Americans Focus on Debt and Savings: 44% Plan to Use Tax Refunds for Financial Relief

As tax season approaches, a recent income tax survey by ACI Worldwide in partnership with YouGov has provided insightful data on how U.S. taxpayers plan to utilize their tax refunds. The survey highlights a significant trend where nearly 40% of taxpayers intend to allocate their refunds towards paying off debts, including credit card balances and loans. This shift indicates that many Americans are increasingly dependent on their tax refunds to manage their financial responsibilities amidst ongoing inflationary pressures.

Key Findings from the ACI Worldwide Survey

The survey unveiled several important trends regarding taxpayer behavior:

- Approximately 44% of respondents plan to deposit their tax refunds into savings accounts, showcasing a cautious approach towards spending.

- The findings reflect a growing sentiment of financial insecurity, with many prioritizing debt reduction over discretionary expenditures.

Digital Payment Preferences on the Rise

The report also notes a notable shift towards digital payment methods during tax season:

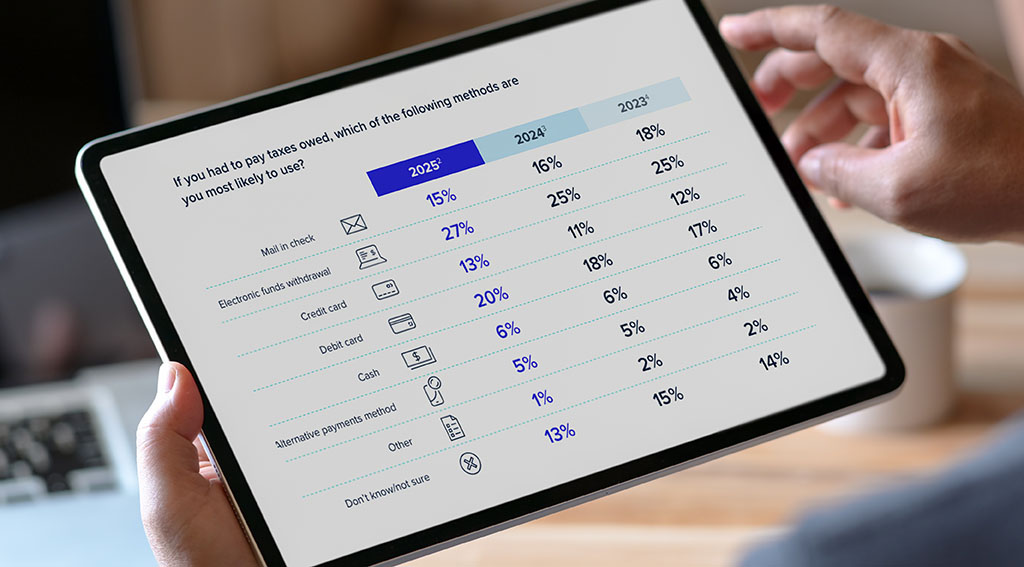

- 65% of respondents prefer to pay taxes using digital channels, a significant increase compared to previous years.

- The use of paper-based checks has declined to just 15%, particularly as younger generations favor platforms like PayPal, Google Pay, and Apple Pay.

- Moreover, 80% of participants expressed a preference for receiving their tax refunds via electronic deposit rather than traditional methods.

Expert Insights on Financial Decisions

Ron Shultz, General Manager of ACI Speedpay, commented on the survey findings:

“As we enter the tax season, many Americans are looking to maximize their tax refunds and make smart financial decisions, whether it’s paying off high-interest debt or building up their savings. This year’s findings show that taxpayers are continuing to pivot to digital payment channels to pay taxes and receive their refunds quickly.”

Awareness of Tax-Related Scams

The survey also revealed concerning trends regarding tax-related fraud:

- There is a noticeable lack of awareness about common payment fraud schemes, especially among Generation Z respondents.

- Approximately one-third of those who reported encountering scams were targeted by fraudsters impersonating the IRS.

- The data indicates a 3% increase in identity theft cases where personal information was used fraudulently.

Shultz emphasized the importance of consumer education to combat fraud:

“Tax season is a prime opportunity for scammers to target consumers who feel overwhelmed by the complexities and time pressures of filing. By using secure digital payment channels with robust verification capabilities, taxpayers can safeguard their financial information.”

Tax Filing Preferences and Refund Allocation

When it comes to tax filing preferences, the survey found:

- 39% of respondents plan to file electronically using popular software like TurboTax and H&R Block.

- 27% will file with the assistance of a tax professional, either electronically or by mail.

- Only 11% still prefer traditional paper filing methods.

Regarding how taxpayers plan to allocate their tax refunds, the top three responses were:

- 44% will deposit the funds into savings.

- 39% intend to pay off outstanding debts.

- 20% will use the money for minor purchases, such as clothing or sporting goods.

Fraud Experiences Among Taxpayers

Finally, the survey highlighted common fraud experiences reported by respondents:

- Phone scams: 17%

- Phishing scams: 16%

- Identity theft: 13%

For more insights on managing your taxes and avoiding scams, visit IRS.gov or check out our tax tips page.