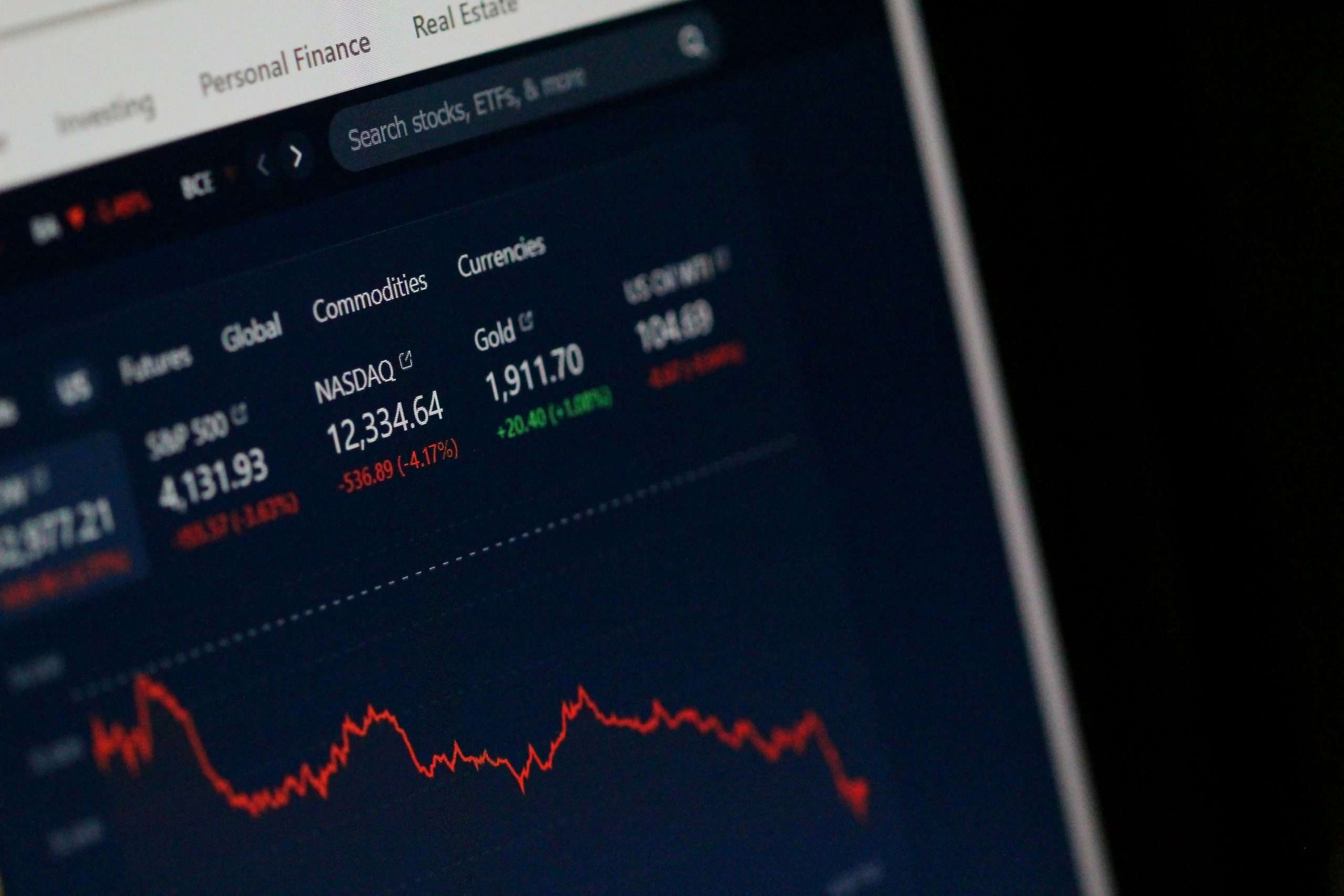

Securitize Secures Strategic Investment for Tokenized Securities Platform Growth

Securitize, a prominent platform in the realm of tokenizing real-world assets, has recently secured a significant investment from Jump Crypto, the digital asset division of Jump Trading Group. This strategic collaboration aims to enhance the digital securities landscape and improve institutional access to these innovative financial tools.

Details of the Investment

While the exact amount of the investment remains undisclosed, it is confirmed that Jump Crypto has acquired an equity stake in Securitize. This partnership is expected to bolster the capabilities of Securitize in the rapidly evolving world of digital assets.

About Securitize

Securitize has established itself as a leader in the field of tokenized securities, having successfully tokenized over $3.8 billion in assets as of May 2025. The company collaborates closely with major asset managers, including:

- Apollo

- BlackRock

- Hamilton Lane

- KKR

Its comprehensive ecosystem encompasses a range of services, such as:

- SEC-registered broker-dealer

- Digital transfer agent

- Fund administrator

- Operator of a SEC-regulated Alternative Trading System (ATS)

Future Plans and Collaborations

With the backing from Jump Crypto, Securitize is set to enhance its collateral management solutions. The two firms are poised to collaborate on developing new blockchain-based investment tools, further solidifying their positions in the digital asset market.

Statements from Leadership

Securitize CEO Carlos Domingo expressed enthusiasm about the investment, stating, “Institutional adoption of tokenized assets is accelerating, and Jump’s investment further validates the potential of blockchain technology in transforming capital markets. By working together, we aim to create seamless pathways for investors to access tokenized investment opportunities while maintaining the highest standards of security and compliance.”

Saurabh Sharma from Jump Crypto added, “Jump is focused on being at the forefront of digital asset innovation, and we believe that tokenization will play a critical role in the evolution of financial markets. Our investment in Securitize reflects our commitment to supporting the infrastructure necessary for institutional adoption of blockchain-based assets and decentralized finance.”

Conclusion

This strategic investment marks a significant milestone in the journey of Securitize and highlights the growing importance of tokenized assets in modern finance. As the collaboration unfolds, both firms look forward to pioneering advancements in the blockchain sector.

For more insights on Securitize and its services, visit their official website. Additionally, learn about the Jump Trading Group and their innovative approach to digital assets.