Similar Posts

Unlocking ESG Excellence: How Greenomy’s B Corp Certification Elevates Corporate Responsibility

Greenomy, a leader in ESG reporting solutions, has achieved B Corporation certification, reflecting its commitment to positive change and enhanced ESG practices. The certification, awarded by B Lab, highlights Greenomy’s compliance with rigorous standards in governance, community involvement, and environmental stewardship, earning a score of 107.3. The company has legally committed to prioritizing purpose alongside profit and must renew this commitment every three years. Greenomy aims to democratize ESG knowledge through its free Greenomy Academy, while focusing on community involvement, diversity, and employee development. CEO Alexander Stevens emphasizes the certification as a mandate for driving sustainable economic transformation.

Shift4’s Bold Move: Acquiring Global Blue in a $2.5 Billion Strategic Deal

Shift4, an integrated payments company from Allentown, Pennsylvania, has announced its acquisition of Global Blue, a Swiss payments platform, for $7.50 per share, totaling approximately $2.5 billion. Shift4 President Taylor Lauber highlighted the transformative potential of this acquisition, which aims to enhance the merchant experience through unified payment solutions and unlock new revenue streams. Significant shareholders Ant International and Tencent will remain investors and explore partnerships to boost global e-commerce payment solutions. The acquisition is expected to close by Q3 2025, pending regulatory approvals, with financing from cash reserves and a $1.795 billion bridge loan.

Red Oak Transforms Financial Connectivity: Acquires 4U Platform for Enhanced Compliance Solutions

Red Oak Compliance has acquired 4U Platform to enhance content distribution, engagement, and analytics in the investment industry. This strategic acquisition positions Red Oak as the first provider of a Compliance Connectivity Platform, merging technologies to streamline marketing compliance workflows. Known for its AI-powered compliance tools, Red Oak aids investment firms in navigating regulatory approvals. The integration of 4U’s centralized library of pre-approved content aims to foster collaboration, improve regulatory workflows, and connect content delivery with compliance systems. The partnership is expected to revolutionize compliance and marketing processes, benefiting financial advisors and their clients.

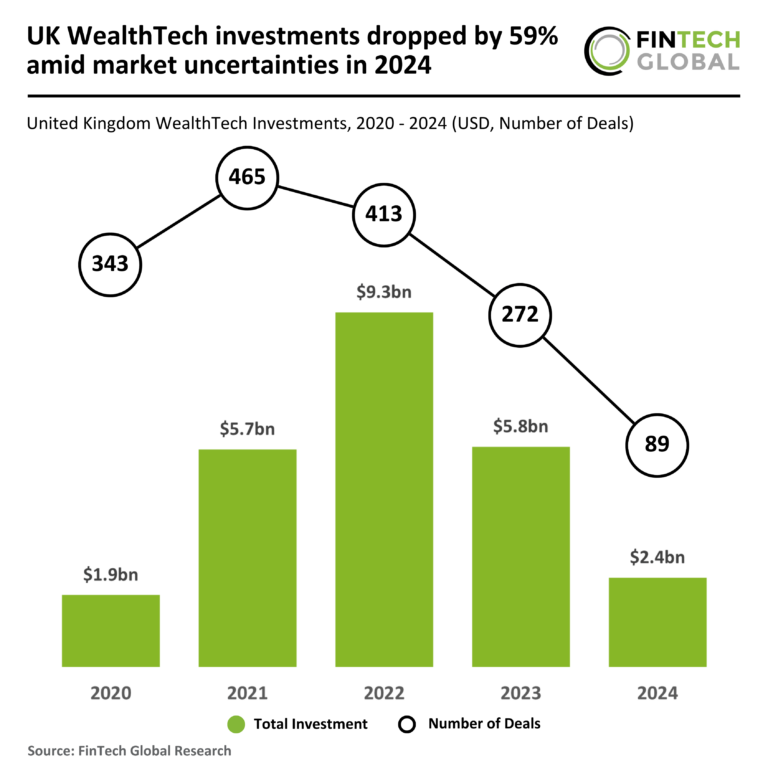

UK WealthTech Investments Plummet 59% in 2024: Navigating Market Uncertainties

In 2024, the UK WealthTech sector experienced a dramatic 59% decline in investments, totaling only $2.4 billion compared to $5.8 billion in 2023. Deal activity dropped significantly, with just 89 completed transactions—a 67% decrease and the lowest in five years. The funding figures were heavily influenced by Abound’s $1 billion deal, without which total funding would have fallen to $1.4 billion. Although the average deal value rose to $26.5 million, it would drop to $16.1 million excluding Abound. Investor sentiment has shifted towards established firms, reflecting a cautious approach amidst economic uncertainty and regulatory challenges.

MANSA Secures $10M Funding to Revolutionize Cross-Border Payment Liquidity Solutions

MANSA, a global FinTech leader in cross-border payments, has raised $10 million in funding to tackle global liquidity challenges with stablecoin solutions. The round featured a $3 million pre-seed investment from Tether and Polymorphic Capital, alongside contributions from other investors. The funds will support MANSA’s expansion into Latin America and Southeast Asia, where demand for efficient payment solutions is rising. Since its launch in August 2024, MANSA has processed $27 million in transactions, with a 574% increase in recent on-chain activities. CEO Mouloukou Sanoh emphasized the funding’s role in enhancing payment efficiency worldwide.