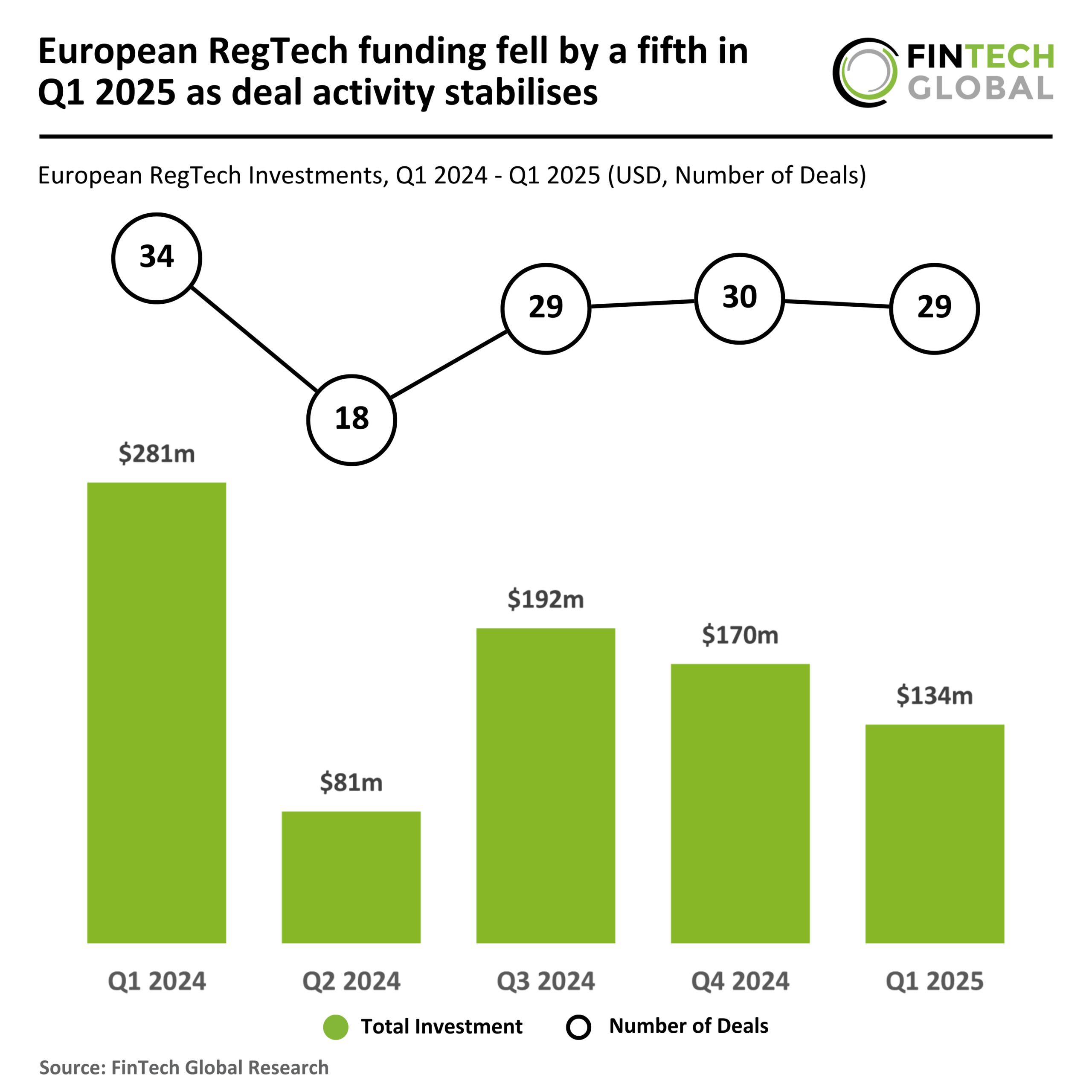

Q1 2025 Sees European RegTech Funding Dip 20% Amidst Stabilizing Deal Activity

In the realm of financial technology, the European RegTech sector is experiencing notable fluctuations in investment patterns. The latest statistics for Q1 2025 reveal a significant shift, with funding and deal activity showing a downward trend that highlights the cautious approach of investors in the current economic climate.

Decline in European RegTech Funding

During the first quarter of 2025, European RegTech funding saw a substantial decrease, dropping by 20% quarter-over-quarter (QoQ). This decline is reflective of a broader trend in the investment landscape.

Funding Statistics

- Only 29 deals were completed in Q1 2025, a 15% decrease from 34 deals in Q1 2024.

- Total funding reached just $134 million, marking a dramatic 52% drop from $281 million in the same period last year.

This reduction in capital inflow indicates an increasingly cautious investment climate, likely influenced by ongoing economic uncertainties and regulatory changes across the region.

Average Deal Size and Investor Sentiment

The average deal value in Q1 2025 was recorded at $4.6 million, a decrease from $8.3 million in Q1 2024. This trend suggests that investors are shifting towards smaller, less capital-intensive deals as the market grapples with a slower growth environment and intensified scrutiny.

Comparison with Previous Quarters

- Average deal size in Q4 2024 was approximately $5.7 million.

- Deal activity decreased by 3% from Q4 2024 to Q1 2025.

- Funding fell by 21% from $170 million in Q4 2024 to $134 million in Q1 2025.

Highlighting Key Players: ThreatMark

One of the standout achievements in Q1 2025 was the significant funding round secured by ThreatMark, an innovator in the RegTech space specializing in fraud prevention for financial institutions. The company raised $23 million in one of the largest European RegTech deals of the quarter.

About ThreatMark

The funding round was led by esteemed investors such as Octopus Ventures, Riverside Acceleration Capital, and Springtide Ventures. ThreatMark’s AI-powered Behavioural Intelligence Platform offers real-time fraud prevention by integrating behavioral biometrics, transactional monitoring, and threat detection.

Addressing Global Fraud Challenges

With global fraud losses reaching an alarming $486 billion in 2023, ThreatMark’s innovative solutions are critical for enhancing fraud defenses across various institutions. The new capital will enable ThreatMark to expand its advanced technological solutions and drive product innovation, reinforcing its position as a vital player in the RegTech ecosystem.

As the European RegTech sector continues to evolve, stakeholders must remain vigilant and adaptable to the changing investment landscape. For more insights into financial technology trends, visit our Financial Tech Insights page.