US Dominates RegTech Market with 44% of Global Deals in Q1: A Leader in Regulatory Technology Innovation

In the first quarter of 2025, the global Regulatory Technology (RegTech) sector experienced notable changes in investment trends, highlighting the evolving landscape of compliance and regulatory solutions. This article delves into the key statistics of RegTech investments and the factors influencing these trends.

Decline in Global RegTech Deal Activity

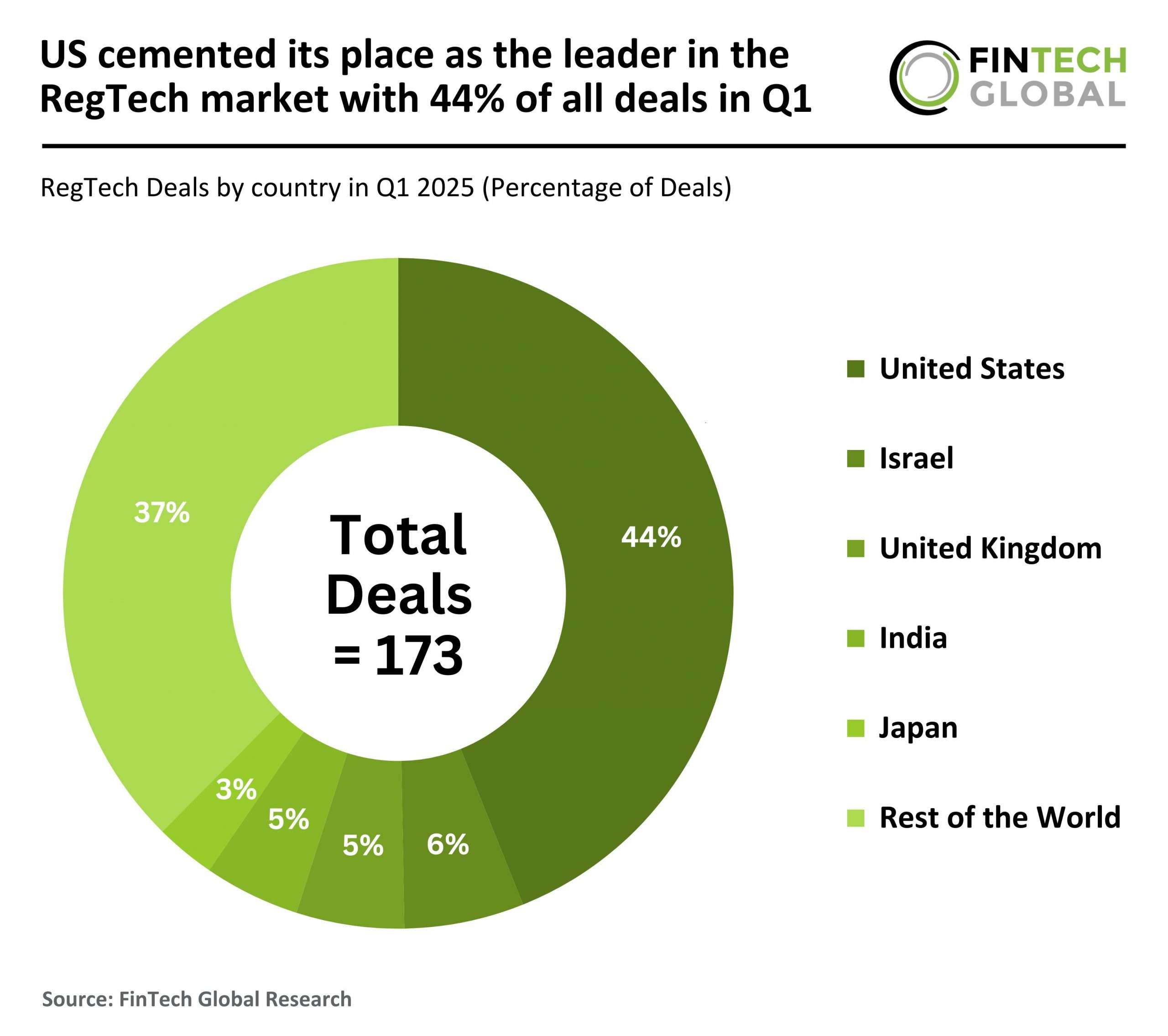

In Q1 2025, the global RegTech market witnessed an 18% year-over-year decline in deal activity, resulting in a total of 173 deals. This marks a significant drop from the 214 deals recorded in Q1 2024. Despite this fall in the number of deals, funding levels increased, reaching $2.3 billion, which is an 18% rise from the $1.9 billion raised during the same period last year.

Trends in Funding

This increase in funding, paired with a decrease in deal volume, indicates a trend towards larger investment rounds and a growing confidence among investors in select high-potential RegTech companies. The market is shifting towards a focus on sizable investments in firms that demonstrate robust growth potential.

US Dominates the RegTech Landscape

The United States continues to hold the lead in the RegTech market, accounting for 44% of all deals in Q1 2025, with a total of 76 deals. However, this represents a 28% decrease from the 105 deals completed in Q1 2024. Other notable players include:

- Israel: Secured 10 deals (6% share), moving into the top three and surpassing China.

- United Kingdom: Ranked third with 9 deals (5% share), down from 17 deals the previous year.

Despite the overall decline in deal activity, these countries remain pivotal in shaping the global RegTech environment.

Major RegTech Deal of Q1 2025

One of the most significant developments in the RegTech sector this quarter was Cybereason’s achievement, a leading global cybersecurity firm specializing in advanced endpoint detection and response (EDR) solutions. Cybereason secured a remarkable $120 million funding round, led by prominent investors such as SoftBank Corp., SoftBank Vision Fund 2, and Liberty Strategic Capital.

This investment underscores investor confidence in Cybereason’s capabilities to combat increasingly complex cyber threats. With a presence in over 40 countries and a strategic partnership with Trustwave, Cybereason is committed to supporting organizations throughout the incident lifecycle. The funding will enhance their global reach, strengthen EDR and consulting services, and accelerate the adoption of their innovative threat protection platform across highly regulated industries.

Conclusion

As the RegTech landscape evolves, companies like Cybereason are set to navigate the complexities of compliance and cybersecurity, positioning themselves as leaders in a challenging market. For more insights on RegTech trends and investment opportunities, visit our RegTech Insights page.