Similar Posts

Nancy Langer Takes the Helm as President and CEO of CSI, Pioneering the Next Wave of Innovation

CSI has appointed Nancy Langer as its new President, CEO, and board member, succeeding David Culbertson, who will transition to vice chair of the board. Langer, with over 35 years of FinTech experience, previously served as CEO of Transact Campus, leading significant growth and digital transformation. Her record includes notable achievements at CoreLogic and Metavante. Frank Martire, CSI’s board chair, highlighted Langer’s expertise in transforming financial tech organizations as key to driving innovation at CSI, especially for community banks. Langer expressed her commitment to fostering a culture of innovation and enhancing customer service in her new role.

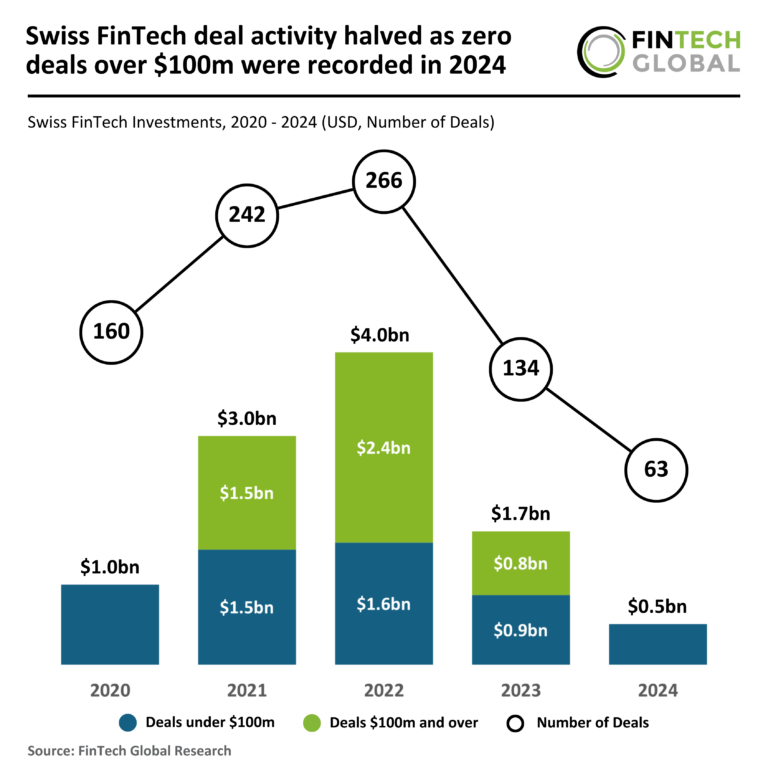

Swiss FinTech Landscape Shifts: 2024 Sees Dramatic 50% Drop in Deal Activity with No Transactions Over $100M

In 2024, the Swiss FinTech sector saw significant declines in deal activity and total funding. The year ended with just 63 deals, a 53% drop from 2023’s 134 deals, and total funding fell to $521 million, down 70% from $1.7 billion the previous year. All investments were under $100 million, reflecting a shift towards smaller, less risky ventures amid economic uncertainties. Despite this downturn, Alpian, a digital banking platform, secured the largest deal at $84 million and doubled its client base within four months, demonstrating resilience and effective financial strategies.

Stacks Secures $10M Investment to Revolutionize Financial Closures with Cutting-Edge AI Technology

Stacks, an AI-driven financial close platform, has raised $10 million in funding through two rounds led by EQT Ventures and General Catalyst. This includes a $3 million pre-seed round and a $7 million seed round, with participation from s16vc and notable angel investors. Founded by Albert Malikov, a former Uber and Plaid executive, Stacks aims to automate financial workflows and reduce inefficiencies in closing processes. The platform integrates with ERP systems and collaboration tools, enhancing accuracy and reducing closing times. Malikov envisions simplifying month-end processes, allowing finance teams to focus on strategic contributions and revenue optimization.

AU10TIX Names Yair Tal as New CEO to Drive Innovation and Growth

AU10TIX, a prominent identity verification provider based in Israel and New York, has appointed Yair Tal as its new CEO, succeeding Dan Yerushalmi. Tal, with over 20 years of experience in payments and fintech, previously led AI-driven localization at BLEND and transformed Payoneer into a global e-payment leader. His focus is on combating the rising threat of deepfake fraud, emphasizing the importance of trust in business. AU10TIX develops advanced identity verification technology across various industries, ensuring automated customer onboarding while effectively preventing fraud. The company aims to expand its machine learning capabilities and international reach.

Cytora and Aisix Solutions Join Forces to Equip Insurers with Advanced Wildfire Risk Data

Cytora has partnered with Aisix Solutions to enhance wildfire risk assessment for insurers by integrating Aisix’s AI-driven climate data analytics into Cytora’s underwriting workflows. This collaboration aims to improve decision-making speed, accuracy, and transparency amidst growing climate change challenges. Insurers will benefit from real-time asset-level risk assessments, improved accuracy in underwriting, and increased transparency in navigating complex climate-related risks. Cytora’s COO, Juan de Castro, and Aisix’s CEO, Mihalis Belantis, emphasized the importance of this partnership in providing insurers with critical insights for sustainable decision-making as wildfire events become more frequent and intense.