Similar Posts

OX Security Secures $60M in Series B Funding to Propel AI-Powered Application Security Innovations

OX Security, an application security company founded in 2021, has raised $60 million in Series B funding, led by DTCP with contributions from firms like Swisscom Ventures and Microsoft. This brings its total funding to $94 million. The company offers a next-gen security platform that identifies critical vulnerabilities using its proprietary Code Projection engine. The new funds will support global expansion, product development, and AI-driven risk mitigation strategies. In just a year, OX Security has generated $10 million in revenue and expanded its client base to over 200, including major firms like IBM and Microsoft. CEO Neatsun Ziv emphasizes prioritizing actionable threats to prevent breaches.

CrediLinq Raises $8.5M to Enhance Embedded Finance Solutions for Digital SMEs

CrediLinq recently secured $8.5 million in a Series A funding round led by OM/VC and MS&AD Ventures, with participation from Citi North America and other investors. The funds will support the company’s global expansion, starting in the U.S., U.K., and Australia, and enhance its Credit-as-a-Service platform aimed at improving capital access for underserved digital-first SMEs. CrediLinq plans to invest in its technology and leadership team while strengthening partnerships with e-commerce platforms like Amazon and TikTok Shop. The investment underscores confidence in CrediLinq’s innovative approach to lending and its potential for significant global impact.

Experience Seamless Banking: ANZ Plus Launches Australia’s First Fully Password-Free Web Banking!

ANZ is set to launch Australia’s first fully password-less web banking feature on its ANZ Plus platform by mid-2025. This innovative login method utilizes biometric authentication and mobile number confirmation to enhance user convenience and security, eliminating traditional passwords. Maile Carnegie, ANZ’s group executive for Australia retail, highlighted the feature’s potential to transform account access while improving security against phishing and breaches. This initiative is part of ANZ’s broader strategy to combat online fraud, which includes tools like CallSafe and the forthcoming Digital Padlock. ANZ’s commitment to innovation and customer safety is evident in these developments.

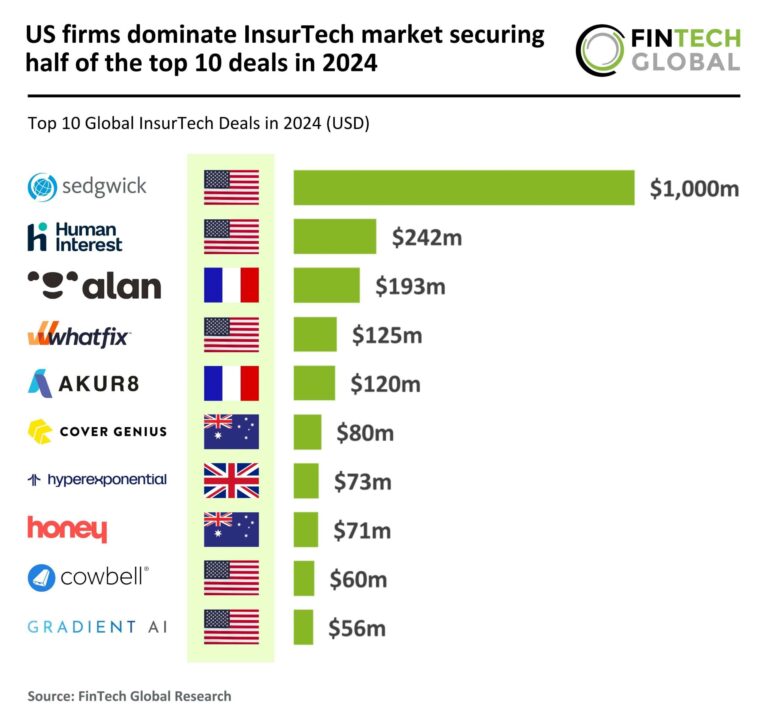

US InsurTech Powerhouses Lead the Market: Securing 50% of Top 10 Deals in 2024

In 2024, the InsurTech market faced a significant funding decline, with global investments dropping 35% year-over-year to $5 billion, and deal count plummeting to 206 from 609 in 2020. U.S. firms led the sector with five of the top ten funding deals, while Australia and France secured two each. The UK saw a decrease, and emerging markets like Singapore and India were absent from the top rankings. Notably, French InsurTech Alan raised $193 million in Series F funding, expanding its health insurance offerings and enhancing its position in the market, particularly through partnerships with Belfius Bank.

Gen Digital Raises $950 Million in Senior Notes Offering to Strengthen Cybersecurity Leadership

Gen Digital, a leading cybersecurity firm, has announced a $950 million senior notes offering to enhance digital safety for its 500 million users. The notes will have a 6.25% interest rate and mature in 2033, with a private placement closing expected on February 13, 2025. Available only to qualified institutional buyers and non-U.S. investors, the proceeds will be used to repurchase all outstanding 5.00% senior notes due in 2025. Gen Digital’s portfolio includes well-known brands like Norton, Avast, and LifeLock, aimed at protecting users from digital threats. For more details, visit Gen Digital’s official site.

Bamboo Insurance Unveils Innovative Fire Prevention Tool Powered by Whisker Labs’ Cutting-Edge Ting Sensor

Bamboo Insurance, a California-based InsurTech company, has launched a fire prevention initiative in partnership with Whisker Labs, providing eligible policyholders with the Ting fire prevention sensor and service at no cost. This initiative aims to enhance household safety by identifying hidden fire hazards and reducing risks related to electrical fires. The Ting sensor offers real-time alerts, power outage notifications, and frozen pipe prevention. By 2025, Bamboo plans to distribute the sensor and three years of service to 5,000 policyholders, promoting safety and customer trust. CEO John Chu highlights the initiative’s commitment to preventing home fires proactively.