Navigating the Future of Transaction Monitoring: Balancing Risk, Efficiency, and Trust

In the world of finance, automated systems for Anti-Money Laundering (AML) operations are essential. However, the challenge of managing false positives remains a significant hurdle for financial institutions. These false positives occur when legitimate transactions are erroneously flagged as suspicious, leading to inefficiencies and customer dissatisfaction.

Understanding False Positives in AML Operations

False positives can arise from various factors, including:

- Rigid detection rules: Outdated or overly strict algorithms can misidentify normal transactions.

- Inaccurate customer data: Failure to maintain updated customer records can lead to unnecessary alerts.

- Similar names: Transactions involving individuals with similar names can trigger alarms, even when they are legitimate.

A single flagged transaction can initiate a lengthy investigation process, often involving multiple teams. For instance, a small business owner might experience frozen funds and delays due to receiving a larger-than-usual payment from a client, all because of a misinterpretation by the automated system.

The Impact of False Positives on Financial Institutions

While automation is crucial for compliance, excessive false positives can drain resources and erode customer trust. Institutions must recalibrate their systems to enhance efficiency and accuracy. Here are some strategies to tackle this issue:

- Improved data governance: Regularly updating and maintaining customer data can significantly reduce false alerts.

- Dynamic rule updating: Adapting detection algorithms based on real-time data can enhance accuracy.

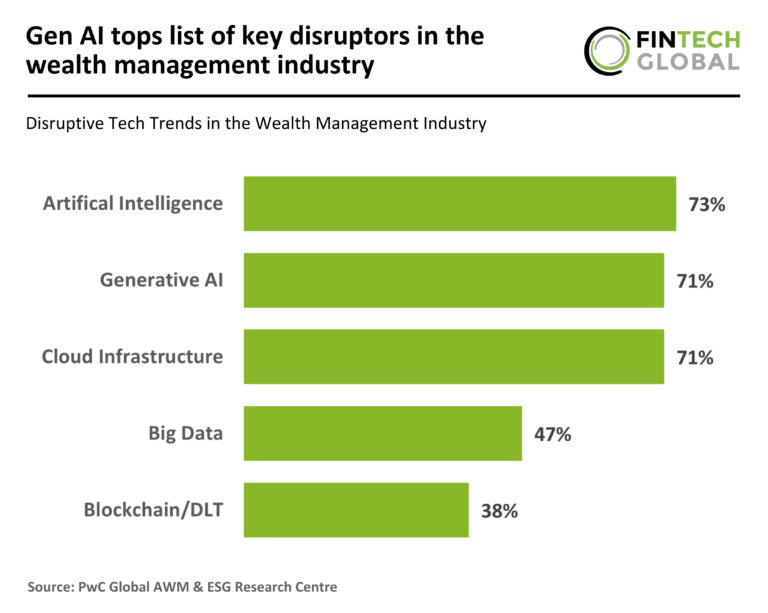

- Context-aware decision-making: Leveraging AI and machine learning can help institutions differentiate between legitimate and suspicious transactions.

Balancing Compliance and Customer Experience

The challenge extends beyond technical adjustments; it also involves strategic decision-making. Financial institutions must balance:

- Business efficiency against risk exposure.

- Customer experience against compliance integrity.

Investing in sophisticated tools and training for compliance staff can yield significant returns, allowing them to focus on genuine threats rather than chasing after false alarms.

Shifting Towards Predictive Monitoring

Organizations are evolving their approach to managing false positives by adopting predictive monitoring techniques. This involves:

- Utilizing real-time AI insights rather than relying solely on predefined rules.

- Aligning with broader industry trends towards risk-based compliance, as encouraged by regulatory bodies like the Financial Action Task Force and the European Banking Authority.

Conclusion: A New Standard for Transaction Monitoring

Ultimately, minimizing false positives is becoming the benchmark for effective transaction monitoring. This strategic upgrade is essential for financial institutions aiming to operate efficiently, safeguard their customers, and stay one step ahead of fraudsters and regulators.

For more insights on enhancing compliance frameworks, check out our related articles on effective compliance strategies and latest technologies in fraud detection.