Similar Posts

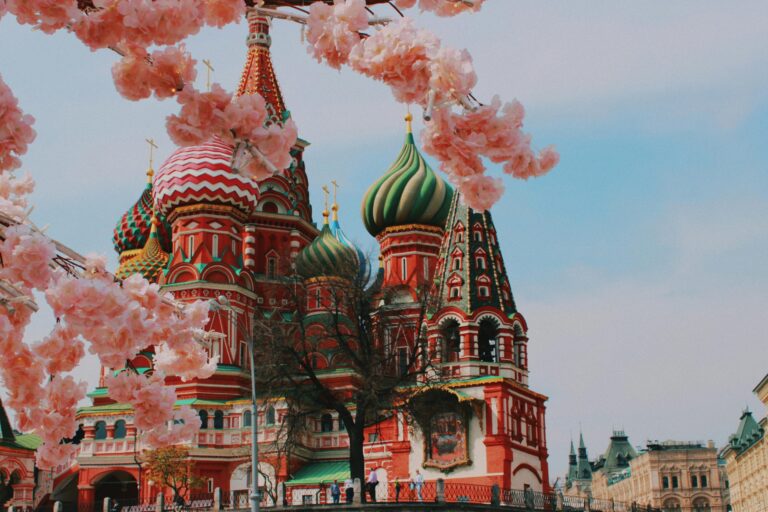

Russia Urges SCO Nations to Unite on Sustainable Finance Standards for Global Impact

Russia has proposed the establishment of unified standards for sustainable financing within the Shanghai Cooperation Organisation (SCO) to improve regional investment and assess Environmental, Social, and Governance (ESG) risks. Announced by Nikita Kondratyev during a meeting in Tianjin, the initiative aims to attract capital for sustainable projects by creating a tailored financial architecture for SCO countries. Key objectives include enhancing the investment climate, aligning sustainability metrics, and reducing investment fragmentation. The proposal encourages sharing best practices and adapting ESG tools to local markets, emphasizing the need for coordinated action among emerging economies to support economic growth and resilience.

Taulia and Lloyds Team Up to Launch Visa-Enabled Virtual Cards Revolutionizing B2B Payments

Taulia, a leader in working capital management and part of the SAP Group, has teamed up with Lloyds, the UK’s top financial services provider, to incorporate Visa-enabled Virtual Cards into the SAP Business Suite. This partnership allows businesses to streamline B2B payment transactions by issuing Virtual Cards to suppliers globally, enhancing cash flow management and supplier relationships. Key benefits include improved supplier trust, reduced fraud risk, and optimized working capital. Experts from Taulia and Lloyds expressed enthusiasm for the collaboration, highlighting its potential to revolutionize corporate payment processes through embedded finance technology. For further details, visit Taulia’s and Lloyds’ websites.

ESMA Seeks Feedback on Draft Standards to Regulate ESG Rating Providers in Europe

The European Securities and Markets Authority (ESMA) has initiated a public consultation to establish new regulations for ESG rating providers, aiming to improve transparency and accountability in the sector. The proposed Regulatory Technical Standards (RTS) include guidelines for information submission, internal safeguards to prevent conflicts of interest, and transparency requirements for disclosures to stakeholders. ESMA seeks feedback from financial institutions and companies involved with ESG ratings until June 20, 2025, after which it will finalize the standards for submission to the European Commission in October 2025. This initiative is crucial for companies seeking ESG recognition and financial institutions relying on ESG scores.

Unlocking Global Success: How Stripe Fuels Luckin Coffee’s Expansion with Seamless One-Click Local Payments

Stripe has partnered with Luckin Coffee to enhance payment solutions as the company expands into Malaysia and Singapore. This collaboration aims to improve cross-border payment experiences in Southeast Asia, where demand for specialty coffee is growing. Luckin Coffee, known for its mobile-first O2O model, has implemented a localized payment system through Stripe, supporting various local options like credit cards, Apple Pay, and GrabPay. Stripe also provides advisory support on market insights and compliance. Luckin Coffee’s General Manager emphasized the partnership’s alignment with their technology-driven strategy, while Stripe’s Regional Head highlighted the importance of innovative operations for global scalability.

Deepfakes: The Emerging Financial Threat and Essential Strategies for Defense

Deepfakes pose a significant threat to the financial sector, as demonstrated by a recent incident involving a FinTech company that was deceived during a transaction. These AI-generated media can replicate voices and appearances, leading to fraud, identity theft, misinformation, and substantial financial losses. Currently, U.S. legislation is lagging, though some states have introduced laws targeting deepfake fraud. To combat these risks, financial institutions should adopt AI verification tools, multi-factor authentication, employee training, and industry collaboration. As the technology evolves, proactive measures are essential to protect operations and influence future regulations.