new markets and the introduction of life insurance solutions. CEO Tim Bonacci emphasized the investment’s validation of Luma’s market value and commitment to client-focused innovation. Sixth Street Growth’s Michael McGinn expressed enthusiasm for Luma’s potential to enhance wealth management infrastructure.

Combating a $103.6 Billion Fraud Crisis: Europe’s Strategic Battle Against Financial Deception

Nasdaq Verafin has released the report “Financial Crime Insights: Europe,” highlighting the extensive financial crime affecting the continent. According to the 2024 Global Financial Crime Report, around $750 billion in illicit funds infiltrated Europe’s financial systems, representing 2.3% of the GDP. A significant portion, $194.9 billion, is linked to cross-border transactions, stressing the need for international cooperation. Fraud has resulted in losses of $103.6 billion, threatening financial integrity. Executive VP Stephanie Champion calls for collaboration among stakeholders to combat these crimes. The report also recommends enhanced anti-money laundering efforts and innovative fraud prevention strategies to secure the financial ecosystem.

Unlocking KYC Compliance: The Critical Role of Customer Success Strategies

Implementing a proactive Customer Success Programme is crucial for businesses using the KYC Portal, ensuring they exceed compliance objectives in a dynamic regulatory landscape. This program emphasizes regular client interactions to adapt the platform to evolving needs, optimizing workflows, integrating new features, and exploring advanced applications. The dedicated customer success team provides personalized support, enhancing efficiency and productivity. By actively monitoring client usage and soliciting feedback, KYC Portal addresses potential issues promptly. Committed to building long-term partnerships, the program includes continuous training and collaboration, empowering clients to scale effectively while navigating compliance complexities. Customer success is central to KYC Portal’s ethos.

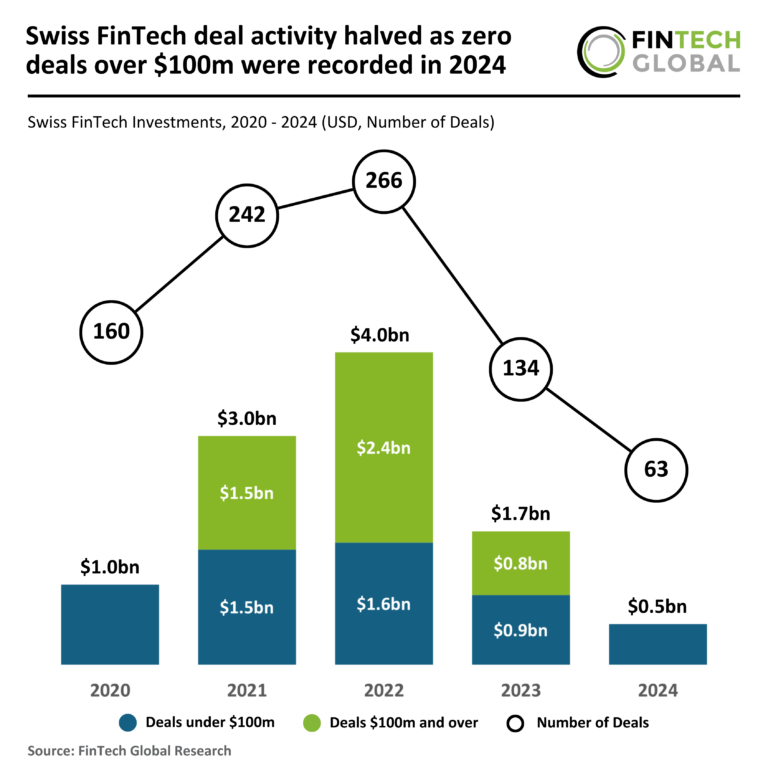

Swiss FinTech Landscape Shifts: 2024 Sees Dramatic 50% Drop in Deal Activity with No Transactions Over $100M

In 2024, the Swiss FinTech sector saw significant declines in deal activity and total funding. The year ended with just 63 deals, a 53% drop from 2023’s 134 deals, and total funding fell to $521 million, down 70% from $1.7 billion the previous year. All investments were under $100 million, reflecting a shift towards smaller, less risky ventures amid economic uncertainties. Despite this downturn, Alpian, a digital banking platform, secured the largest deal at $84 million and doubled its client base within four months, demonstrating resilience and effective financial strategies.

Unlocking Financial Crime Prevention: The Power of Collaboration Over Isolation

Financial institutions face increasing pressure to enhance anti-fraud strategies as financial crime becomes more sophisticated. In Poland, credit fraud attempts soared to 324.2 million PLN (€75 million) in 2024, a trend seen across Europe. Collaboration among banks, FinTech, and crypto firms is crucial but hindered by legal concerns, operational inertia, and privacy issues. Salv, a company focused on combating financial crime, emphasizes the need for real-time, peer-to-peer communication for effective intelligence sharing. By fostering secure, structured exchanges of alerts, institutions can better detect and prevent fraud while respecting customer privacy and complying with regulations.