Similar Posts

Shawbrook Bank Transforms Mortgage Product Development Through Digital Acceleration

Shawbrook Bank has significantly improved its mortgage product switching process through a partnership with AND Digital, reducing the switching time from 107 days to just 13 days. This transformation involved moving away from outdated legacy systems and adopting agile development practices, leading to enhanced technological infrastructure and training for Shawbrook’s teams. The collaboration resulted in a fully integrated mortgage switch system utilizing Microsoft Azure and React, featuring automated valuations and streamlined credit checks. Efficiency gains include reduced deployment times from 12 hours to 2 hours and broker application journey times cut from 40 minutes to 8 minutes, fostering a culture of innovation.

Safetrust Secures Strategic Investment from dormakaba: A Major Step for Secure Identity Solutions

Safetrust, a leader in secure identity solutions, has received a strategic investment from dormakaba, a global access solutions provider. This partnership aims to enhance Safetrust’s market presence and advance its post-quantum-ready security technology. While specific investment details remain undisclosed, the collaboration will improve Safetrust’s innovative technologies that leverage neuroscience and data analytics for enhanced security intelligence. Safetrust’s offerings include cloud-connected sensors and solutions for physical access and digital identity verification. Both CEOs expressed enthusiasm for the partnership, highlighting its potential to address security challenges in a digital landscape.

Elevate Your SME’s Success: Banca AideXa – Your Trusted Partner in KYB and Fraud Prevention

Banca AideXa, an Italian FinTech supporting SMEs, has partnered with Trustfull, a fraud prevention provider, to enhance Know Your Business (KYB) controls during customer onboarding. This collaboration aims to improve security measures while maintaining a smooth user experience. Founded in 2020, Banca AideXa leverages open banking and AI to streamline financing for SMEs, which contribute 50% of Italy’s GDP. Trustfull’s technology analyzes digital signals to detect fraud, reinforcing Banca AideXa’s commitment to secure and efficient financial services. Both companies emphasize that this partnership will advance their mission to redefine financial services for SMEs in Italy.

EBA Streamlines ICT Risk Management Requirements Under DORA: What You Need to Know

The European Banking Authority (EBA) has updated its Guidelines on ICT and security risk management to align with the Digital Operational Resilience Act (DORA), effective January 17, 2025. The revisions narrow the focus to credit institutions, payment institutions, and exempted entities, aiming to eliminate overlaps with existing regulations. Key changes include a streamlined approach to relationship management for payment service users and a refined scope that excludes certain payment service providers under the Payment Services Directive (PSD2). These updates reflect the evolving regulatory landscape as the financial sector prepares for DORA’s implementation.

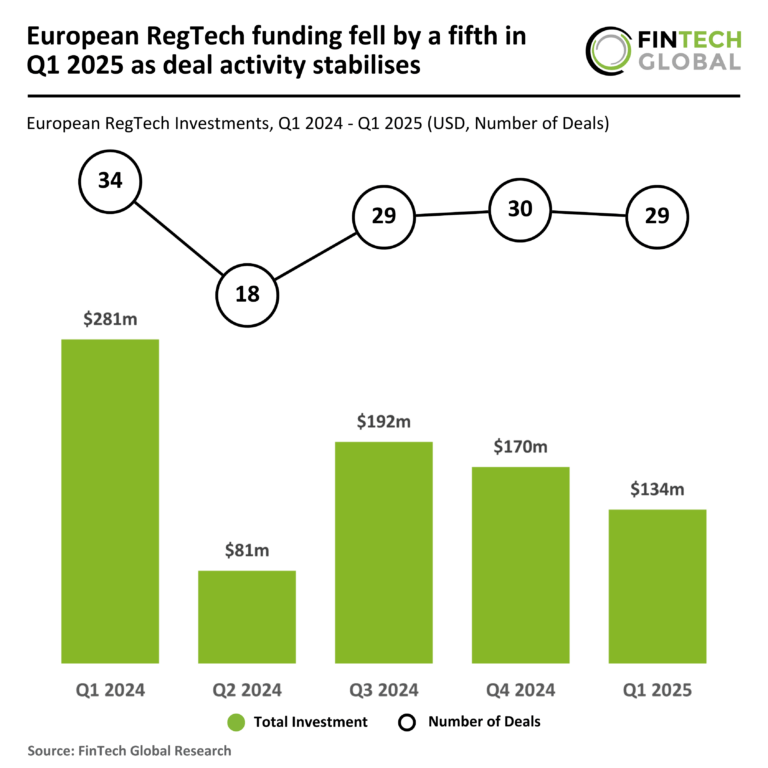

Q1 2025 Sees European RegTech Funding Dip 20% Amidst Stabilizing Deal Activity

In Q1 2025, the European RegTech sector experienced a significant decline in investment, with funding dropping 20% quarter-over-quarter to $134 million, reflecting a broader cautious investment climate. Only 29 deals were completed, a 15% decrease from the previous year, with average deal sizes falling to $4.6 million. Notably, ThreatMark secured $23 million in funding, making it one of the largest deals this quarter, driven by investors like Octopus Ventures. The company focuses on fraud prevention, crucial given the $486 billion in global fraud losses in 2023. The evolving landscape requires stakeholders to adapt to these changes.

N5 Secures $20M to Accelerate AI-Powered Fintech Innovations and Expand Globally

N5, a prominent technology firm in the financial sector, has secured a US$20 million investment to enhance its AI solutions and expand internationally. The funding attracted new investors like Alexia Ventures and Scale-Up Ventures, alongside existing supporters. N5 plans to develop its platforms—AIfred, Pep, and Singular—to improve efficiency in finance and insurance, having already expanded to 18 countries. CEO Julián Colombo highlighted AI’s potential to increase accessibility for the 1.4 billion unbanked globally. The company is shifting focus from acquisitions to a partner distribution model, collaborating with firms like EY and Capgemini to broaden service reach.