Similar Posts

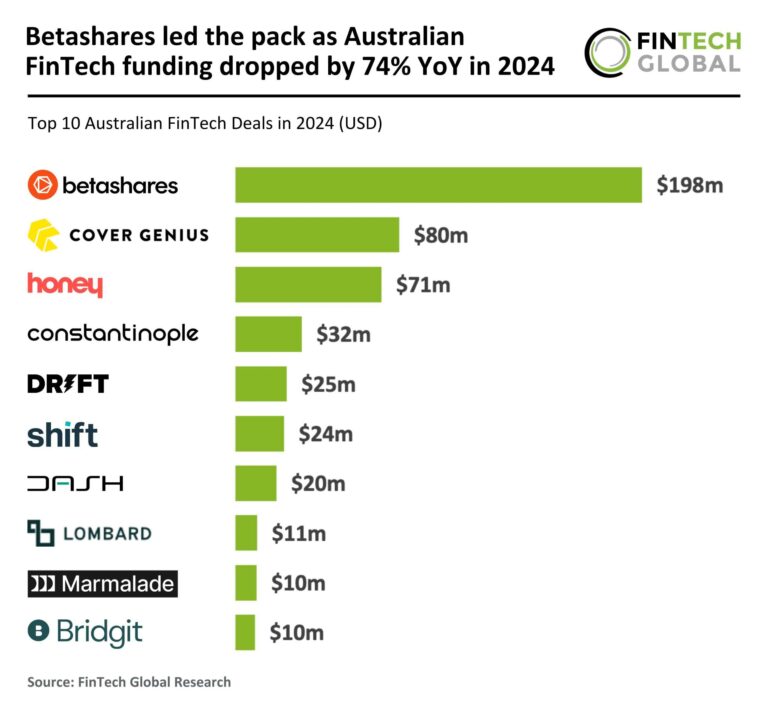

Betashares Tops Australian FinTech Scene Despite 74% Year-Over-Year Funding Decline in 2024

In 2024, the Australian FinTech landscape experienced a significant investment decline, with funding plummeting 74% to $891 million from $3.5 billion in 2023. Deal activity also fell sharply, with only 57 deals recorded, a 66% drop from the previous year. Investors are becoming more selective, focusing on sustainable growth, as reflected in the decreased average deal size of $15.6 million. Notably, Betashares secured the largest deal of the year with a $198 million investment from Temasek. As the market adjusts, FinTech firms must prioritize transparency and cost-effectiveness to attract investment and create long-term value.

Bank of America Strengthens Global GPS Leadership with Strategic Appointments in Mexico and Hong Kong

Bank of America has strengthened its Global Payments Solutions (GPS) leadership with two key appointments in Asia Pacific and Latin America. Phil Carmalt will become Head of Asia Pacific GPS Product in Hong Kong, where he will oversee product management and strategy execution. With over 20 years of experience, he previously led Cash & Trade Product at DBS Hong Kong. Meanwhile, Gabriel Andrade has been appointed Managing Director and Head of GPS for Mexico, focusing on payment solutions and liquidity services from Mexico City. Andrade brings over 30 years of banking experience, including senior roles at Citibanamex.

