Similar Posts

Charm Security Secures $8M Funding to Unveil Revolutionary AI-Driven Customer Protection Platform

Charm Security, an AI-powered customer security platform, has emerged from stealth mode to combat scams and human-centric fraud, securing $8 million in seed funding led by Team8. The platform’s mission is to develop real-time AI solutions that prevent fraud before it occurs by combining psychological insights with risk assessments. With plans to expand its team, enhance product development, and scale market presence, Charm aims to address the growing threat of AI-driven scams. CEO Roy Zur emphasizes the need for innovative strategies to protect users, while Team8’s Rakefet Russak Aminoach notes the urgent demand for new fraud prevention approaches.

Unmissable Week: 23 Small FinTech Fundraises You Need to Know About!

This week, the FinTech sector secured $793.7 million in funding, marking a decrease from the previous month’s trend of over $1 billion weekly. Notably, NinjaOne led with a $500 million Series C round, boosting its valuation to $5 billion. A total of 23 companies received funding, with most deals under $15 million. Taktile raised $50 million in Series B for AI-driven decision automation. The US and UK each saw ten companies close funding rounds, although European FinTech activity has sharply declined by 63% year-on-year in 2024. Various sectors, including PayTech and CyberTech, experienced diverse funding activities.

William Davenport Takes the Helm as Managing Director of Wordwatch: A New Era Begins!

Wordwatch has appointed William Davenport as its new Managing Director, leveraging his 12 years of experience at Business Systems Ltd to drive the company’s strategic growth. Davenport, previously Chief Sales Officer, is recognized for enhancing Wordwatch’s market presence through key client acquisitions and developing a channel partner program. The company focuses on improving compliance management solutions for regulated organizations, addressing challenges posed by fragmented legacy systems. Davenport aims to expand compliance solutions and strengthen partnerships while maintaining Wordwatch’s channel-only model. He expressed enthusiasm for leading the company into a new growth phase, supported by CEO Mike Wardell’s endorsement of his expertise.

RegTech Innovator Kovr.ai Secures $3.6M Funding to Revolutionize Cyber Compliance Solutions

Kovr.ai, specializing in AI-native cyber compliance automation, has launched with $3.6 million in seed funding co-led by IronGate and Xfund. Founded by industry veterans Andrew Black and Sri Iyer, the platform aims to simplify compliance for organizations in regulated sectors. Kovr.ai automates processes for standards like FedRAMP, CMMC, and NIST, significantly reducing resource demands. The funding will support team expansion in engineering, product development, and marketing, enhancing integration with DevOps tools like GitHub and Splunk. Kovr.ai’s real-time monitoring, AI-powered documentation, and audit-ready reports position it as a key player in compliance innovation.

Zevero Launches Cutting-Edge AI Solution to Simplify ESG Reporting Across Global Standards

Zevero has launched an AI-powered ESG Disclosure Reporting tool to simplify and accelerate sustainability reporting for companies amid increasing regulatory demands. This innovative platform addresses the challenges of complex ESG disclosure requirements, enabling organizations to efficiently manage reporting tasks. The tool utilizes AI to extract and interpret data from internal documents, generating accurate reports that comply with major frameworks in over 100 languages. It reduces reporting time by over 40% and boasts a data accuracy rate exceeding 90%. Designed for businesses of all sizes, Zevero’s solution supports long-term sustainability goals and regulatory compliance, aiming to streamline the reporting process.

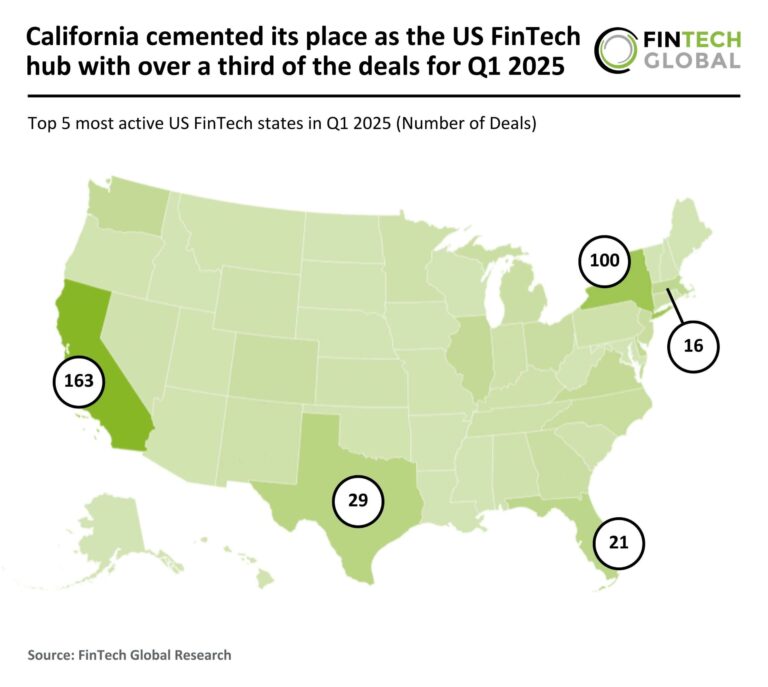

California Reigns Supreme as the US FinTech Hub, Capturing Over 33% of Q1 2025 Investment Deals

In Q1 2025, the US FinTech sector experienced a significant downturn, with deal activity dropping 58% and total funding decreasing to $9.6 billion, a 54% decline from Q1 2024. California remained the leading FinTech hub, accounting for 36% of deals despite a 52% reduction, while New York and Texas also saw declines. Notably, Mercury Financial secured a $300 million funding round led by Sequoia Capital, highlighting ongoing investment interest in innovative banking solutions for startups. This trend reflects a cautious investor approach amid macroeconomic challenges, suggesting a shift in resource allocation within the FinTech industry.