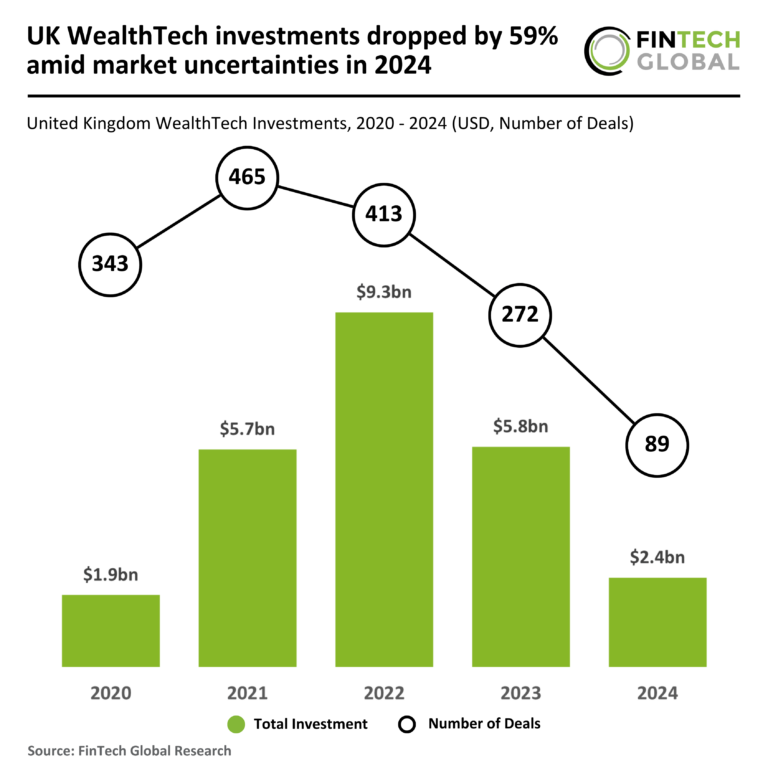

UK WealthTech Investments Plummet 59% in 2024: Navigating Market Uncertainties

In 2024, the UK WealthTech sector experienced a dramatic 59% decline in investments, totaling only $2.4 billion compared to $5.8 billion in 2023. Deal activity dropped significantly, with just 89 completed transactions—a 67% decrease and the lowest in five years. The funding figures were heavily influenced by Abound’s $1 billion deal, without which total funding would have fallen to $1.4 billion. Although the average deal value rose to $26.5 million, it would drop to $16.1 million excluding Abound. Investor sentiment has shifted towards established firms, reflecting a cautious approach amidst economic uncertainty and regulatory challenges.

Betterment Expands Horizons: Acquisition of Ellevest’s Automated Investing Division

Betterment, a leading US digital investment advisor, has acquired the automated investing division of Ellevest, a firm focused on women’s financial needs. This acquisition aims to strengthen Betterment’s position in the digital investing sector. While it excludes Ellevest’s other accounts and employees, it will enhance Betterment’s offerings for its 900,000 customers managing over $55 billion in assets. The transition for Ellevest’s automated investing clients to Betterment is set for April 17, 2025. Ellevest will continue its wealth management services for high-net-worth clients. Betterment’s CEO expressed excitement about the acquisition, emphasizing the improved services for clients.

Jumio Unveils Cross-Transaction Risk Feature to Supercharge Fraud Detection

Jumio has launched its Cross-Transaction Risk feature, part of the Jumio Identity Reputation suite, aimed at enhancing fraud detection for businesses globally. Unlike traditional methods that assess identity at a single point, this tool continuously evaluates identity attributes over time, resulting in a real-time recognition system. Early adopters have seen a 28% increase in fraud detection, improved user experience, and continuous risk monitoring. A telecommunications provider in the Asia-Pacific region successfully used Cross-Transaction Risk to reject over 50% of fraudulent ID transactions during a sophisticated fraud attack. Jumio’s Chief Product and Technology Officer highlighted its role in connecting identity data for better fraud prevention.

Clearcover Launches Innovative Insurance Exchange to Transform Non-Standard Auto Insurance Market

Clearcover has launched the Clearcover Inter-Insurance Exchange (CIX) to strengthen its presence in the non-standard auto insurance market and provide tailored solutions for underserved drivers, such as those with foreign licenses or inconsistent insurance histories. This initiative aligns with the company’s goal to enhance profitability and accessibility in auto insurance. Additionally, Clearcover is expanding into Texas through the Clearcover General Agency. The CIX features expanded coverage options, competitive commissions for agents, and AI-driven technology for improved customer self-service. CEO Kyle Nakatsuji emphasized that this launch represents a pivotal moment in redefining auto insurance and enhancing customer empowerment.